SushiSwap Price Prediction: SUSHI poised for correction after rallying 200% in two weeks

- SushiSwap led the DeFi sector in recovery by spiking massively to trade highs of $1.45 in November.

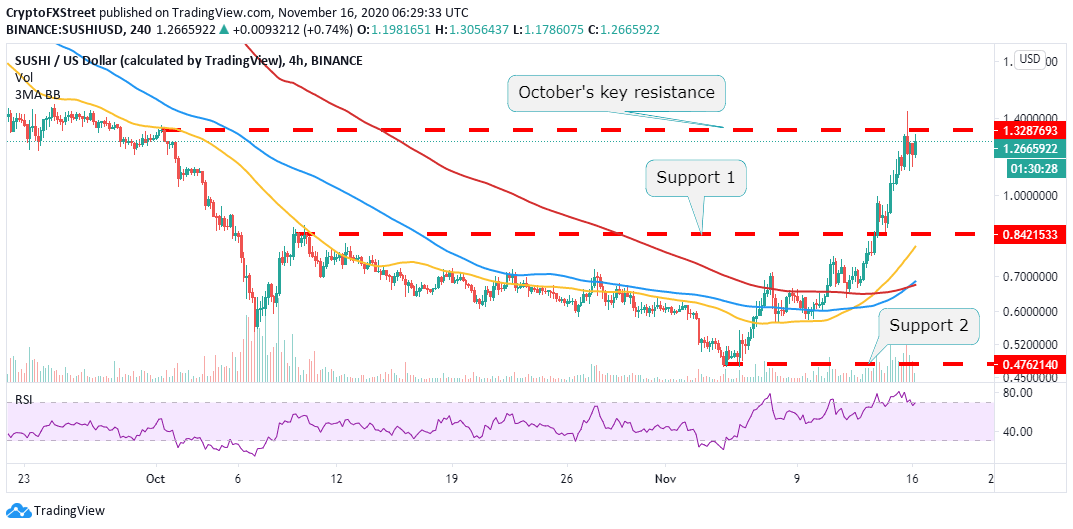

- A reversal from the monthly high is in the offing following the rejection from the resistance range between $1.33 and $1.45.

SushiSwap has recently become a decentralized finance (DeFi) darling token. The massive gains posted in the last 14 days have brought the once-troubled cryptoasset back into the limelight. SushiSwap is changing at $1.28 at the time of writing after growing by over 200% since the beginning of November. The losses seem to be coming back into the picture on SushiSwap hitting October's hurdle between $1.33 and $1.45.

SushiSwap retreat seems imminent

Sellers appear to be streaming back in masses, aiming to regain control over the price and perhaps erase some of the gains accrued in November. The Relative Strength Index on the 4-hour chart gives credence to the bearish outlook after sliding from the overbought region.

The first point of contact in case declines progress is $0.84, but if the bearish grip becomes more vigorous, SUSHI will seek support at $0.47. All the three simple moving averages; the 50 SMA, 100 SMA and 200 SMA, will absorb some of the selling pressure, preventing SushiSwap from plunging massively.

SUSHI/USD 4-hour chart

The TD Sequential indicator has presented multiple sell signals in the form of green nine candlesticks on the 4-hour, 12-hour, and daily charts. In other words, the uptrend may have hit its elastic limit, and SUSHI could commence dumping.

SUSHI/USD 4-hour, 12-hour and daily charts

It is worth mentioning that Santiment's Network Growth metric highlights a spike in the number of new addresses joining the network. If sustained over time, rising network growth is usually a bullish sign for the asset's value.

SushiSwap network growth chart

On the flip side, declining network growth highlights the possibility of the price falling soon. Therefore, the spike in SUSHI's network growth invalidates the bearish outlook and affirms SUSHI's potential to continue with the rally.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%20%5B09.51.03%2C%2016%20Nov%2C%202020%5D-637411073553985240.png&w=1536&q=95)