Swiss National Bank rejects Bitcoin reserve proposal

- The Swiss National Bank (SNB) dismisses the idea of holding Bitcoin as a reserve asset.

- SNB Chief Martin Schlegel cites concerns over volatility, security risks, and regulatory uncertainty.

- The decision is in contrast to growing global corporate and sovereign interest in Bitcoin reserves, particularly in the U.S.

Swiss National Bank has rejected a proposal to adopt Bitcoin as a reserve asset, citing concerns over volatility, security, and liquidity.

Swiss National Bank reject Bitcoin adoption on “volatility and “economic” concerns

Despite increasing global corporate and sovereign interest in Bitcoin adoption, the Swiss National Bank (SNB) has firmly rejected the idea of holding Bitcoin as part of its reserves.

In a recent statement, SNB Vice Chairman Martin Schlegel reiterated the central bank’s position, emphasizing that cryptocurrencies do not meet the necessary criteria to be included in Switzerland’s foreign-exchange reserves.

“We do not have plans to buy crypto assets.”

- Swiss National Bank (SNB) Vice Chairman Martin Schlegel pointed to Bitcoin’s high price volatility and security risks.

He also highlighted concerns over liquidity and the digital nature of cryptocurrencies, which could make them susceptible to technological failures.

The SNB’s position stands in contrast to growing institutional interest in Bitcoin globally. Notably, U.S. President Donald Trump has expressed support for greater Bitcoin adoption, fueling discussions on integrating Bitcoin into national reserves.

Global Trends: Bitcoin adoption on the rise amid Trump's influence

Switzerland’s reluctance to embrace Bitcoin as a reserve asset pales in contrast to other nations like El-Salvador, and Bhutan who now carry BTC on national balance sheets. More so, more countries are currently exploring regulatory frameworks for cryptocurrency adoption, in attempts to align with the United States regulatory leaning under Trump

In Pakistan, for example, authorities are working on a comprehensive legal framework to support the growth of the digital asset industry, as revealed by Pakistan Crypto Council CEO Bilal Bin Saqib.

Switzerland has built a reputation for strategic political neutrality, and stable national currency. In recent years the country has become a major hub for cryptocurrency and blockchain innovation with major projects like Etherum founded in Crypto Valley in Zug, Switzerland.

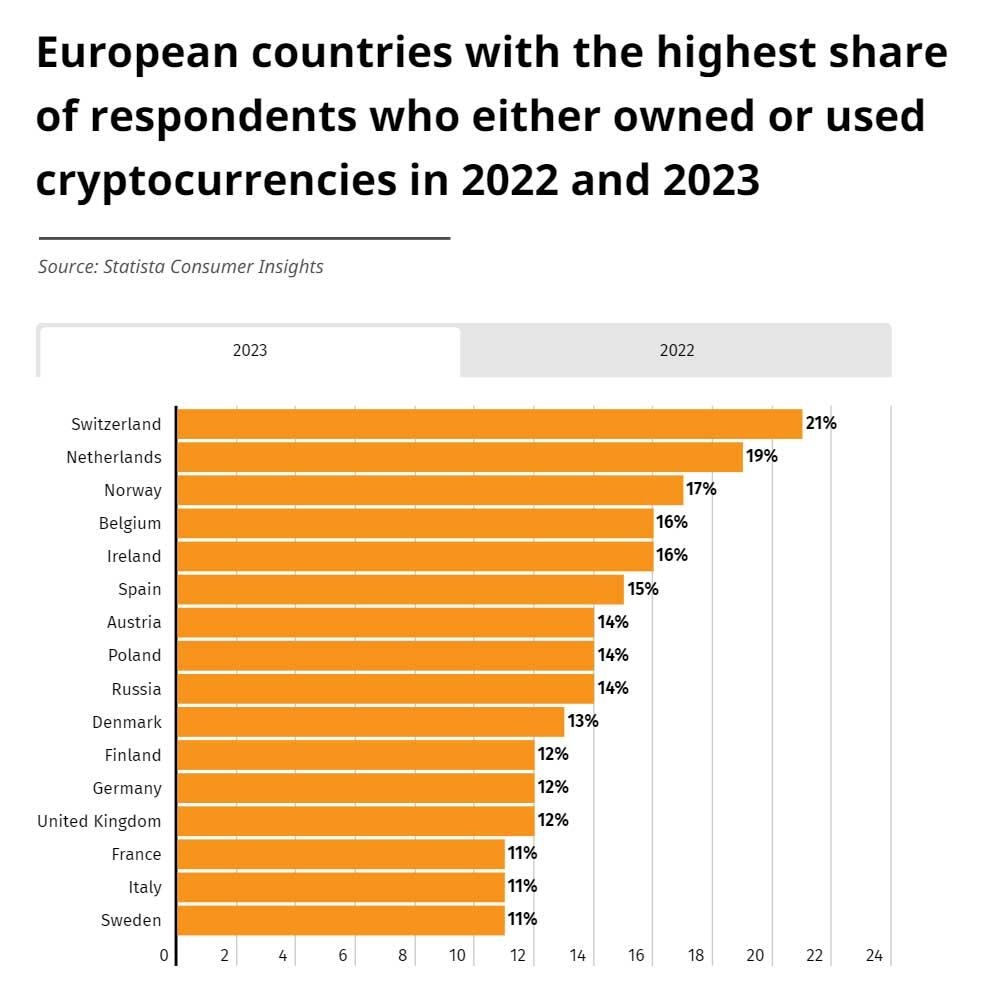

Crypto adoption trends in Europe, 2023 | Source; Financial Mirror, 2023

Notably, Switzerland emerged the country with the fastest crypto adoption rate in Europe according to a 2023 research by the FinancialMirror.

The SNB’s decision suggests that traditional financial institutions remain hesitant to integrate Bitcoin into their monetary policies.

However, with increasing global adoption, overt support from US President Donald Trump amid ongoing regulatory discussions, as well as one of the largest crypto-holding populations in Europe, many analysts believe Switzerland may eventually revisit its stance in the coming years.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.