Stellar to boost network utility with new Matching Fund as XLM edges closer to breakout

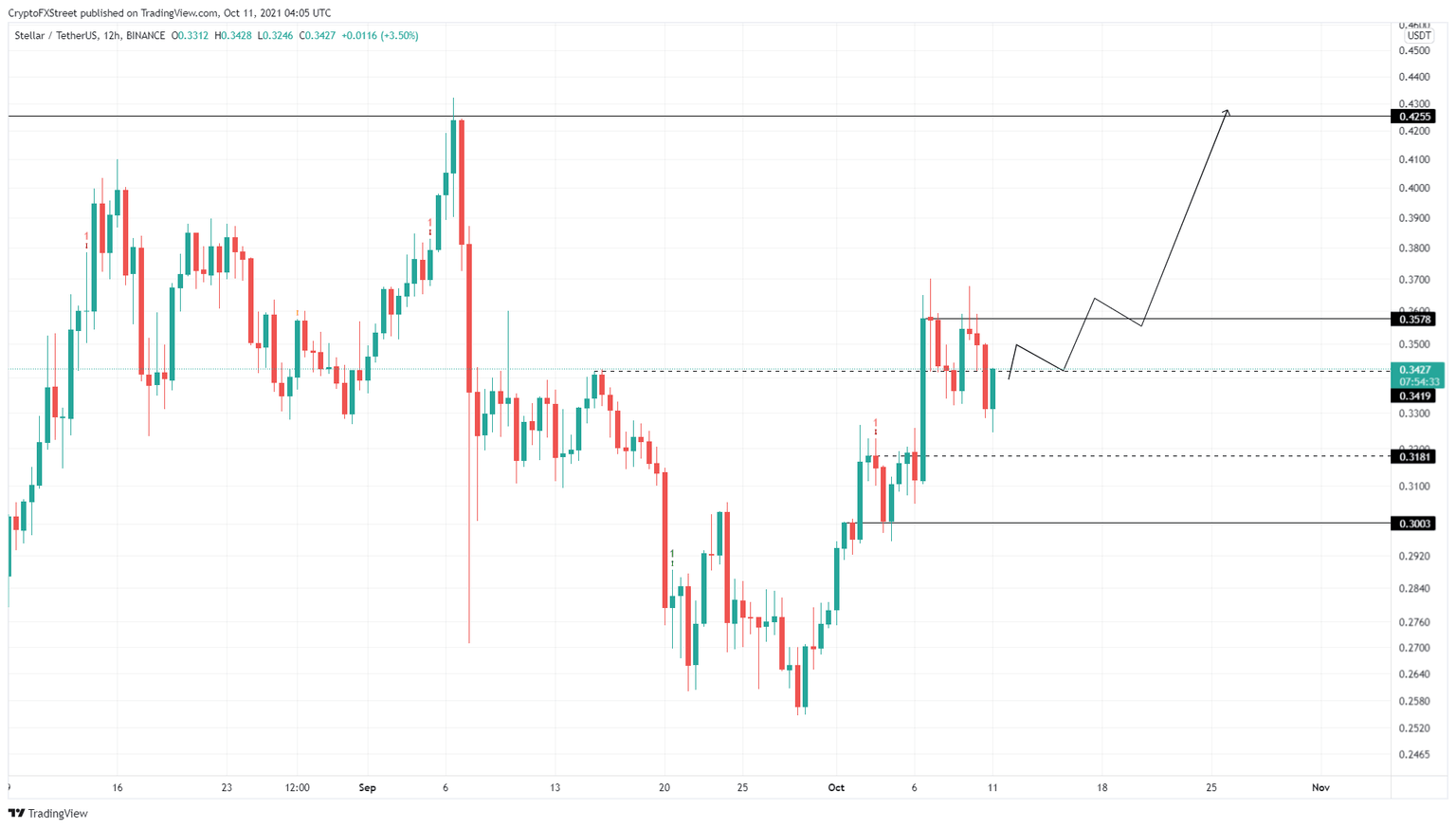

- XLM price is stuck between $0.342 and $0.318 barriers as it ponders on a directional bias.

- Stellar launches the Matching Fund to help early-stage companies interested in building on the XLM blockchain.

- A decisive close above $0.342 and $0.355 will open the path for a retest of $0.426.

XLM price has been consolidating since the October 6 rally. In fact, Stellar looks to be on a slow downswing. Due to this development, the altcoin has slid between a stiff resistance level and a stable support floor. Therefore, XLM price needs to shatter either of the barriers to kick-start a move.

Stellar launches the Matching Fund

The Stellar Development Foundation (SDF) has been on a roll as it recently announced the partnership with MoneyGram on October 6 and also revealed the launch of Matching Fund on October 8.

This development from SDF comes as an extension of its strategic venture-style investments to help grow the Stellar ecosystem. Matching Fund falls within the purview of the Enterprise Fund and will invest in or fund early-stage companies that are in the pre-Series B level and are building on the Stellar blockchain.

The blog stated,

The Matching Fund will match up to $500,000 USD in investment made by a lead investor in a company and processes deals through an expedited process.

Moreover, the Enterprise Fund will continue to support investments across all stages but shift to later stage investments up to Series E (pre-IPO).

With Ripple/XRP, its main rival facing the SEC, Stellar/XLM has received a wide birth to make headway in the remittance industry. Stellar is making good use of this freeway as it recently announced a partnership with MoneyGram, who broke off the collaboration after the SEC sued Ripple.

XLM price vies to head higher

XLM price rose roughly 15% on October 6 on the MoneyGram announcement and sliced through the $0.342 resistance barrier. This uptrend set up equal highs at $0.358. However, soon after the local top, Stellar buyers failed to sustain this ascent, leading to a downswing to $0.325.

Therefore, the $0.342 and $0.358 barriers currently serve as resistance barriers, and XLM price needs to overcome these to have any upswing opportunities.

A decisive close above $0.342 will be an initial confirmation that the buyers are interested, but a 12-hour candlestick close above $0.358 will set up a higher high and indicate the start of a new uptrend. In this case, XLM price could rally and tag the $0.426 supply level, constituting a 26% ascent from the current position.

XLM/USDT 12-hour chart

While things are looking good for XLM price, a failure to slice through $0.342 and $0.358 will reveal a weakness among buyers or absence of buying pressure. In such a scenario, Stellar will likely revisit $0.300, a breakdown of which will invalidate the bullish thesis.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.