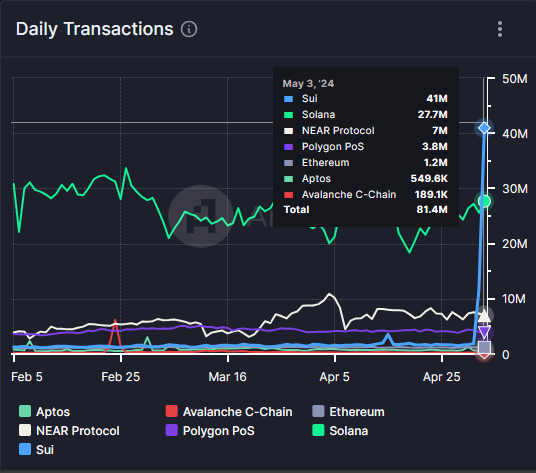

- Sui blockchain daily transactions have reached 41 million relative to 27 million recorded by Solana.

- On a normal day, SUI records 1-2 million transactions daily, while SOL ranges anywhere between 20-35 million, Artemis dashboard shows.

- SUI price could execute a bullish reversal pattern despite current bearish outlook.

Sui (SUI) price has dipped 3 % in the past 24 hours and remains down 15% in the last week. However, other metrics suggest something could be at play in the Sui ecosystem as daily transactions skyrocket.

Also Read: Sui soars nearly 12% after partnership with BytePlus

Sui daily transactions skyrocket

Despite the bearish outlook seen in the Sui price, daily transactions soared to $40.96 million. With the spike, the Sui chain has overtaken the Solana (SOL) blockchain, which remains at 27.68 million.

When daily transactions skyrocket on a blockchain, it points increased activity and usage of the network. It may indicate various factors, including but not limited to growing adoption of the token, increased trading volume, or the launch of new decentralized applications (dApps) running on the blockchain.

Blockchain daily transaction comparison

However, there are also some negative implications to a surge in daily transactions. These include:

Network congestion

It could cause delays in transaction confirmations and higher fees with users competig to have their transactions processed quickly.

Scalability concerns

Scalability issues are more common during periods of peak activity because not all blockchain networks are similar in terms of capacity to handle large volumes of transactions efficiently.

Security risks

With sudden surges in transactions, the risks of security threats tend to increase. Among them, double-spending attacks or bad actors taking advantage of network vulnerabilities.

Based on the chart below, the Sui chain records an average of 1-2 million transactions daily, while SOL ranges anywhere between 20-35 million.

Daily transactions comparison by chain

This means something could be happening on the network, but remains under the wraps, as the Sui network did not respond immediately to FXStreet request for comment.

Nevertheless, the surge comes just about two weeks after Sui partnered with BytePlus, the technology arm of ByteDance. The collaboration is intended to bring the firm’s services to Web3, potentially giving rise to innovative Web3 gaming and social apps.

@EmanAbio and Long Li, BytePlus Regional Manager, announced this new partnership onstage at Sui Connect Dubai today.

— Sui (@SuiNetwork) April 17, 2024

BytePlus will explore data warehousing, content recommendation, content generation, and augmented reality in Web3 game platforms and socialFi projects in… pic.twitter.com/hrjTQBTsqz

It also comes just under a month after Hong Kong-based first digital's $3 billion stablecoin FDUSD arrived to Sui network as part of a DeFi push. The integration is part of an effort to make the token more embedded into the decentralized finance space, First Digital's CEO Vincent Chok said in an interview.

Why SUI price could be primed for recovery

At the time of writing, the Sui price is trading for $1.0594, and while it remains in a broadly bearish technical formation, a bullish reversal could take place soon, with two fundamentals pointing to this effect.

- Sui price is almost filling a descending/falling wedge pattern, which could precede a bullish breakout.

- The Relative Strength Index (RSI) shows that SUI token is almost oversold, which precedes a correction or pullback.

SUI/USDT 1-day chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ripple's XRP eyes massive rally following spike in key on-chain metric

Ripple's XRP trades near $2.40, up 1% on Monday following a 40% surge in its futures open interest. The surge could help the remittance-based token overcome the key resistance of a bullish pennant pattern.

Crypto Today: Bitcoin taps $100K, AI Tokens surge as Ripple CEO announces US hirings

The cryptocurrency sector valuation increased by $11 billion on Monday to reach an 18-day peak of $3.47 trillion. Bitcoin price crossed the $102,480 mark, on course to print a seventh consecutive green candle.

Solana memecoins to watch in January 2025: Pudgy Penguins, Fartcoin, Ai16z lead the way

Solana memecoins took center stage on Monday, crossing the $22 billion aggregate market cap milestone as the crypto sector's positive start to 2025 enters day six.

Bitcoin reclaims $100K as Calamos announces upcoming launch of first ever downside protection BTC ETF

Bitcoin rallied above $100,000 on Monday following asset manager Calamos' announcement of a 100% downside protection Bitcoin exchange-traded fund to help investors manage their risk.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.