- Sushi price had a significant but healthy 25% correction after a massive uptrend.

- Several on-chain metrics remain heavily bullish and indicate Sushi can climb higher.

On November 6, 2020, Sushi started a major rally from a low of $0.472, reaching $4.163 in January 2021. So far, bulls have been in control of the trend and there have been no red flags.

Sushi price aiming to establish a new high after a healthy correction

Sushi is down by 25% since January 4 but it seems that several on-chain metrics remain in favor of the bulls. Despite the price plummeting, the number of Sushi coins inside exchanges has continued to decline since December 20, 2020, from 42.7% to only 22% currently.

SUSHI supply on exchanges chart

Additionally, the number of whales holding between 100,000 and 1,000,000 coins has increased since January 1 from 18 to 25, indicating that investors are willing to buy the dip and expect Sushi price to rise higher.

SUSHI Holders Distribution chart

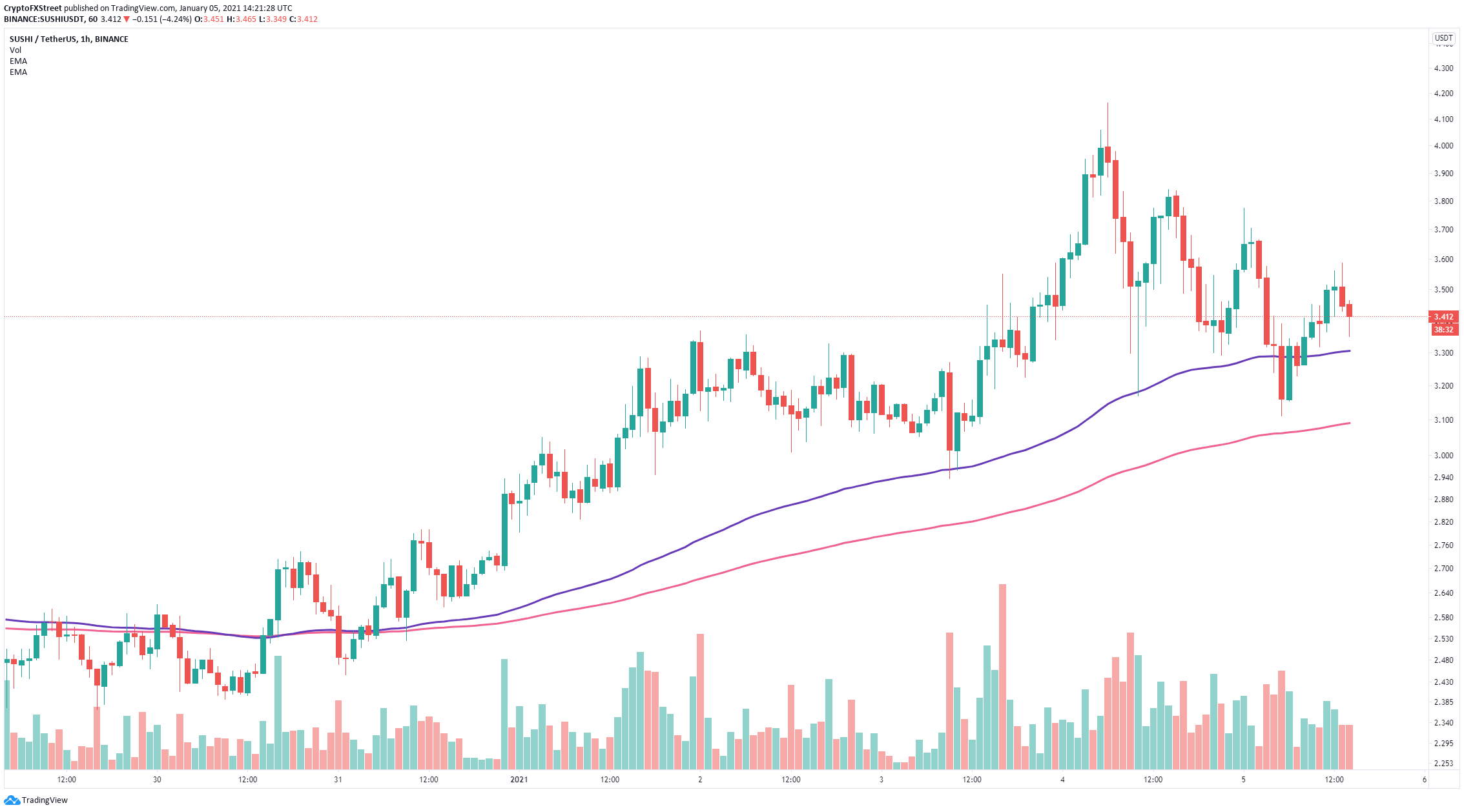

However, in the short-term, the bears are in control right now after establishing a clear downtrend on the hourly chart, setting several lower highs and lower lows.

SUSHI/USD 1-hour chart

Sushi dropped below the 100-EMA briefly but has rebounded. A clear breakdown below the 100-EMA will quickly push the digital asset down to the 200-EMA at $3.08. Losing this level would be notable and could potentially send Sushi towards $2.4.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum ETFs recorded net inflows of $104.1 million on Friday — their highest daily inflow since February 4, per SoSoValue data. As a result, the products saw a weekly net inflow of $157.1 million, which also marks their highest net buying activity since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation filed a registration statement with the Securities & Exchange Commission on Friday, signaling its intent to offer and sell a wide range of securities.

Bitwise hints at NEAR ETF following Delaware registration

The filing marks a crucial step before a firm submits an application for an ETF with the SEC. While Bitwise has not yet applied for a NEAR ETF with the SEC, similar actions preceded its previous XRP and Aptos ETF filings.

Bitcoin price could reach $285K by 2030 as Citigroup forecasts $1.6 trillion stablecoin inflows

Bitcoin price outlook strengthens as Citigroup projects $1.6 trillion stablecoin growth, calling them critical bridges between banks and blockchain.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20[15.18.21,%2005%20Jan,%202021]-637454533306239856.png)

%20[15.22.17,%2005%20Jan,%202021]-637454533408592479.png)