Sushiswap price under siege of bearish coup with 20% implosion at risk

- Sushiswap price is in distress, over the past 24 trading hours several key levels have been broken.

- Although the RSI is oversold, more pain is on the horizon.

- Together with gold, Bitcoin is selling off and putting altcoins on the chopping block.

Sushiswap (SUSHI) price is seeing traders run for the hills on Friday as Bitcoin is sliding further away sub-$30,000 as the recovery rally is losing steam. To make matters worse, this altcoin season looks to be one of the worst seasons in terms of performance. With several crucial elements being broken by forceful bears, at least another 20% pain is in the cards.

Sushiswap price faces headwinds from Bitcoin sell-off

Sushiswap price has been tanking sharply since this week started with already a 15% loss from Wednesday. The domino effect could be one of the main reasons why these sharp and heavy headwinds are suddenly emerging for altcoins. With a very mixed earnings season in US equities, indices have been selling off, triggering some US Dollar strength and, in its turn, pushing gold and Bitcoin lower.

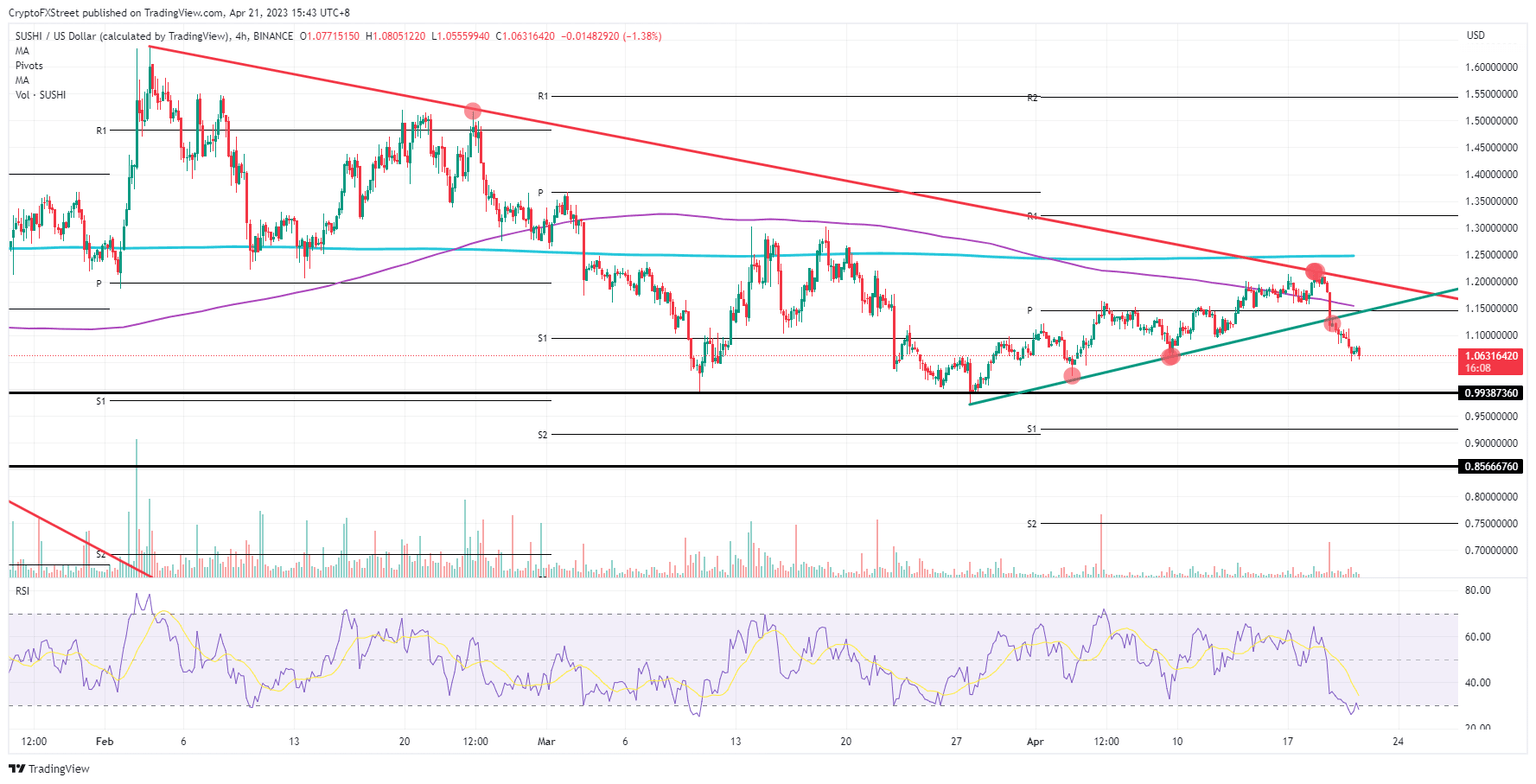

SUSHI traders are, of course, getting very nervous when leading cryptocurrency Bitcoin breaks below $30,000 and shows no sign of being able to break back above it. This triggers the repatriation of funds and explains the sell-off in Sushiswap. Expect first to see a brief slide below $1.00, followed by another 15% drop toward $0.85 to find support.

SUSHI/USD 4H-chart

The situation could still be salvaged if sentiment sees a turn for more risk-on behavior. That would come if earnings start to pick up, equities rally, and gold and Bitcoin could even reverse their current course. This market reversal would pick up altcoins for the ride higher. Expect a reentry above the green ascending trendline, paring back the incurred losses since Wednesday.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.