- Stellar Network saw several of its nodes go offline on April 6.

- This malfunction led to a temporary halt in transaction validation.

- XLM price eyes a retracement as investors book profit near the local top at $0.60.

Stellar network’s validator nodes experienced an unexpected breakdown recently. During the same period, the XLM price also hit a dead end and is eyeing a pullback.

Validators crash, but Stellar network continues operation

On April 6, several Stellar Development Foundation’s (SDF) validator nodes temporarily stopped validating transactions, which resulted in a halt for some transactions while others progressed as usual.

In a blog post, the SDT team stated:

During the entirety of the SDF node downtime, the Stellar network remained online. Because it is decentralized, and the majority of Stellar network validator nodes were still functioning, the network continued to process transactions.

Although the SDF worked to resolve the issues quickly, popular exchanges like Binance, Bitfinex and Bitstamp reported this issue as they halted withdrawals.

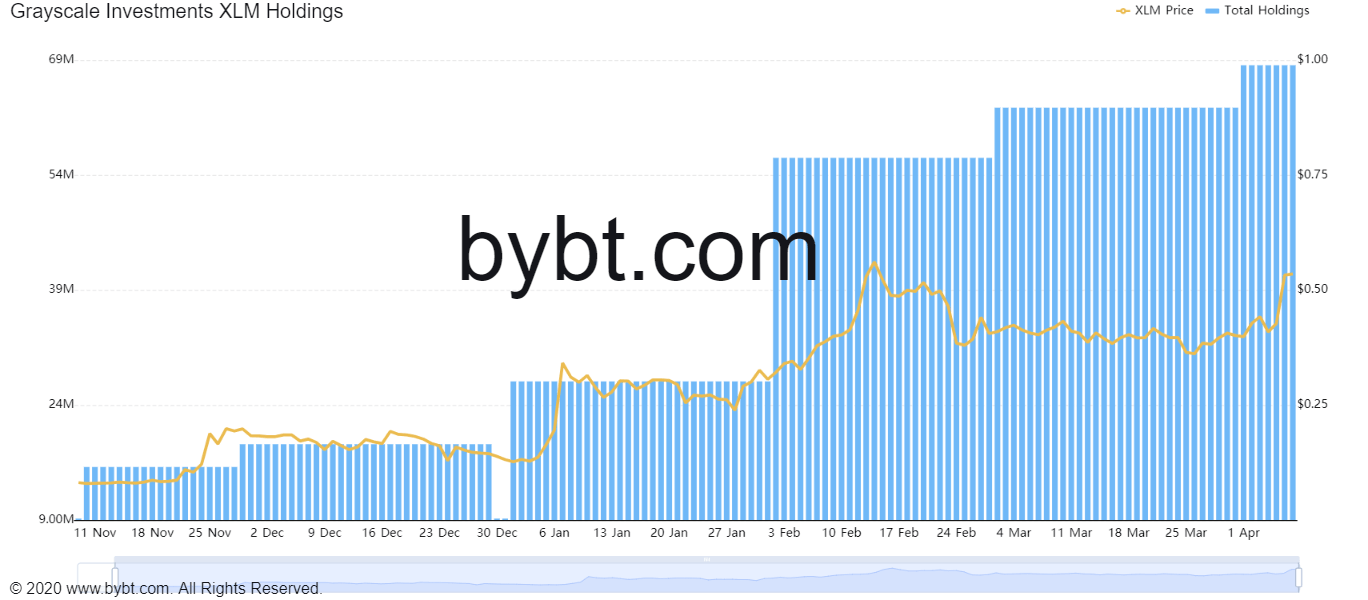

Despite the recent setback, there are also positive news surrounding Stellar, as investment company Grayscale increased its XLM holdings by purchasing 5.5 million tokens last week.

Grayscale XLM holdings chart

The recent addition brings their total holdings to 68.59 million XLM, worth approximately $37 million at the current price.

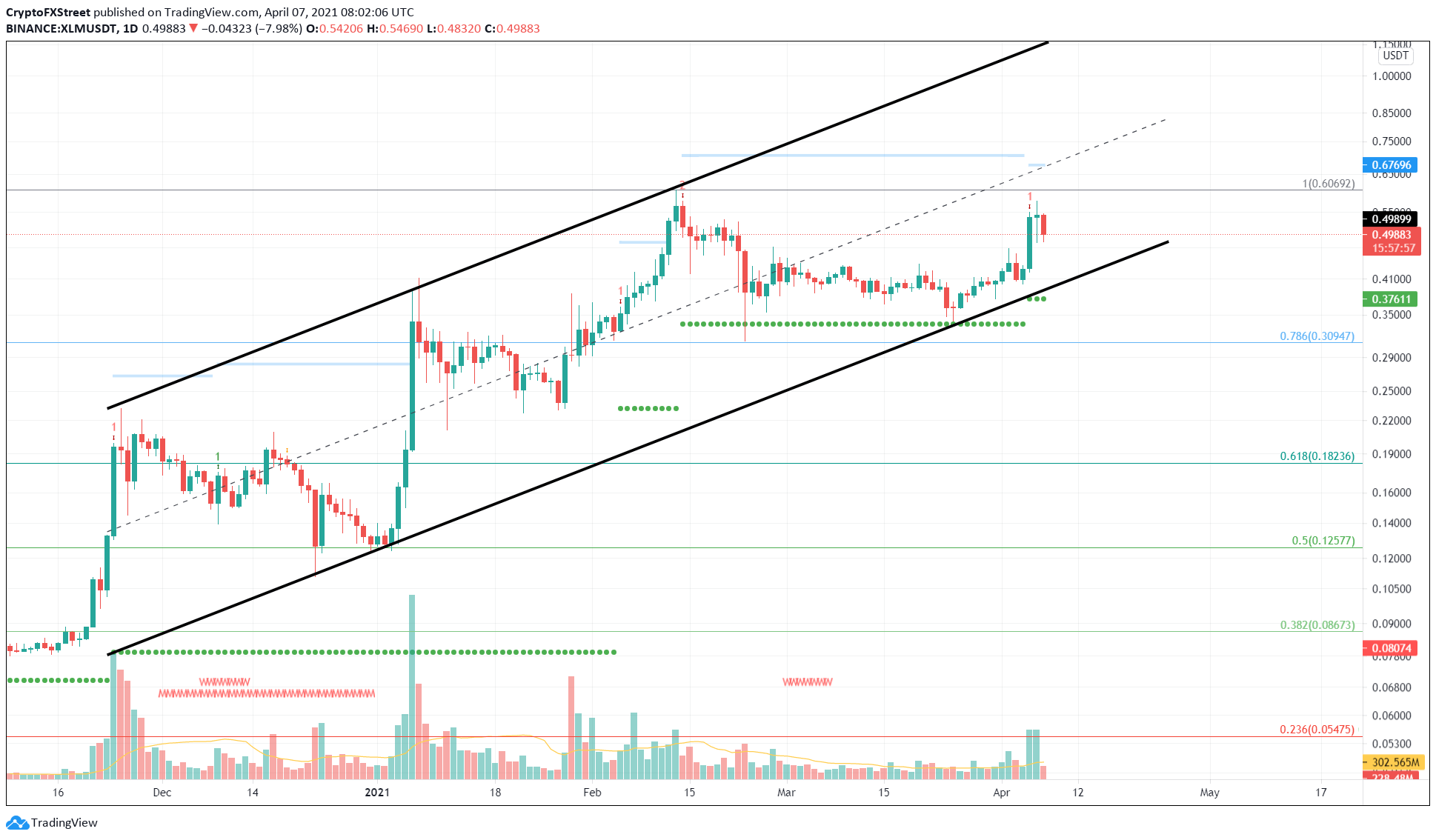

XLM price may reverse as major red flag develops

The XLM price has failed to create a higher high as it faces resistance at the ascending parallel channel middle line. The technical formation is formed as a result of higher highs and higher lows connected using trend lines.

After creating a swing low on March 25, the remittance token was on a trajectory toward the channel’s upper boundary. However, the XLM price journey faced a blockade around the previous local top at $0.60, which coincides with the middle line.

A rejection here might send the Stellar price crashing toward the lower boundary at $0.41. However, this downtrend will likely face exhaustion after a 22% drop to $0.37, which is the State Trend Support set up by the Momentum Reversal Indicator (MRI).

If sellers overwhelm the level mentioned above, the XLM price could slide another 10% to a subsequent demand barrier at $0.33.

Adding credence to the bearish outlook is the recently spawned cycle top signal presented in the form of a red-one candlestick on the 1-day chart. This setup forecasts a one-to-four candlestick correction.

XLM/USDT 1-day chart

A potential spike in buying pressure that would push the XLM price above the MRI’s breakout line at $0.70 might catalyze the buyers to pile up. Such a move would provide the remittance token a chance to surge toward the ascending parallel channel upper trend line around $1.42.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

PEPE Price Forecast: PEPE could rally to double digits if it breaks above its key resistance level

Pepe (PEPE) memecoin approaches its descending trendline, trading around $0.000007 on Tuesday; a breakout indicates a bullish move ahead.

Tron Price Prediction: Tether’s $1B move triggers TRX ahead of US Congress stablecoin bill review on Wednesday

Tron price defied the broader crypto market downtrend, surging 3% to $0.25 on Monday. This bullish momentum comes as stablecoin issuer Tether minted another $1 billion worth of USDT on the Tron network, according to on-chain data from Arkham.

Ethereum Price Forecast: Short-term holders spark $400 million in realized losses, staking flows surge

Ethereum (ETH) bounced off the $1,800 support on Monday following increased selling pressure from short-term holders (STHs) and tensions surrounding President Donald Trump's reciprocal tariff kick-off on April 2.

BlackRock CEO warns Bitcoin could replace US Dollar as global reserve currency, crypto ETFs witness inflows

BlackRock CEO Larry Fink stated in an annual letter to investors on Monday that the US national debt could cause the Dollar's global reserve status to be replaced with Bitcoin if investors begin to see the digital currency as a safer asset.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.