SushiSwap price rallying by 63% in four days causes $4.8 million worth of short liquidations

- SushiSwap price is among the best-performing assets this past week, marking a 63% rise to trade above $1.

- The rally led to $4.87 million worth of short contracts being liquidated, the highest in nearly three months.

- The rally is certainly substantial as it is boosted with the help of SUSHI investors, whose participation has shot up by 670% in four days.

SushiSwap price registered unprecedented gains in the past couple of days, most of which came in this month as investors jumped on the opportunity to make the most of the opportunity. The network also seemed to benefit from their participation, resulting in short traders witnessing a nightmare.

SushiSwap price skyrockets

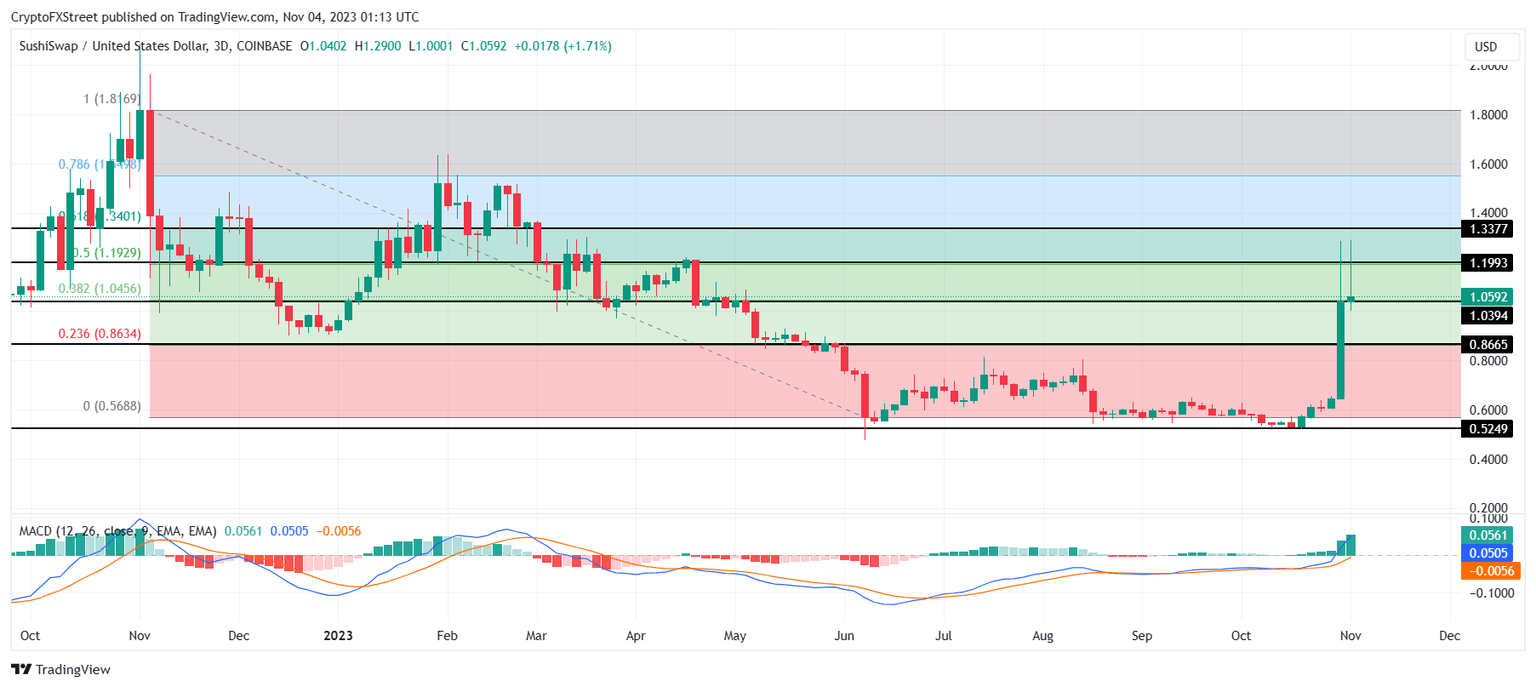

SushiSwap price, trading at $1.05 at the time of writing, noted a 63% rally in the span of just four days. On the three-day chart, it is evident that the rise took place this month, which pulled SUSHI up through some crucial barriers.

Breaching $0.86 and $1.03, the altcoin managed to rise past the 23.6% and 38.2% Fibonacci Retracement from $1.81 to $0.56. If the altcoin can test the $1.03 level as support, it would enable a rise toward $1.19, which coincides with the 50% Fibonacci level.

SUSHI/USD 1-day chart

However, losing this level would leave SUSHI vulnerable to a slip toward $0.86, and a three-day candlestick close below this line would confirm that the bullish thesis has been invalidated and SushiSwap price could fall below $0.80.

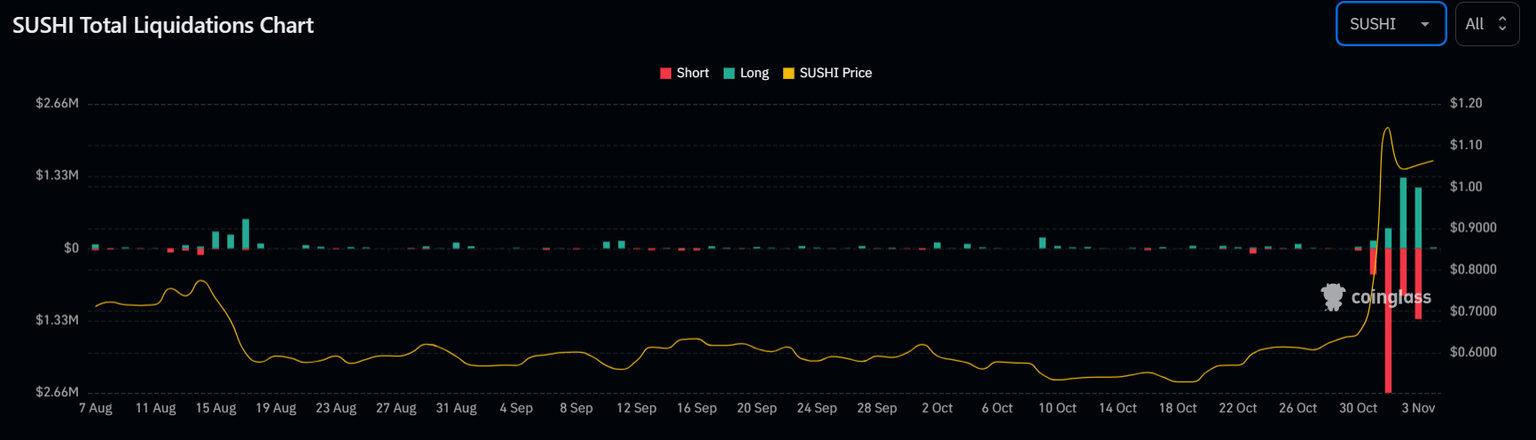

SUSHI short traders’ suffer

A decline in SushiSwap price would avenge short traders as the last four days were the worst for them. According to data obtained from Coinglass, the rally resulted in short contracts being heavily liquidated consistently for three days.

As traders kept hoping for a decline that never came, short contracts kept getting liquidated, and in this time span, about $4.87 million worth of shorts witnessed liquidation.

SushiSwap liquidations

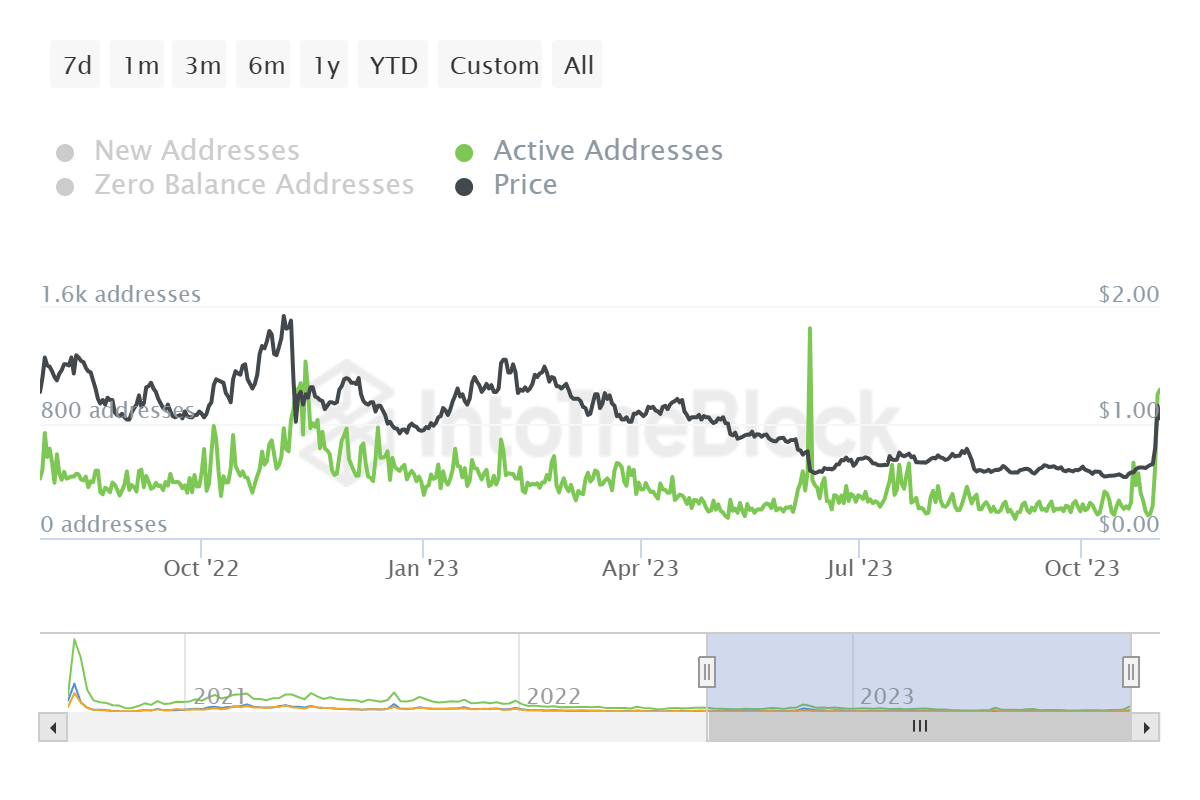

Interestingly, the blame for traders’ losses falls on none other than the SUSHI investors. The initial rise grabbed the attention of SUSHI holders, who became active and started conducting transactions on the network.

Consequently, the active addresses jumped from 196 to 1,304 in two days, suggesting a 670% rise. This kept the bullish momentum going, which resulted in a 63% rally.

SushiSwap active addresses

Thus, to exact profits, there is a chance that short traders could be pining for a decline, and if the SushiSwap price loses the $1.03 support level, short traders will achieve what they want.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.