Sui price volatility increases with $53 million worth of SUI tokens due to hit markets

- Sui price ascended 140% as meme coin and staking narratives drove markets.

- SUI could retrace the 78.6% Fibonacci level at $1.31 as AI and RWAs become latest sensation.

- The bearish thesis will be invalidated if the staking token records a higher high above $1.65.

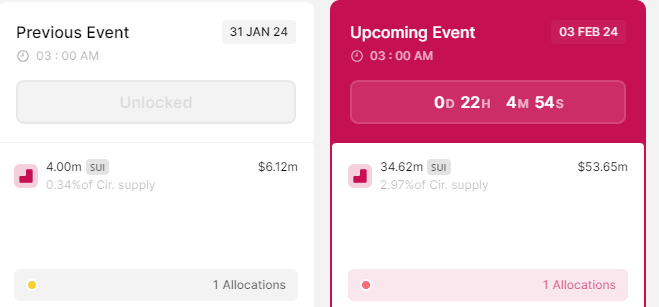

Sui (SUI) price is down a fraction with heightened volatility as holders prepare for 34.62 million SUI tokens worth $53.31 million to hit the market as part of community early access program.

Also Read: SUI, YGG and AGIX holders gear up for $11 million worth of token unlocks this weekend

SUI price braces for volatility

As part of the initiative,Sui community members will be able to obtain SUI directly, with those who have contributed in improving the adoption, stability, security, and reliability of the Sui ecosystem during the Devnet and Testnet phases also included.

SUI token unlocks

Sui price outlook

Sui price is coiling up for a correction, with a 15% pullback likely to the 78.6% Fibonacci level at $1.31. In the dire case, the drop could see the altcoin retrace the most critical Fibonacci level of 61.8% at $1.05. This would denote a 30% drop below current levels.

Multiple technical indicators support this thesis. The Relative Strength Index (RSI) is at levels where it has corrected multiple times with the price mirroring the rejection. The Awesome Oscillator (AO) is also showing a pronounced red histogram bar, which is a bearish sign, accentuated by the Moving Average Convergence Divergence (MACD), which was losing slope after a vivid northbound trajectory.

SUI/USDT 1-day chart

On the flip side, if the bulls show resolve, Sui price could extend the intermediate trend, potentially clearing the local top at $1.65. A higher high above this level would invalidate the bearish thesis, bringing the $2.00 range high into focus.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.