- Terra Classic price breached the $0.00011495 key roadblock with an intra-day high of $0.00012900, but the breakout proved premature.

- With LUNC still broadly bullish, the price could take another 15% swing at the key barrier amid abounding USTC hype.

- It comes after Luna Classic Labs acquired 25.6 million USTC worth about $500,000 as part of its Treasury Reserve Policy.

- The bullish thesis will be invalidated upon a break and close below $0.00008392 level.

Terra Classic (LUNC) is on a recovery rally, ploughing back to recover the ground lost after a steep fall as the price action consolidated within a descending parallel channel. The $0.00005234 support floor came into play, breaking the fall and providing the launchpad for a recovery.

Also Read: Terra Classic community ends minting of USTC tokens, opens doors to token burn

LUNC price booms on key Terra Labs investment

In a recent announcement, an official partner of Luna Classic Labs identified as Trader QT revealed on X that Luna Classic Labs had acquired a total of 25.6 million TerraClassicUSD (USTC) worth about $500,000. The acquisition was part of its Treasury Reserve Policy, with every USTC bought at an average purchase price of $0.021.

I can confirm that today, in an initial strategic investment, Luna Classic Labs has purchased approximately 25.6m $USTC for $500k in accordance with its Treasury Reserve Policy, at an average price of approximately $0.021 per $USTC.

— Trader QT (@0x_Ears) November 26, 2023

The purchase inspired a 300% rise in USTC price, with LUNC, its sister token, rallying along to send Terra Classic price almost 50% north. With this, it erased the losses that had been recorded over the past week, setting the price on a path to retest new price levels towards the close of November.

Generally, the surge reiterates the effort of LUNC and USTC communities in bringing enhanced value to both assets by means of upgrades and other strategies, including token burning.

Unfortunately, after the announcement, Luna Classic Labs received a message from US regulators containing cease and desist action regarding the USTC investment. This was a shock to the ecosystem, which committed to seeking legal advice on resolving it. Notwithstanding, both LUNC and USTC networks remain committed to growth.

Terra Classic price recovery rally hiccups

Terra Classic (LUNC) is up almost 60% in the month, focused on a recovery rally that has seen the cryptocurrency shed a zero. However, the $0.00011495 resistance level has limited the upside potential of the altcoin, and now bulls are strategizing for the next breach attempt after LUNC was overbought.

Increased buying pressure above current levels could see Terra Classic price extend, making a second attempt at the aforementioned barrier, potentially clearing the equal highs at $0.00011495. In a highly bullish case, the gains could extend for the price to test the $0.00012000 psychological level and in highly bullish cases, extend to tag the $0.00013000 level. Such a move would constitute a 30% climb above current levels.

The Relative Strength Index (RSI) above 70 shows LUNC is overbought, which explains the current stagnation and looming pullback as bulls look to refresh. Traders with long positions may consider keeping them open, at least for now, as the RSI could bounce above 70. A break and close below 70 would be the ideal signal to book profits.

Similarly, the Awesome Oscillator (AO) is showing green histogram bars standing strong in the positive territory. This shows the bulls are leading the market.

LUNC/USDT 1-day chart

On-chain metrics to Terra Classic support bullish outlook

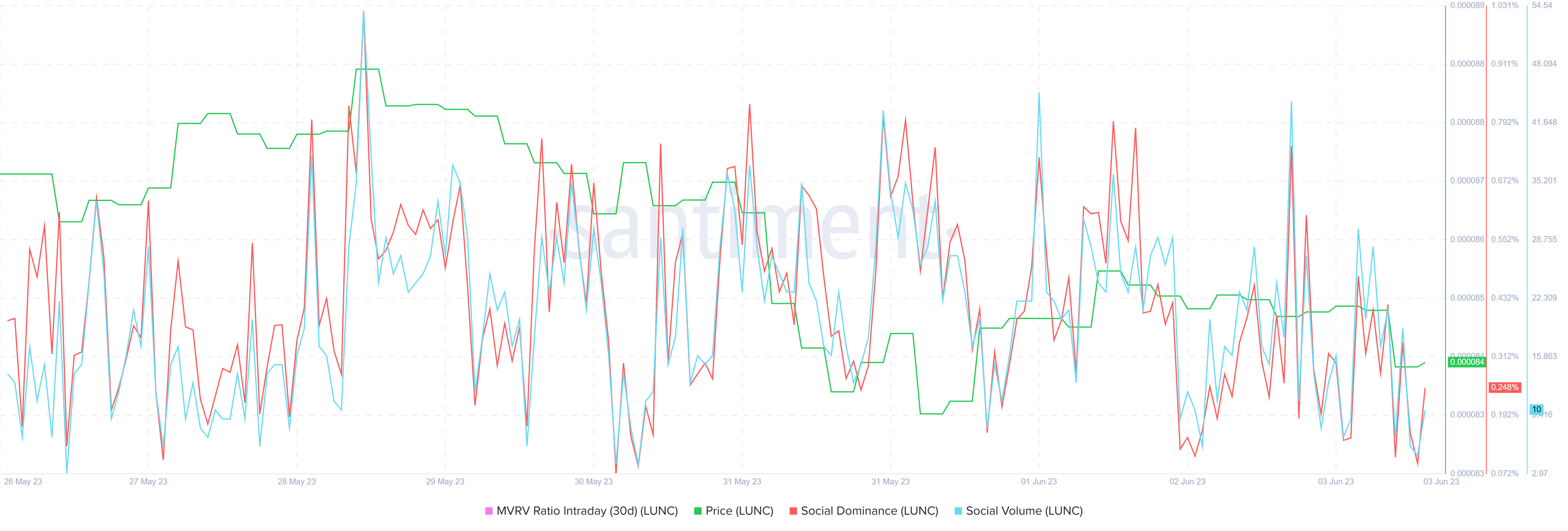

The social volume and social dominance metrics support the bullish outlook for Terra Classic price, showing the share or percentage of LUNC mentions on crypto-related social media is rising, relative to a pool of other popular projects online.

LUNC Santiment: Social volume, Social dominance

The volume of stablecoin deposits was also on a broad climb until late October, superseded by increased Tether (USDT) stablecoin market capitalization. This points to an increase in the volume of fresh capital into the LUNC market, which adds credence to the bullish thesis.

LUNC Santiment: Active stablecoin deposits, USDT marketcap

Further, the network has also been keen on development activity, with this metric showing a consistence climb. It points to development events in the LUNC ecosystem as indicated in the project’s public Github repository,

LUNC Santiment: Development activity.

However, with profit booking standing as the biggest obstacle to the upside potential of Terra Classic price, investors who bought LUNC during the November 21 dip are likely to cash in for 45% profit. This cohort of traders pulling the sell trigger could send Terra Classic price south, breaking below the immediate support at $0.00009706, or lower, the $0.00008392 support level.

In the dire case, the slump could see Terra Classic price invalidate the bullish thesis by slipping below the $0.00007315 swing low.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

%20[04.15.37,%2028%20Nov,%202023]-638367322524340560.png)