Synthetix Network beats DEXes with massive spike in TVL and on-chain metrics, SNX on the rise

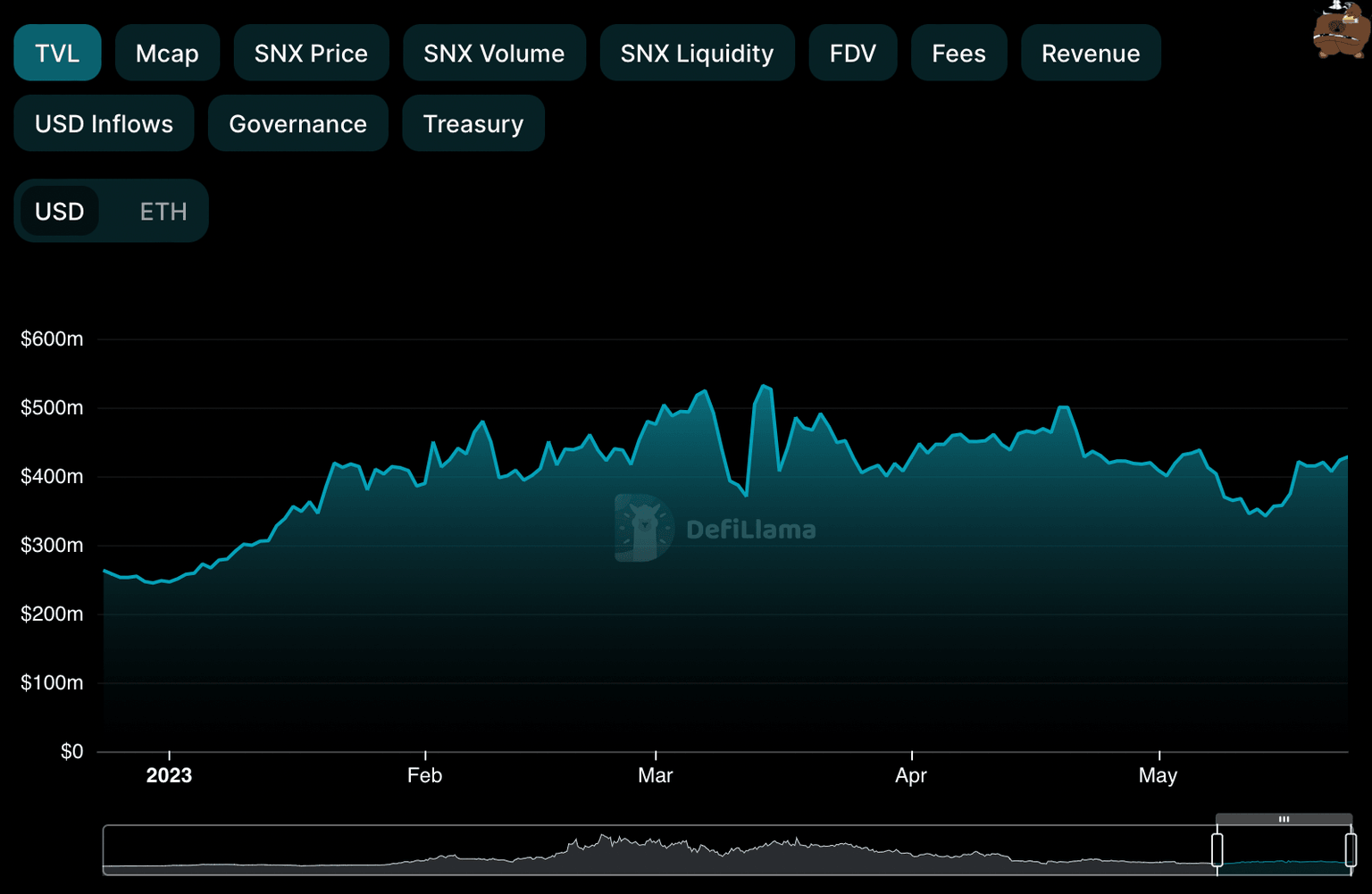

- Synthetix Network’s total value locked nearly doubled to $428.12 million since the beginning of 2023.

- The derivatives liquidity protocol beat trading platforms in volume and daily active users this week, driving SNX price higher.

- Synthetix's founder listed several conceptual proposals to offer SNX trading incentives and staking rewards.

The founder of Synthetix Network, a decentralized derivatives trading platform, submitted a set of conceptual proposals that are likely to benefit SNX holders and community members in the long term.

SNX witnessed a massive spike in Total Value Locked (TVL) and on-chain metrics (volume and daily active users) compared to other decentralized protocols.

Also read: Elon Musk warns traders against “betting the farm” on his favorite cryptocurrency Dogecoin

Synthetix Network beats competitors in daily active users and trade volume

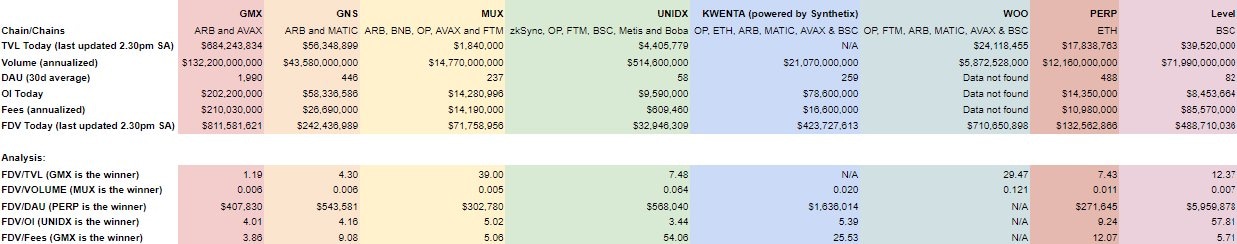

A crypto expert, Paddy the Pirate (@StPaddyPirate) sourced data from DeFiLlama, Tokenterminal and Artemis.xyz for a Decentralized Exchange (DEX) dashboard. Based on data from the dashboard, volume and daily active users witnessed a significant decrease across the board this week.

Perps DEX dashboard

Synthetix Network (SNX) stood out from its competitors with a spike in its volume, nearly four times that of competitor GMX. Interestingly, the rise in on-chain volume this week acted as a bullish catalyst for SNX, driving SNX price higher.

Currently trading at $2.545, SNX yields nearly 17% gains for holders over the past week. Interestingly, the TVL of the protocol climbed from $246.36 million (on January 1) to $428.12 million (at press time), nearly doubling Year Till Date (YTD).

Synthetix Network TVL YTD

What’s driving SNX price rally

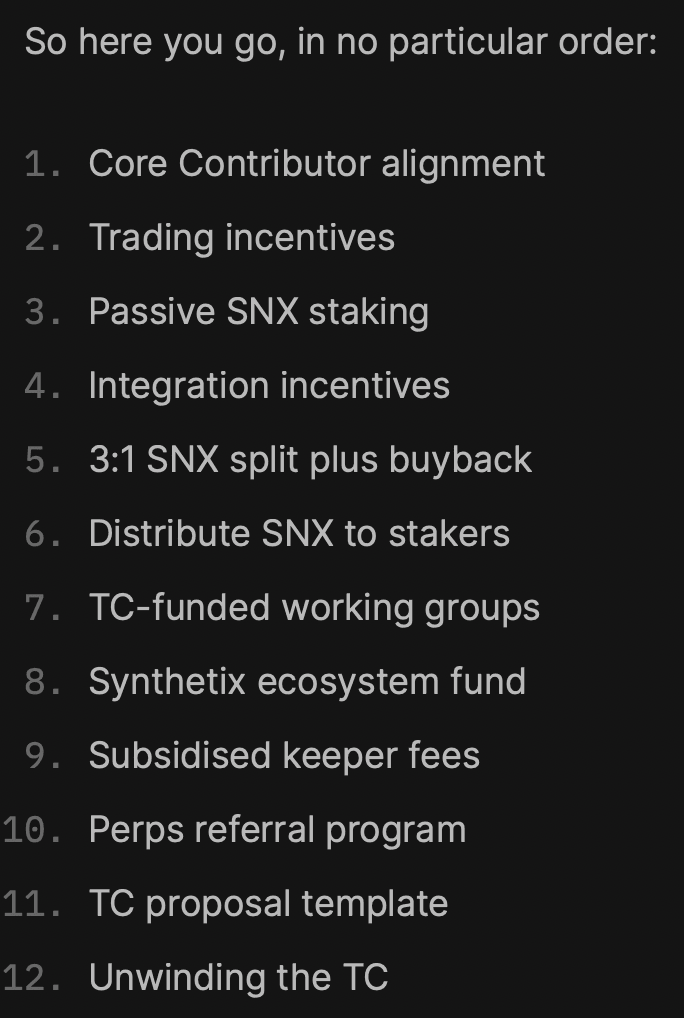

Alongside the spike in on-chain metrics, SNX founder Kane Warwick’s conceptual proposal has acted as a bullish catalyst for the token. Warwick submitted 12 governance proposals to push SNX into the next phase where the community benefits from opportunities in the form of staking yield and trading incentives.

Warwick’s proposals are outlined in a “State of Synthetix” post where the founder suggests a 3:1 split of SNX, followed by a buyback and subsequent burn using the Synthetix Treasury’s fee yield.

Proposals by Kane Warwick

Warwick explains that the proposals are only in the conceptual stage and the founder controls one out of four votes on the council. The post started a discussion within the community, acting as a catalyst for SNX price.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.