Sushi price primed for 70% rally as SUSHI bulls clear critical resistance level

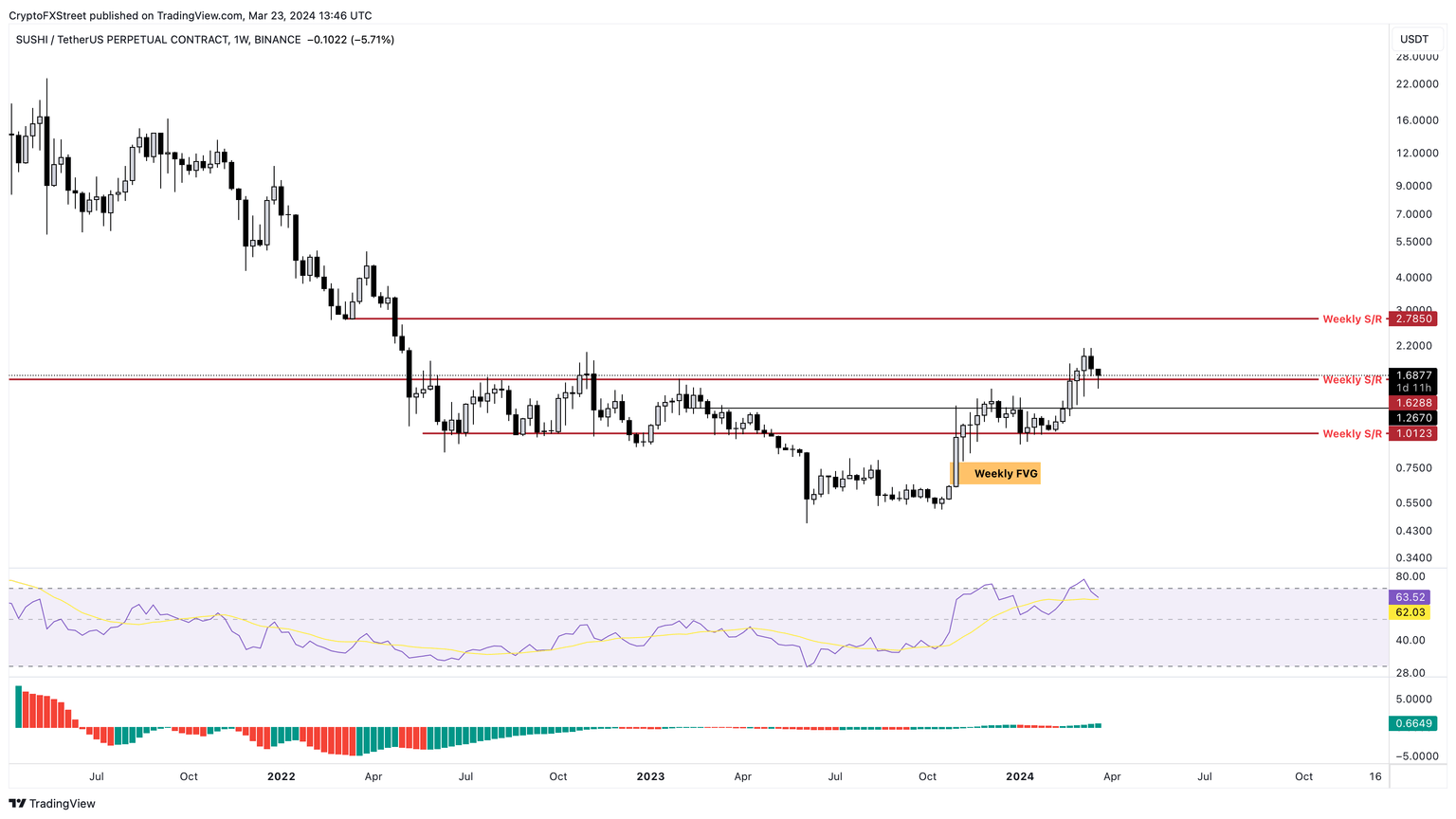

- Sushi price has overcome a resistance level at $1.628, showing bullish strength.

- If the $1.628 level holds, investors can expect SUSHI to kickstart a 70% rally to $2.78.

- A breakdown of the $1.012 level would invalidate the bullish thesis.

Sushi (SUSHI) price shows readiness to move higher after it recently overcame a key hurdle. If the market outlook remains unchanged or improves favoring the bulls SUSHI could trigger a massive upswing.

Also read: Bitcoin Weekly Forecast: BTC may have recovered, but is it out of the woods?

Sushi price has all signs of kickstarting an uptrend

Sushi price consolidation above $1.012 lasted eight weeks, leading to a 109% rally in the next five weeks. This move overcame another critical hurdle at $1.628 and currently hovers above it. But with Bitcoin price showing weakness investors need to exercise caution.

If BTC continues to move sideways or trends higher, then the Sushi price could kickstart an uptrend. Supporting the bullish outlook is the bullish momentum displayed by the Relative Strength Index (RSI), which is situated around the 70 level.

A potential correction to the intermediate support level at $1.267 could be likely, as this move would allow RSI to reset to the 50 mean level.

So, a bounce around $1.267 or $1.628 will be good accumulation zones for patient SUSHI buyers. Assuming the Sushi price bounces from its current position a retest of the $2.785 resistance level would constitute a 70% gain.

SUSHI/USDT 1-week chart

On the other hand, if Sushi price breaks the $1.267 intermediate support level, it would signal weakness. If the selling pressure continues to build, SUSHI could slide lower and tag the $1.012 barrier.

A breakdown of this level would create a lower low and invalidate the bullish thesis for SUSHI. In such a case, Sushi price would risk a 22% correction to the weekly imbalance, extending from $0.792 to $0.642.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.