Strong Bounce Brings Bitcoin Back above 5K

After a sharp drop of almost 20 percent, cryptocurrencies surged yesterday. Bitcoin (+4.4%) has recovered and is above the $5,000 level. Similar moves experienced Ethereum (+2.81%), Ripple(+2.37%), Bitcoin Cash (+6.32%), and other altcoins. Ethereum-based tokens also had a sharp recovery, with Link(+6.87%), CRO(+8.7%), and BAT(+8.46%) among the best performers.

After this positive advances, the market capitalization of the sector still is 2.47 percent less than 24 hours ago, and currently holds at $148.444 billion. The traded volume, though went up by 49.36 percent, to $59.644 billion, whereas Bitcoin dominance is 64.82 percent, almost unchanged from yesterday's value of 64.4 percent.

Hot News

CBOE Implied volatility Index, VIX, a measure of investors' fear, surged to its highest levels in history. Wall Street stock indices plunged over 12 percent on Monday, experiencing one of the largest declines of the last 30 years, as the effects of the COVID-19 pandemic on the economy are showing.

As an example of what's coming, yesterday, the flight industry stated they would need over $50 billion emergency aid to keep them afloat. VIX jumped +43.98 percent in a single session as S&P 500 index dropped by 11.98 percent, the Dow Jones Industrial Average DJIA 12-92 percent, and the Nasdaq Composite COMP fell 13.23 percent.

Technical Analysis - Bitcoin

Yesterday noon, Bitcoin has bounced off sharply after it found buyers at the $4.500 level and recovered its $5,000 psychological level. It seems the price moves in a slightly descending channel, with the current price touching the upper side.

The price has moved to the upper channel of the Bollinger Bands, and its MACD continues pointing upwards. All this is positive for the digital currency, but it is close to resistance levels. If the price breaks above $5,700, it may continue to $6,650.

|

Support |

Pivot Point |

Resistance |

|

4,500 |

5,700

|

6,300 |

|

4,000 |

6,650 | |

|

3,500 |

7,200 |

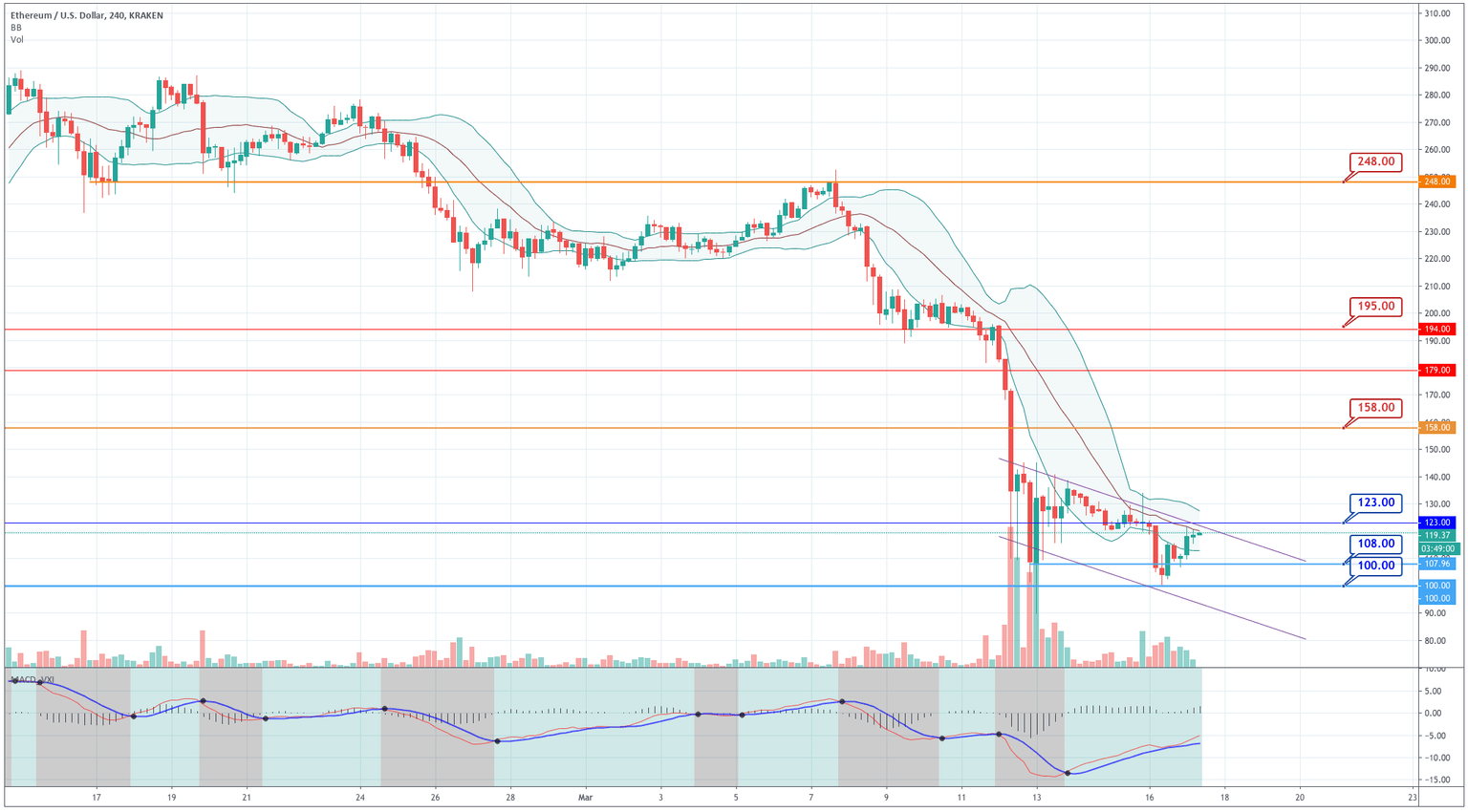

Ethereum

Ethereum is touching resistance levels, after its bounce off from the $100 level. The latest price action has also made a descending channel. Now it remains to be seen whether it can break the resistance of the downward channel or continues to follow its trajectory. The MACD is still in a bullish phase, but the price still has to move above its mid-Bollinger line to show us a bullish bias. If the price breaks above $123, we could see an impulse to $140. Otherwise, a test of the $100 level could happen.

|

Support |

Pivot Point |

Resistance |

|

110.00 |

123.00

|

128.00 |

|

100.00 |

140.00 | |

|

89.00 |

158.00 |

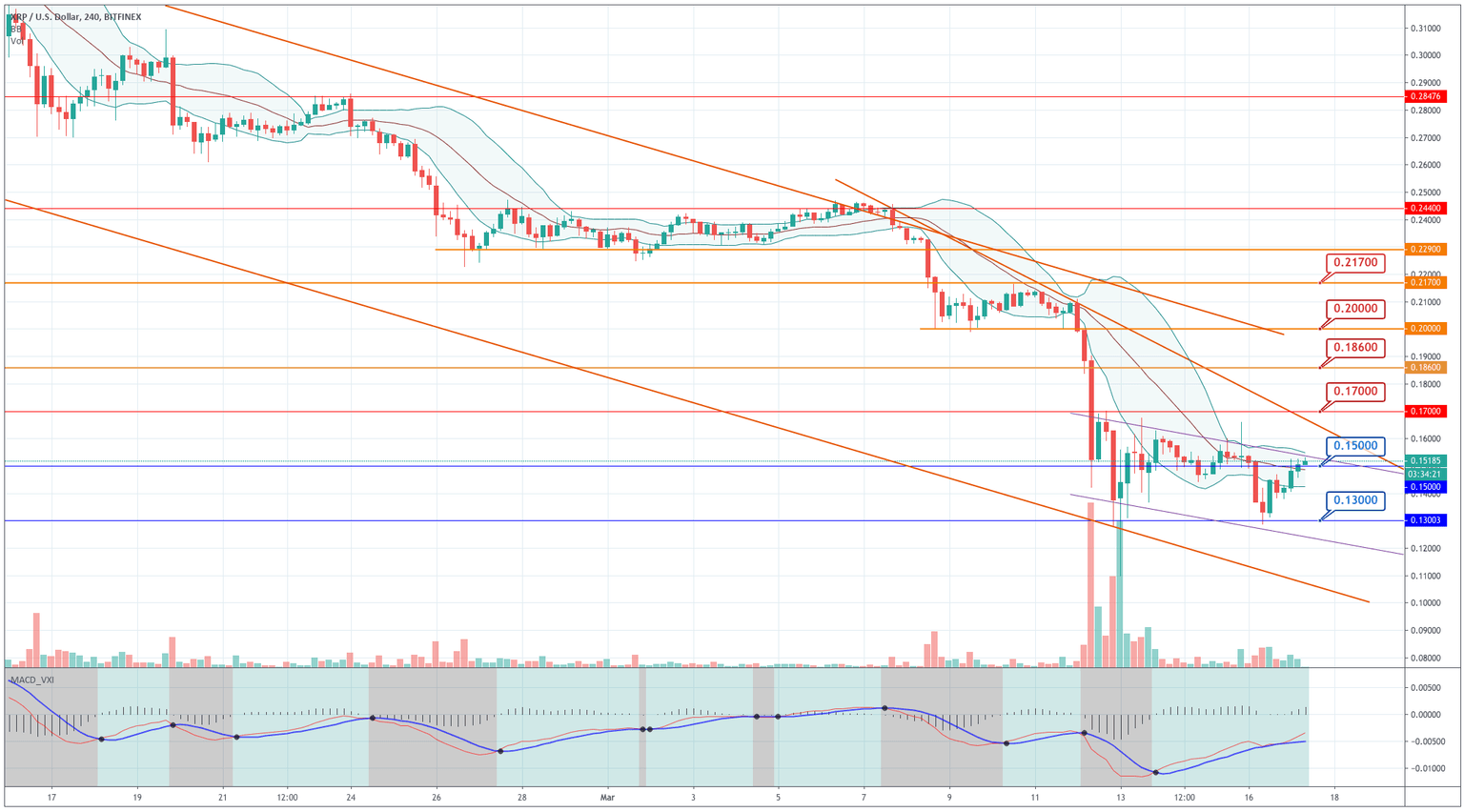

Ripple

Ripple has followed the overall market bounce. In this case, the rebound came from the $.0.13 level, and it drove the price above $0.15. The price is now in the upper Bollinger channel and near the +1SD line, which is positive for the buyers. The MACD confirms the current positive bias. The price is near resistance levels and possibly at the top of a slightly descending channel. A break above $0.16 could continue moving the asset towards $0.17. But the momentum is fading, and also a reversal of this short-term bounce could happen.

|

Support |

Pivot Point |

Resistance |

|

0.1300 |

0.1600

|

0.1700 |

|

0.1200 |

0.1860 | |

|

0.1050 |

0.2000 |

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and