Stellar Price Prediction: XLM faces one last barrier before $0.84

- Stellar price has just defended a key support level on the 12-hour chart.

- The digital asset aims for a significant rebound towards $0.60 as it faces only one resistance barrier.

- The overall momentum remains bullish for Stellar.

Stellar price is closer than ever to its previous all-time high of $0.85, established on January 3, 2018. The digital asset established a robust uptrend since the beginning of 2021 and aims for new all-time highs in the near future.

Stellar price defends support level and targets $0.6

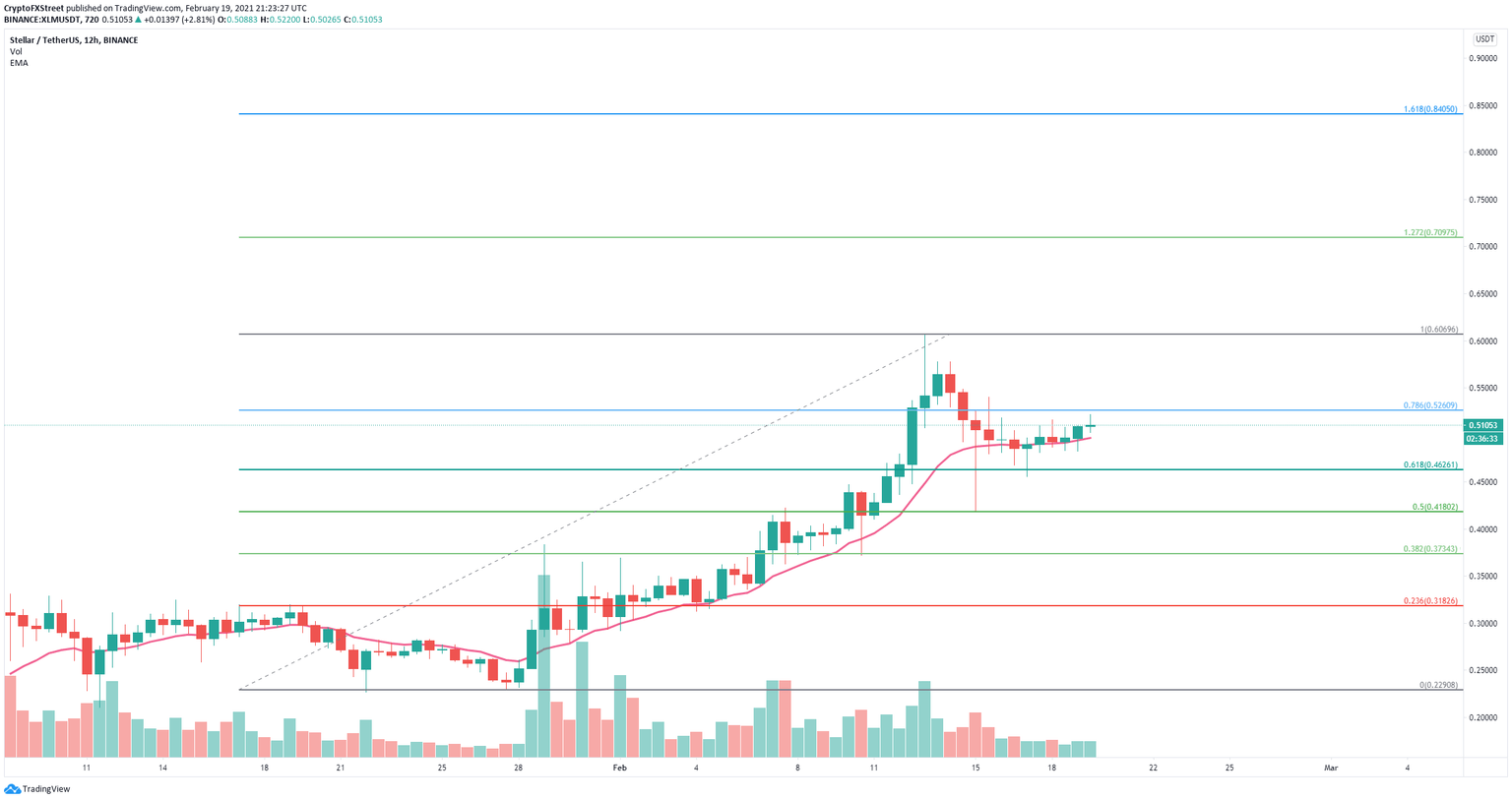

On the 12-hour chart, XLM bulls defended the critical 12-EMA support level, which has been a significant guide for Stellar price since January 28. The only resistance level is located at $0.52 at the 78.6% Fibonacci level.

XLM/USD 12-hour chart

A breakout above this point should quickly push Stellar price towards $0.60. The next potential price targets are $0.71 at the 127.2% Fib level and finally $0.84 at the 161.8% fib level.

On the other hand, losing the 12-EMA support level will push Stellar price down to $0.46 again and $0.418 at the 50% Fibonacci level. Losing this significant support level can drive the digital asset towards $0.37.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.