- Synthetix leads the recovery in the crypto market alongside Chainlink and Ren.

- Synthetix upside capped under $5.00, the price is likely to settle for consolidation.

The decentralized finance (DeFi) token, Synthetix along with other selected cryptocurrencies like Chainlink (LINK) and Ren (REN) decoupled and rallied extensively in the last 24 hours. Although the flagship cryptocurrency, Bitcoin, also pushed above some key levels, the breakout made by these three digital assets has accrued over 20% in gains.

Synthetix is up 26% in the last 24 hours to exchange hands at $4.74. All the attention is channeled to the next key hurdle at $5.00. If the resistance is broken, it will pave the way for more action towards $6.00.

Synthetix adopts Layer-2 scaling solution

Ethereum is the core platform for the execution of DeFi tokens such as SNX. However, exorbitant gas fees are becoming an issue of concern. Although Ethereum 2.0 upgrade is expected before the end of the year, developers cannot sit and wait. For this reason, solutions that have come up to help DeFi projects bring down the transaction fees in the meantime.

Synthetix is the first among many DeFi projects to implement a barely tested but secure Layer-2 solution. The upgrade will see the protocol curb the high gas fees via the implementation of a couple of proposals; Fomalhaut (which went live on September 24) and Deneb, scheduled for September 29. Fomalhaut is expected to remove transaction fees for minor SNX stakers. Other DeFi projects are also considering the upgrade, including Aave (LEND) and UniSwap (UNI).

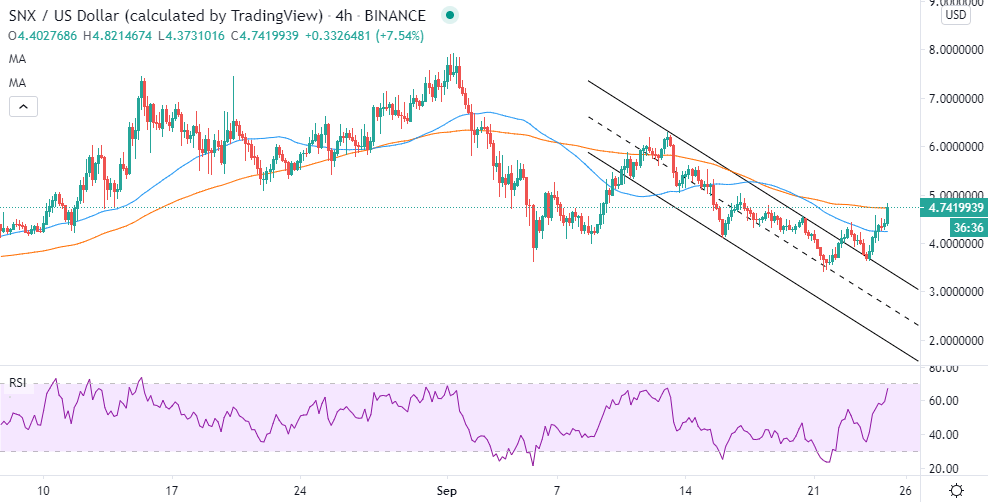

Synthetix breaks the parallel descending channel resistance

Following the bearish wave that swept throughout the crypto market earlier in September, SNX/USD established support at $3.50. This support has been tested twice in less than a month. Initially, SNX rebounded, stepping marginally above $6.00. However, increased seller activities saw it lose ground to the same $3.50. The ongoing recovery has made it above the parallel descending channel resistance, giving credence to the bulls' return.

Meanwhile, the immediate upside is capped by the 100 Exponential Moving Average (EMA) in the 4-hour range. Turning this moving average into support could boost Synthetix past $5.00, hence commencing the next phase of the rally to $6.00. The momentum is supported by the Relative Strength Index (RSI) as it closes in on the overbought region.

SNX/USD 4-hour chart

IntoTheBlock’s IOMAP model reveals a challenging resistance zone between $4.75 and $4.89. This range carries around 600 addresses that previously bought 3.77 million SNX. Bulls will have a hard time penetrating this area; however, if they manage to turn it into a support, the rally to $6.00 will become apparent.

SNX IOMAP chart

On the downside, SNX is sitting above an area with immense support. The region between $4.46 and $4.60, where nearly 980 addresses purchased 6.72 million SNX, is strong enough to absorb most of the selling pressure in case of a reversal.

Looking at the other side of the picture

Synthetix has rallied massively in the last 24 hours. However, it is essential to realize that a retreat is likely, mostly if the resistance between $4.75 and $4.89 remains intact. IntoTheBlock’s “Daily Active Addresses” model shows a slump in the number of new addresses joining the network over September.

SNX new addresses chart

The token is likely to lack the inflow volume to support the uptrend hence the possibility of stalling. Note that we do not expect SNX to plunge below the critical support highlighted by the IOMAP between $4.46 and $4.60.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

TRUMP token leads $906 million in unlocks this week with over $330 million release

According to Tokenomist, 15 altcoins will unlock more than $5 million each in the next 7 days. Wu Blockchain data shows that the total unlocked value exceeds $906 million, of which the TRUMP token will unlock more than $330 million.

Why Mantra token’s dramatic 90% crash wiped out $5.2B market share

Mantra price hovered at $0.83 during the Asian session on Monday, following a massive 90% crash from $6.33 on Sunday. The crash wiped out $5.2 billion in the token’s market capitalization, quickly drawing comparisons to the infamous collapse of Terra LUNA and FTX in 2022.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC is on the verge of a breakout while ETH and XRP stabilize

Bitcoin price approaches its key resistance level at $85,000 on Monday; a breakout indicates a bullish trend ahead. Ethereum and Ripple found support around their key levels last week, suggesting a recovery is in the cards.

Bitcoin and crypto market sees recovery as Fed official says agency ready to stabilize market if necessary

Bitcoin rallied 5% on Friday, trading just below $84,000 following Susan Collins, head of the Boston Federal Reserve (Fed), hinting that the agency could stabilize markets with "various tools" if needed.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637366034962290513.png)

-637366035570743825.png)