Terra Classic price sees traders gear up for another bearish outcome

- Terra Classic price is unable to rebound after the 25% decline from last week.

- LUNC cannot jump back up as an important floor keeps attracting traders.

- Expect a possible premature completion of the bearish triangle with LUNC set to shed another 70% of the value.

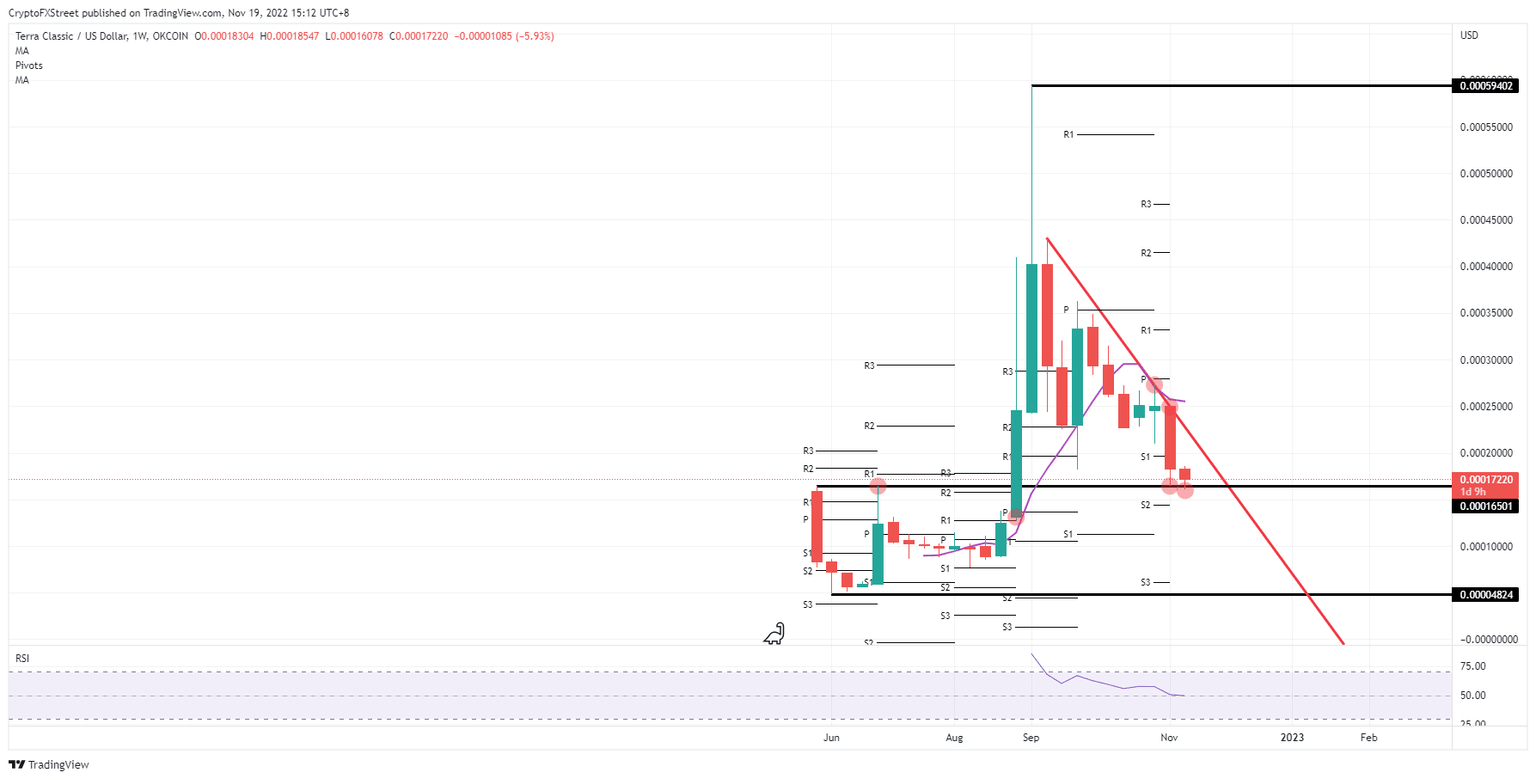

Terra Classic (LUNC) price is pure from a technical point of view, still stuck in a bearish triangle on a weekly chart. The descending side of the triangle has already undergone two secured tests and ran alongside the 55-day Simple Moving Average (SMA) for a while. The triangle baseline at $0.00016501 still holds for the moment, but sees pressure building as a third test is underway this week. Will the level hold or break into Sunday night's close?

LUNC set to crater as markets are falling back into to overall 2022 pattern

Terra Classic has been seeing that earlier mentioned $0.00016501 as quite a pivotal level in its existence ever since LUNC saw the light of day. It was the peak at its opening week back in May/June, saw a test but failed to break it to the upside in June, and got a clear break in August. Since that rally, price has been falling with consistently lower highs in September, building pressure that led to last week's test and the current test this week at the level.

LUNC price, next to that, sees downward pressure coming in from the red descending trend line that is orchestrating the bearish squeeze with lower highs each week. Although the bulls came close at the beginning of last week, not even a false break could be triggered. Expect, with the current turn of events in FTX, more downward surprises to pop up in the coming days and weeks, that could first push LUNC towards $0.000014422 before cratering toward $0.000006166 as more US dollar strength is coming back into play.

LUNC/USD weekly chart

Although that underpinning is there, it could simply not be enough to support price action if a few external elements chose to create some headwinds. A combination of elements like another missile hitting Poland, US dollar strength that kicks back in, and equities that sell off would be a toxic cocktail that would see DOGE price hit $0.0566 or even $0.0409, depending on the severity of the catalyst that triggered the move. That would mean that another 30% to 50% of losses could still unfold after another FTX casualty or geopolitics erupting again.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.