STRK price climbs 6% after Starknet promises cheaper transactions

- Starknet releases its 2024 roadmap, based on improving performance, reducing fees, and introducing version upgrades.

- Starknet’s plan includes boosting data availability and parallel transactions.

- STRK price climbed nearly 6% on the day, wiping out recent losses.

Starknet, a Layer 2 network that operates on the Ethereum mainnet, released its 2024 roadmap on Wednesday, promising users version upgrades and scaling without compromising on security. The news seems to have been well-received by crypto market participants, with Starknet native token STRK registering gains despite the broad-based market sell-off.

Also read: Starknet fixes STRK token airdrop issues for Immutable X and ETH pool stakers

Starknet to cut transaction costs for users

Ethereum’s Dencun upgrade reduced transaction costs for Layer 2 chains like Starknet after its successful implementation on March 13. In 2023, the Layer 2 chain’s community asked for an improvement in the chain’s performance and a reduction in its fees.

Starknet promises to deliver on these upgrades and improve the scalability of its protocol in 2024. Developers and users depend on an improvement in throughput and a reduction in the transaction fees of the Layer 2 chain.

The Layer 2 chain improved its throughput by ten times in 2023, when it released its Starknet Alpha version 0.12.0.

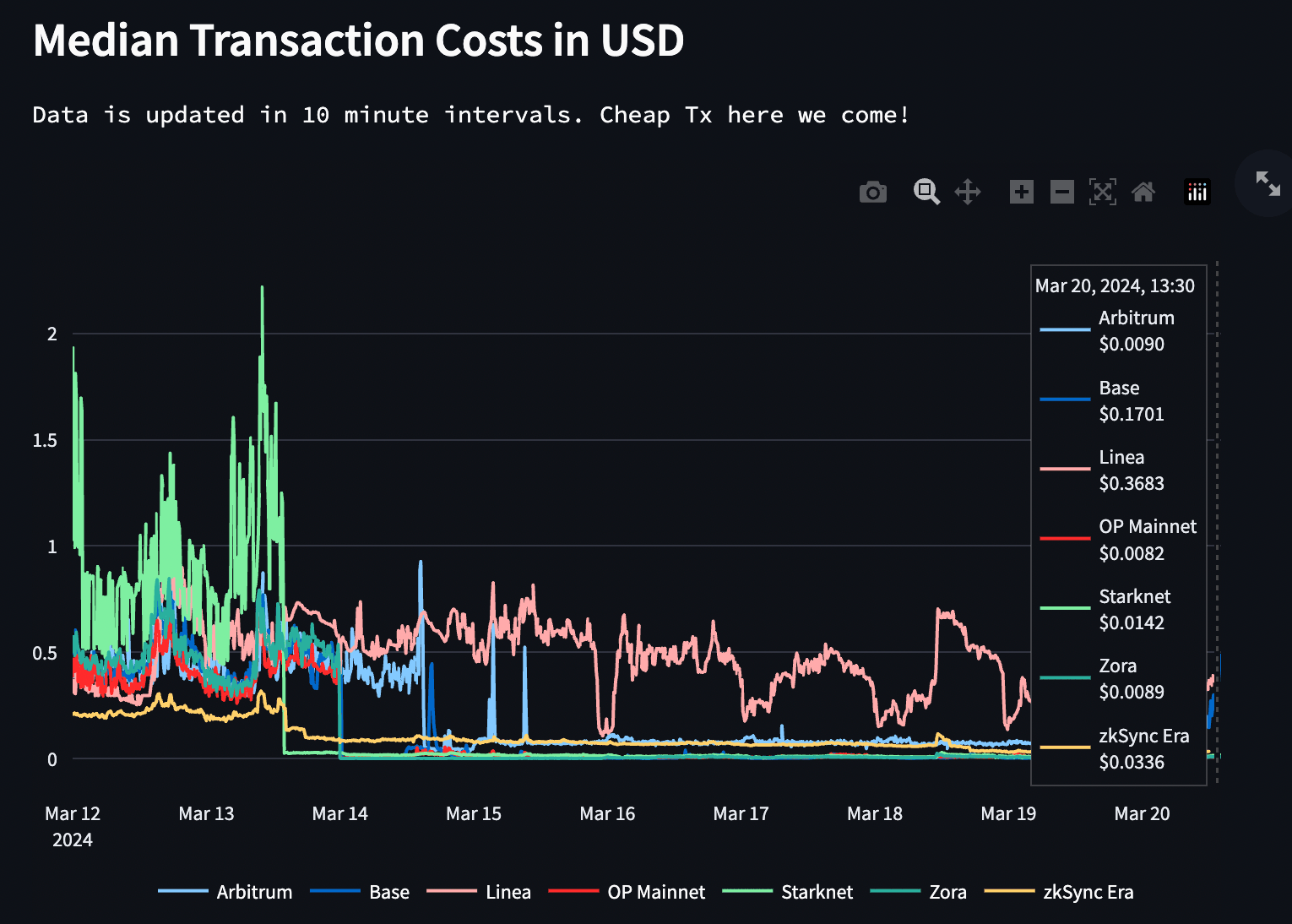

According to data on the median transaction costs of Layer 2 chains in USD, Optimism ($0.0082), Arbitrum ($0.0090) and Zora ($0.0089) are still cheaper than Starknet ($0.0142). The Layer 2 chain aims to change this with its upcoming version upgrades.

Median transaction costs in USD. Source: EIP4844 Tracker Streamlit

The roadmap is as follows:

Starknet roadmap. Source: Starknet’s official blogpost on Medium

The upgrade v0.14.0 will introduce Volition, Applicative recursion and DA compression. These three developmental upgrades focused on storing data on Starknet, instead of the base chain (Ethereum), lowering fees for end users through batching, and reducing data storage and compression of the Layer 2 chain’s footprint on the Ethereum mainnet. Users can therefore expect a reduction in the protocol’s transaction costs in Q4.

STRK price reacts positively to roadmap release

Starknet price reversed a short-term downward trend, with a daily candlestick close above $1.947. There are three key resistance levels in STRK/USDT’s uptrend. The Layer 2 token could face resistance at $2.143 (4-hour Support/Resistance level), $2.295 (1-day S/R), and $2.670 (1-week S/R).

STRK price hit its year-to-date peak at $2.670 on March 14. The Moving Average Convergence/Divergence indicator shows green bars above the zero line, supporting a bullish thesis for STRK price.

The Relative Strength Index (RSI) reads 50.09, in the neutral zone. It’s important to note that RSI climbed in tandem with price. This shows a balance between the bullish and bearish positions in STRK.

STRK/USDT 4-hour chart

In the downside scenario, if STRK price closes below the $1.967 level on the 4-hour chart, it could invalidate the bullish thesis. In such a case, the next level on the downside would be March 19 low at $1.750.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.