- Major cryptocurrency exchange Bitfinex lists SushiSwap's SUSHI token for trading.

- SUSHI jumped 5% following the announcement, rising above $4.5.

- Now, the DeFi token must breach the $4.80 supply barrier to surge higher.

Bitfinex became the fourth major cryptocurrency exchange to list SushiSwap after Binance, Huobi, and FTX. With SUSHI price up almost 40% in the last 24 hours, it might be poised for further highs as it penetrates a new market.

SUSHI price may witness the exchange listing effect

SushiSwap is an automated market maker [AMM] and a decentralized exchange [DEX] with SUSHI as its native token. Although this altcoin is intended to perform several functions, its utility can be boiled down to a primary value proposition: protocol ownership. SUSHI holders receive revenue shares from the exchange's fees and participate in the platform's governance proposals.

The hype around the project has faded since the DeFi summer last year, but it is slowly turning the tide with multiple partnerships strengthening its fundamentals. A significant exchange listing like Bitfinex could help the protocol regain bullish momentum to top off the developments, especially when considering that Uniswap's price doubled in less than 48 hours after it was listed on Bitfinex. Hence, it is likely to expect a similar price action for the newly listed SUSHI token.

Higher highs on the horizon

SUSHI price currently sits at $4.47 after surging a whopping 40% in the past 48 hours. While the recent Bitfinex listing can be regarded as a positive sign, the technicals also point to a bright future.

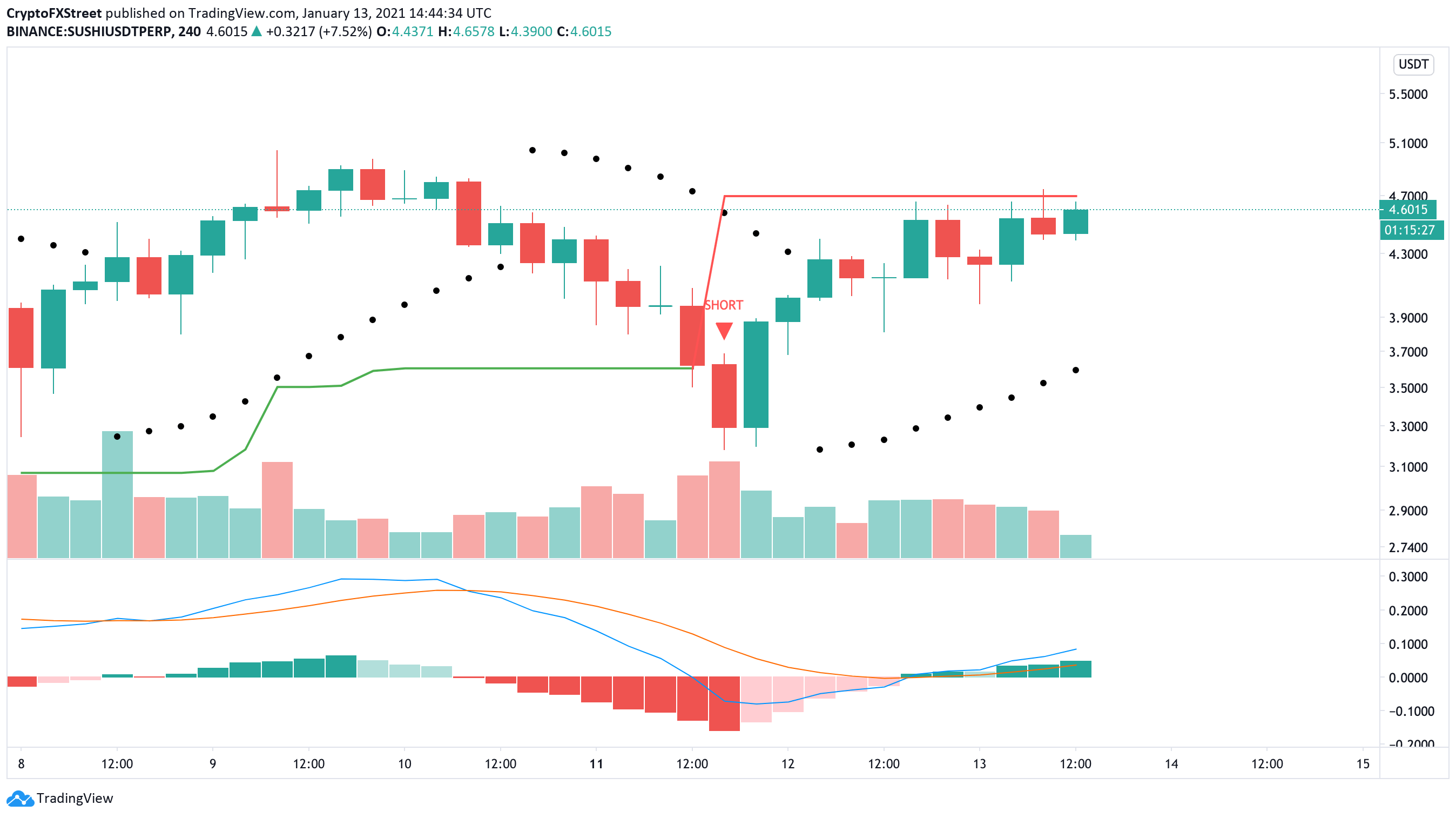

For instance, the Parabolic SAR and the MACD suggest further gains on the horizon after turning bullish on January 12. The SuperTrend indicator could also flash a buy signal if SushiSwap can close above $4.70, but doing so will not be easy SUSHI/USD 4-hour chart

SUSHI/USDT 4-hour chart

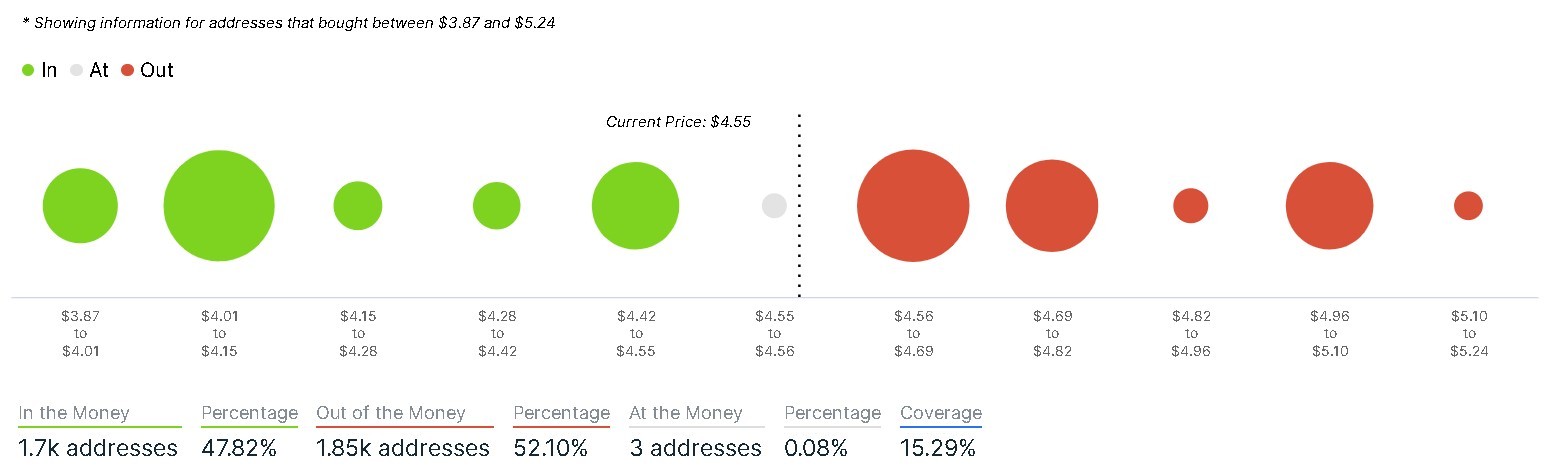

IntoTheBlock's In/Out of the Money Around Price (IOMAP) model suggests that the $4.70 level is a major resistance barrier ahead of SushiSwap. Here, roughly 1,300 addresses had previously purchased 7 million SUSHI. Holders who have been underwater might want to break even at these levels, keeping rising prices at bay.

Therefore, only a 4-hour candlestick close above $4.70 will serve as confirmation of the optimistic outlook. If this were to happen, SUSHI price could rise to the next important interest area at $6.

It is worth noting that SushiSwap sits on top of stable support based on the IOMAP cohorts. This on-chain metric shows that 445 addresses bought 1.62 million SUSH around $4.40. As long as this support level holds, the bullish outlook will remain intact. Failing to do so could see the DeFi token drop towards $4.00.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Is Altcoin Season here as Bitcoin reaches a new all-time high?

Bitcoin reaches a new all-time high of $98,384 on Thursday, with altcoins following the suit. Reports highlight that the recent surge in altcoins was fueled by the victory of crypto-friendly candidate Donal Trump in the US presidential election.

Shanghai court confirms legal recognition of crypto ownership

A Shanghai court has confirmed that owning digital assets, including Bitcoin, is legal under Chinese law. Judge Sun Jie of the Shanghai Songjiang People’s Court shared this opinion through the WeChat account of the Shanghai High People’s Court.

BTC hits an all-time high above $97,850, inches away from the $100K mark

Bitcoin hit a new all-time high of $97,852 on Thursday, and the technical outlook suggests a possible continuation of the rally to $100,000. BTC futures have surged past the $100,000 price mark on Deribit, and Lookonchain data shows whales are accumulating.

Shiba Inu holders withdraw 1.67 trillion SHIB tokens from exchange

Shiba Inu trades slightly higher, around $0.000024, on Thursday after declining more than 5% the previous week. SHIB’s on-chain metrics project a bullish outlook as holders accumulate recent dips, and dormant wallets are on the move, all pointing to a recovery in the cards.

Bitcoin: New high of $100K or correction to $78K?

Bitcoin surged to a new all-time high of $93,265 in the first half of the week, followed by a slight decline in the latter half. Reports highlight that Bitcoin’s current level is still not overvalued and could target levels above $100,000 in the coming weeks.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.