Sui Price Prediction: SUI readies for a possible 45% breakout

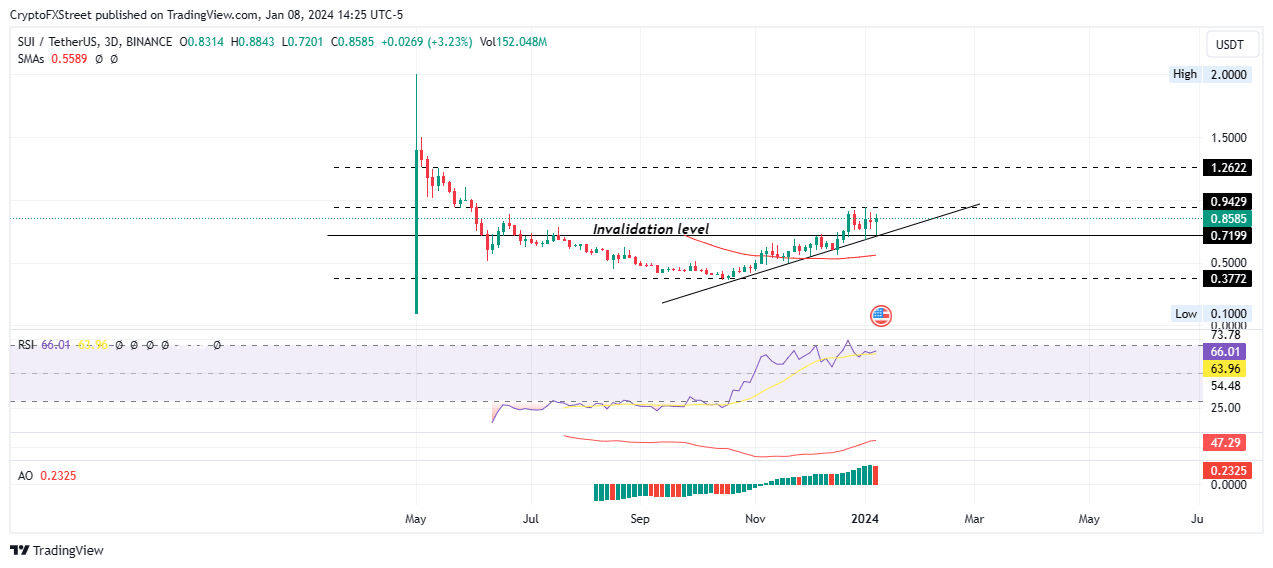

- Sui price remains above the support offered by an ascending trendline that has delivered up to 130% in gains so far.

- SUI could extend the climb to the $1.2622 resistance level as momentum rises and the uptrend gains strength.

- The bullish thesis will be invalidated if the price breaks and closes below the $0.7199 support level.

Sui (SUI) price has not abandoned its recovery rally since the market turned bullish around mid-October. Based on technical indicators, the uptrend may still have ground to cover amid rising bullish fundamentals.

Also Read: $518 million in crypto tokens could flood exchanges in January: APT, INJ, OP, SUI, AXS unlocks

Sui price could rally 45%

Sui (SUI) price remains above an ascending trendline, providing downward support as the altcoin attempts a recovery rally. The upside potential for SUI remains alive as indicated by the technicals, starting with the Relative Strength Index (RSI). With this momentum indicator moving north, momentum is rising as more bulls flock the scene. This explains why the Awesome Oscillator (AO) remains in positive territory.

Also, the position of the RSI at 66 suggests Sui price still has room to travel north before we can talk about the pullback possibility as a consequence of SUI being overbought.

Moreover, the Average Directional Index (ADX) indicator is climbing with the trend strength quantifier showing the uptrend is only getting stronger.

If the accumulation pattern continues, Sui price could soon breach the immediate roadblock at $0.9429. Further north, the altcoin could ascend toward the $1.2622 resistance level in a move that would constitute a 45% climb above current levels.

In a highly bullish case, Sui price could clear the aforementioned barrier before extending north to tag the $1.5000 psychological level.

SUI/USDT 1-day chart

On-chain metrics supporting Sui price bullish outlook

Data from the behavior analytics tool Santiment shows notable spikes in social dominance as well as social volume, suggesting the share of SUI mentions on crypto-related social media has been increasing.

SUI: Social dominance, Social volume

Also, there has been a steady rise in the percentage of total stablecoin supply held by whales with more than $5 million. This metric shows the buying power of investors, with the rise showing a growing capacity to buy SUI. The significant whale accumulation of stablecoins rising from 49.237% on December 5 to the current 52.981%, a 7% increase, indicates they are waiting to buy SUI at a lower price, which is a long-term bullish outlook for the market.

Fresh capital has also been flowing into the SUI market, best seen in the significant climb in Tether (USDT) market capitalization.

Percent of stablecoin total supply held by whales / USDT market cap

Conversely, if profit booking kicks off, Sui price could drop below the immediate support at $0.7199. A daily candlestick close below this level would invalidate the bullish thesis, setting the tone for an extended fall to the 50-day Exponential Moving Average (EMA) at $0.5589.

In a more dire case, Sui price could fall even lower to tag the support floor at $0.3772, standing almost 60% below current levels.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.

%2520%5B22.31.04%2C%252008%2520Jan%2C%25202024%5D-638403443723993195.png&w=1536&q=95)

%2520%5B22.32.17%2C%252008%2520Jan%2C%25202024%5D-638403444032693039.png&w=1536&q=95)