Terra Classic price sees 2022’s negative backdrop easing in last weeks of December

- Terra Classic price flirts with a break above a pivotal level.

- LUNC sees a few key tail risks being resolved before year-end.

- The key speech from Fed Chair Powell later this evening could be proven pivotal for the future of 2023.

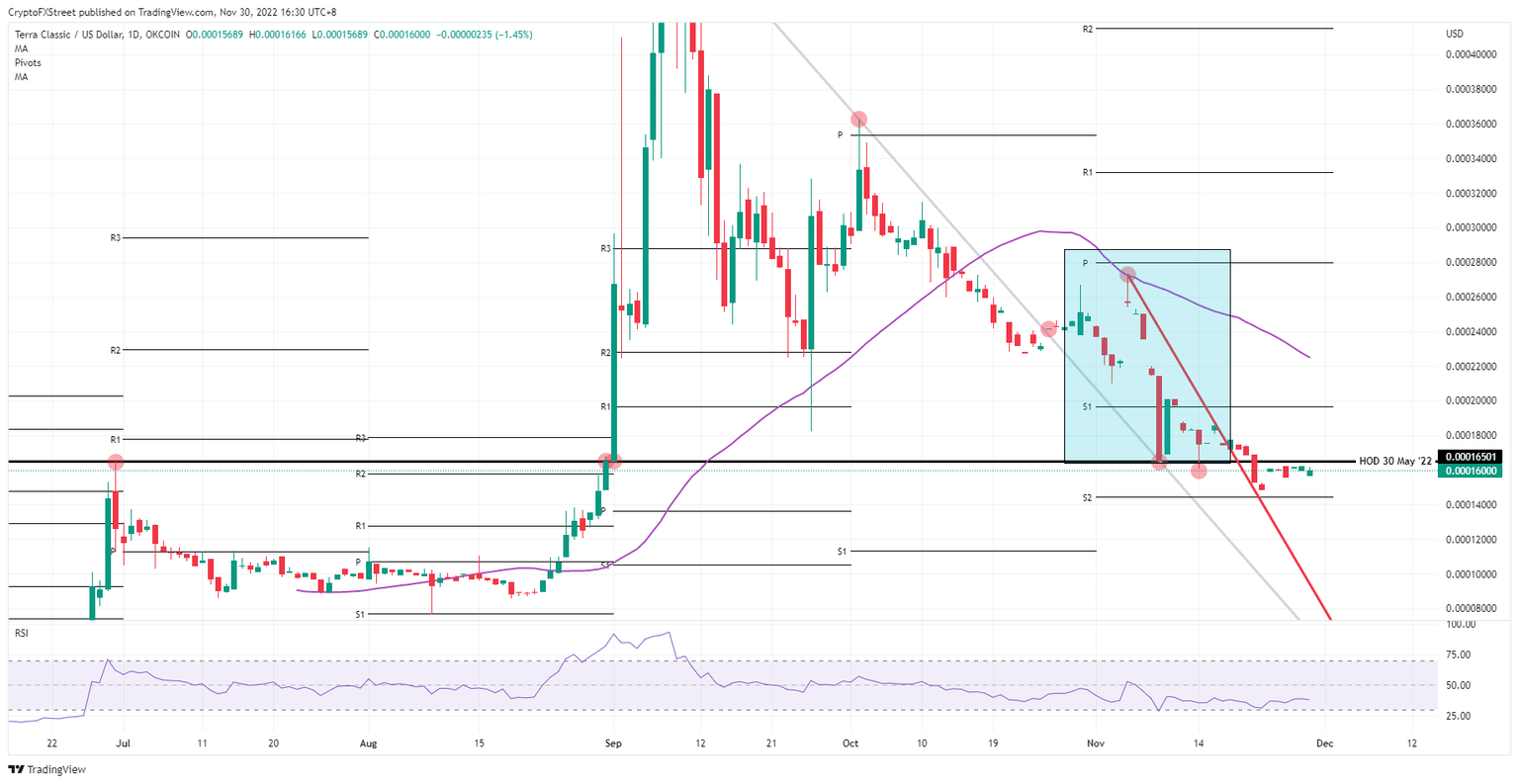

Terra Classic (LUNC) price action is still licking its wounds from the massive meltdown since September. A floor can be distilled from the current view on a daily chart and falls in line with the current events that are taking place on the world stage. China is slowly but surely reopening and is letting go of Covid lockdowns, ramping up the vaccination rate for the elderly. In the background of the World Cup in Qatar, the host country is near signing a deal with Germany to provide its gas supply for the next 15 years. This eases the bearish effect of a few tail risks and should reprice LUNC at roughly $0.00022000.

LUNC sees headwinds abating going into 2023

Terra Classic is set to start gearing up for 2023, although several warnings and precautions could be a pivotal shift away from 2022. Inflation is coming off the highs in both the US and Europe, and central banks keep hiking to ensure inflation remains tilted to the downside. Markets have now grown accustomed to that. Last but not least, the energy puzzle in Europe seems to be getting solved as Germany is close to signing a 15-year gas supply deal with Qatar in the backdrop of the World Cup.

LUNC sees the weather in financial markets clearing up, though not yet to a sunny outlook. A few clouds here and there will remain. This could mean that LUNC has room to move away from the low here, $0.00016000, and a Relative Strength Index (RSI) that has been subdued for far too long. Once the pivotal level at $0.000016501 has been broken to the upside, more room is available to rally up towards $0.00020000 and the next $0.00022000, printing a 41% revaluation in all.

LUNC/USD daily chart

That pivotal level at $0.00016501 could be proven quite the hurdle to take, as although LUNC has been printing green candles it is gapping lower and then performing the gap fill toward the previous day. This could point to bears outpacing the bulls each time at the end of the trading day, building up pressure for a sharp decline in the very short term. Support at $0.00014000 will be pivotal to refrain price action from dropping toward $0.00010000.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.