Stellar price on the brink of a breakout as Euro stablecoin launches on the network

- Stellar price patiently waits for a potential bull flag breakout on the daily chart.

- Germany’s Bankhaus von der Heydt has announced the launch of a Euro stablecoin on the Stellar network.

In a press release on December 10, Germany’s Bankhaus von der Heyd announced a first of its kind token that will be issued by a banking institute to create the EURB stablecoin, fully backed by Euros.

The stablecoin is fully regulated and built on top of the Stellar network. Stellar price is currently around $0.157 inside a slight daily downtrend. Bulls are patiently waiting for the potential of a massive breakout.

Stellar price could be on the verge of a breakout to $0.43

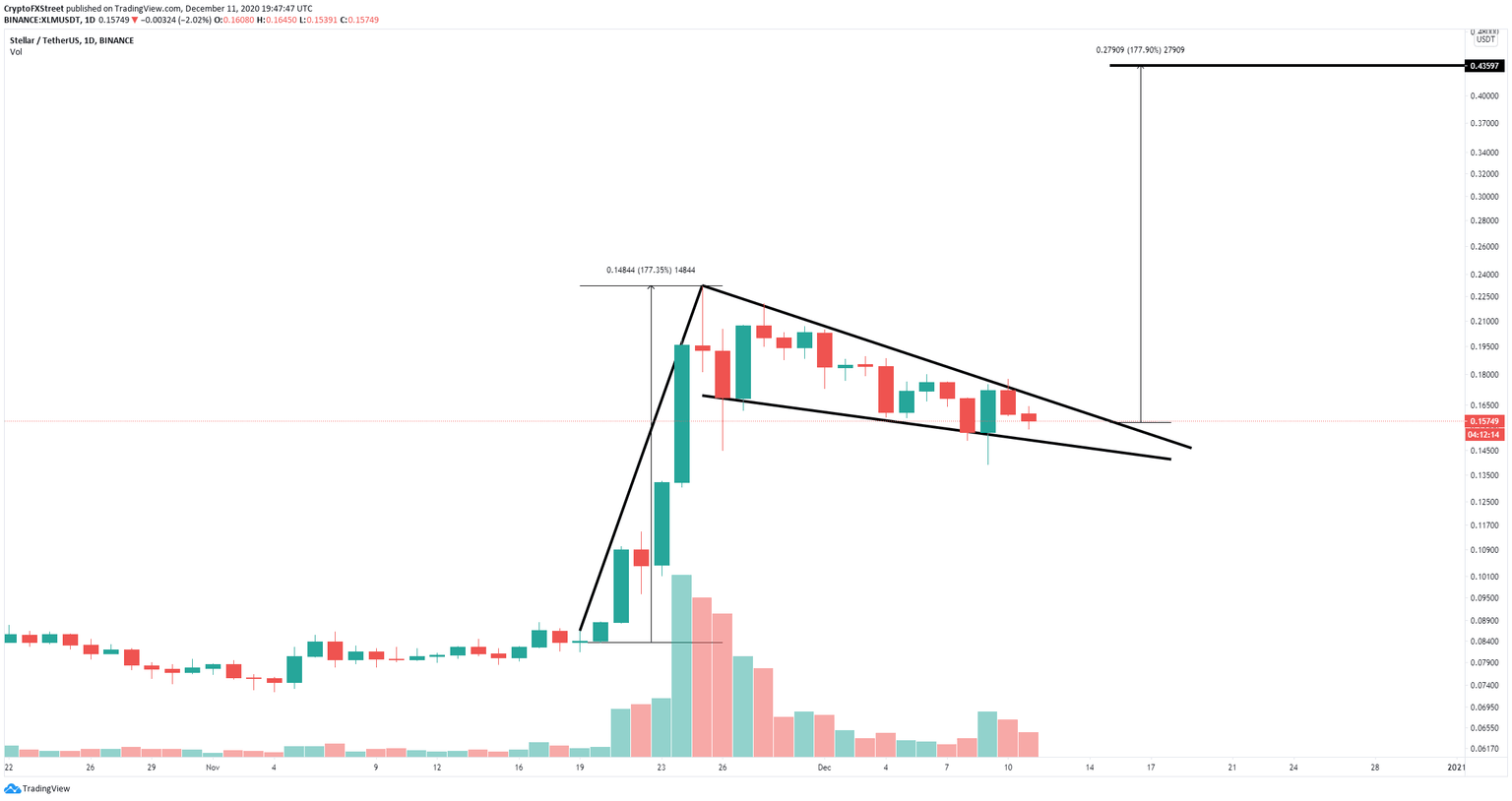

On the daily chart, after a massive 177% rally that started on November 19, the digital asset has established a bull flag which seems to be on the verge of a potential breakout towards a price target of $0.43.

XLM/USD daily chart

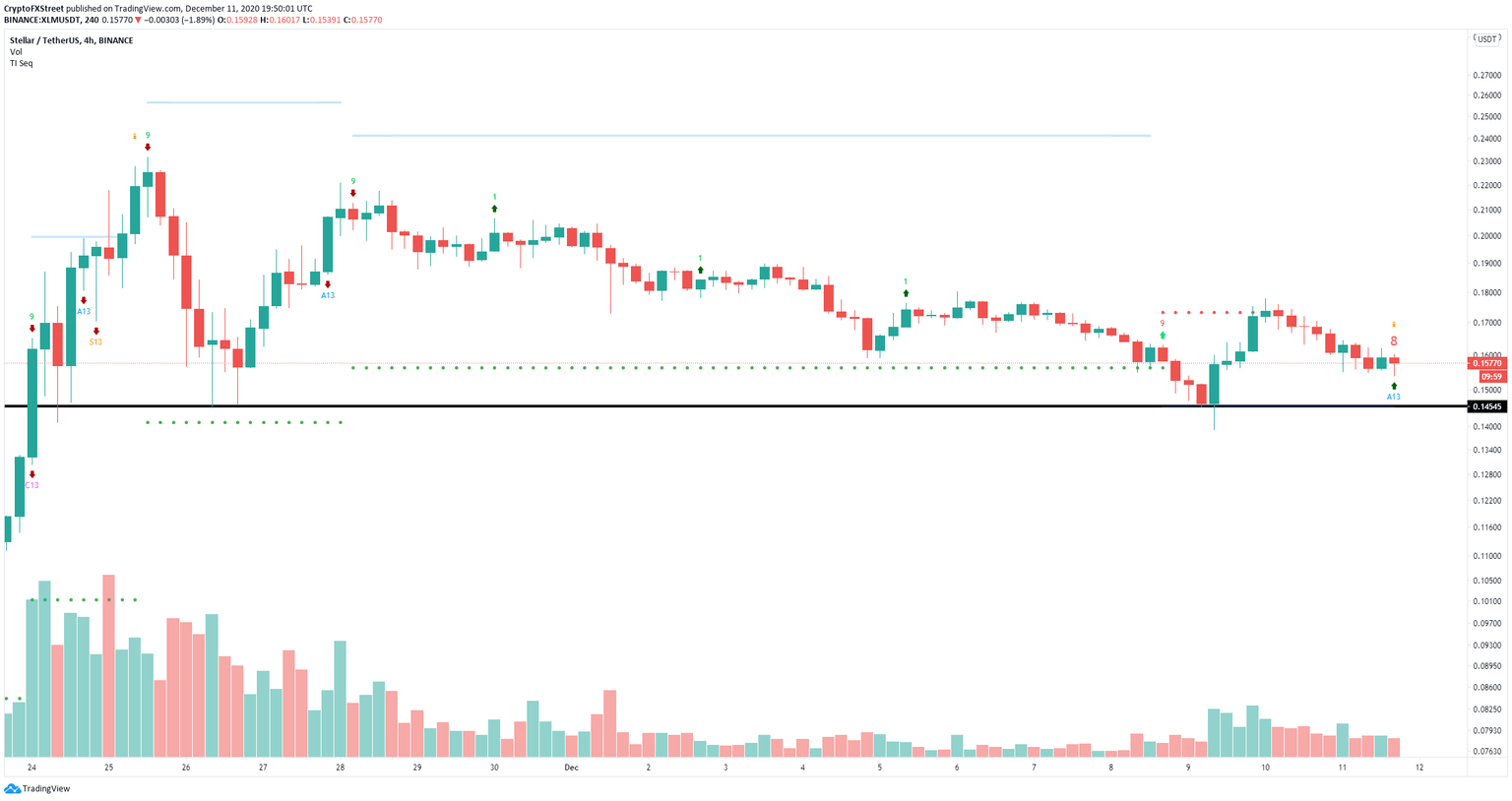

Additionally, the TD Sequential indicator seems to be on the verge of presenting a buy signal on the 4-hour chart after bulls managed to defend a critical support level established at $0.1454. This adds credence to the bullish outlook.

XLM/USD 4-hour chart

Furthermore, it seems that the trading volume of Stellar has increased dramatically over the past two months, surging by more than 500% indicating huge interest in the digital asset and adding even more credence to the bull flag.

In the last 60 days, Stellar trading volume has surged by 517% on the back of numerous fundamental developments. $XLM (Powered by @TheTIEIO) pic.twitter.com/lUvnucM0Yx

— eToro US (@eToroUS) December 11, 2020

However, a breakdown below the support trendline of the bull flag could quickly push Stellar price towards $0.08 as there is very little support on the way down due to the magnitude of the rally.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.