Synthetix Network Token embarks on an uptrend targeting $6 amid improving on-chain metrics

- Synthetix Network Token rebounded from support at $3.3 to deal with an uphill battle at $5.

- The bullish technical picture targets $6, while the strengthening on-chain metrics could support the breakout.

Synthetix Network Token (SNX) rallied 137% from the lows traded in November at $2.5 but hit a high at $6 last week. The market instability last week saw the token dive to $3.3 before the ongoing recovery came into the picture. A break past the resistance at $5 might elevate SNX beyond $6.

Synthetix Network Token bounces off critical support

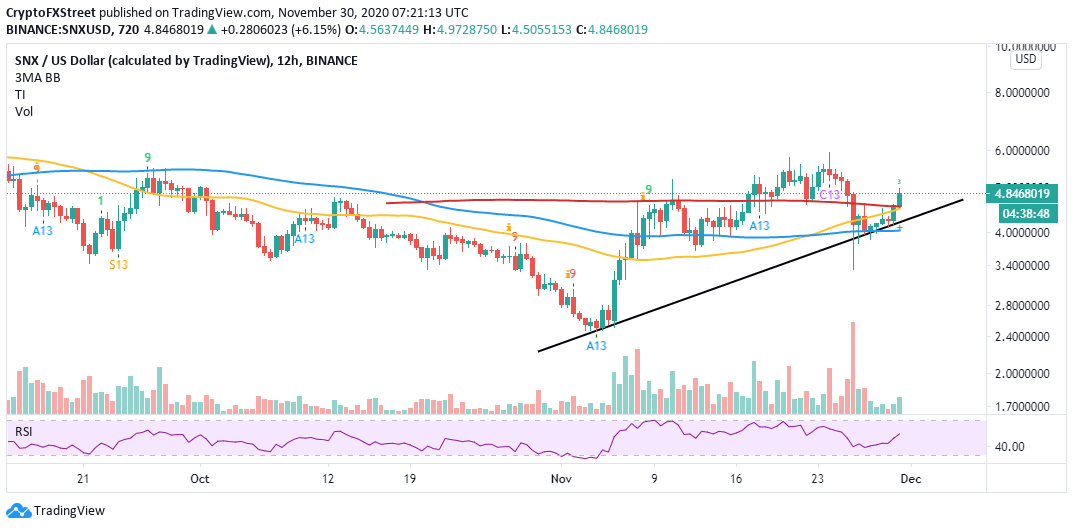

At the time of writing, Synthetix is trading at $4.8 amid the growing bullish grip. The recovery has been validated following a spike above the 50 Simple Moving Average, 100 SMA and the 200 SMA.

If Synthetix closes the day above the confluence formed by the 100 SMA and the 200 SMA, the spike to $6 might begin to materialize. Another bullish indicator would be the golden cross pattern if the 100 SMA crosses above the 200 SMA in the same 12-hour timeframe. Similarly, the Relative Strength Index is moving towards the overbought region, emphasizing the bullish grip.

SNX/USD price chart

On-chain metrics validate the ongoing uptrend

Santiment’s holder distribution chart shows that whales have begun to buy more SNX in anticipation of near term price growth. For instance, addresses holding between 100,000 and 1 million SNX increased by two from 114 on November 27 to 116 on November 30.

On the other hand, addresses containing between 10,000 and 100,000 coins rose from 623 on November 27 to 660 on November 30, representing a 5.6% increase. In other words, the volume moved by the whales seems strong enough to keep Synthetix in the uptrend.

Synthetix Network Token holder distribution chart

The active addresses metric, which measures network activity in 24-hour periods, is beginning to look positive. Usually, growth in this metric tends to lead the price upwards. Therefore, if the spike continues, there is a likelihood of Synthetix continuing with the anticipated uptrend.

Active addresses chart

On the downside, it is worth mentioning that the bullish outlook will be invalidated if the price corrects below the 100 SMA and the 200 SMA confluence support. Besides, closing the day under the immediate hurdle at 45 might encouraged more sellers to join the market in an attempt to pull SNX to lower levels targeting $3.3 (last week’s support).

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520%5B11.02.31%2C%252030%2520Nov%2C%25202020%5D-637423201848819989.png&w=1536&q=95)

%2520%5B10.45.31%2C%252030%2520Nov%2C%25202020%5D-637423200418402323.png&w=1536&q=95)