Terra Classic Price Prediction: Bulls pump LUNC price to $0.000280

- Terra’s Luna Classic price is up by over 12% after brushing shoulders with $0.000280.

- LUNC’s immediate support at $0.000250 is essential for the next move that could see it top $0.000300.

- Resistance at the 200-day SMA could invalidate the bullish outlook in Luna Classic price.

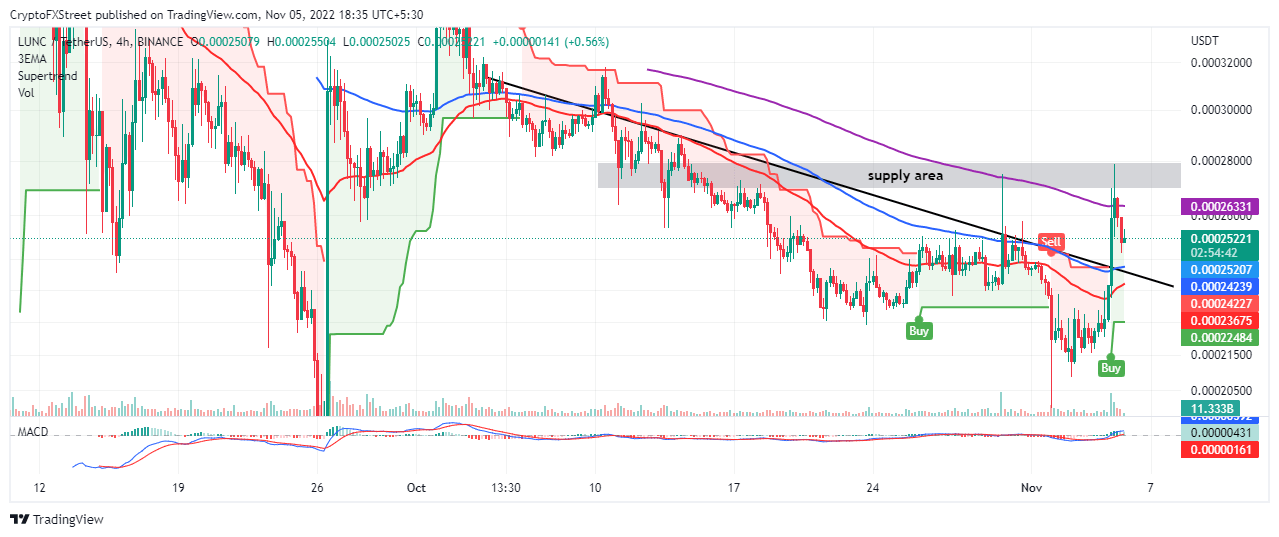

Terra’s Luna Classic price continues with the week-long winning streak that has seen it lift from support at $0.000210. Its bullish momentum gained traction with a subsequent break above $0.000230. Trading above a crucial month-long falling trend line propelled Luna Classic to $0.000280 before returning to trade at $0.000252 on Saturday.

Assessing the bullish potential in Terra Classic price

Odds flipped to favor a bullish move in LUNC’s price as soon as a buy signal from the Moving Average Convergence Divergence (MACD) came into play. The call to buy LUNC coincided with a rebound from its primary support at $0.00021.

Investor confidence in the trend reversal was later bolstered by Terra Classic price spike above a confluence resistance around $0.000242 – created by the 100-day Exponential Moving Average (EMA) (in blue) and the falling trend line (in black).

LUNC/USD four-hour chart

Traders looking for long positions in LUNC price can still do so as long as the Moving Average Convergence Divergence (MACD) upholds its optimistic outlook. With the MACD holding above the mean line, Terra’s Luna Classic could quickly regain momentum for gains above $0.000280.

The four-hour chart brings to light another buy signal, presented by the SuperTrend indicator. This technical index overlays the chart like a moving average, but it uses the average true range (ATR) to gauge market volatility.

A buy signal manifests with the Super Trend flipping below LUNC, as shown on the chart. Terra Classic price is expected to remain in an uptrend direction until the Super Trend moves above the price and sends a sell signal.

Traders should proceed cautiously because support at $0.000250 may bow to the building overhead pressure from resistance at the 200-day EMA (in purple) and LUNC’s weekly high at $0.000280.

A four-hour to a daily close below $0.000250 could validate profitable short positions, with possible exit points at the 100-day EMA and the 50-day EMA.

On the bright side, the odds still favor the bulls, and Terra Classic price may only need to break above $0.000280 to clear the path above $0.000300.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren