Stellar price heading for $0.32 with bulls in a festive mood

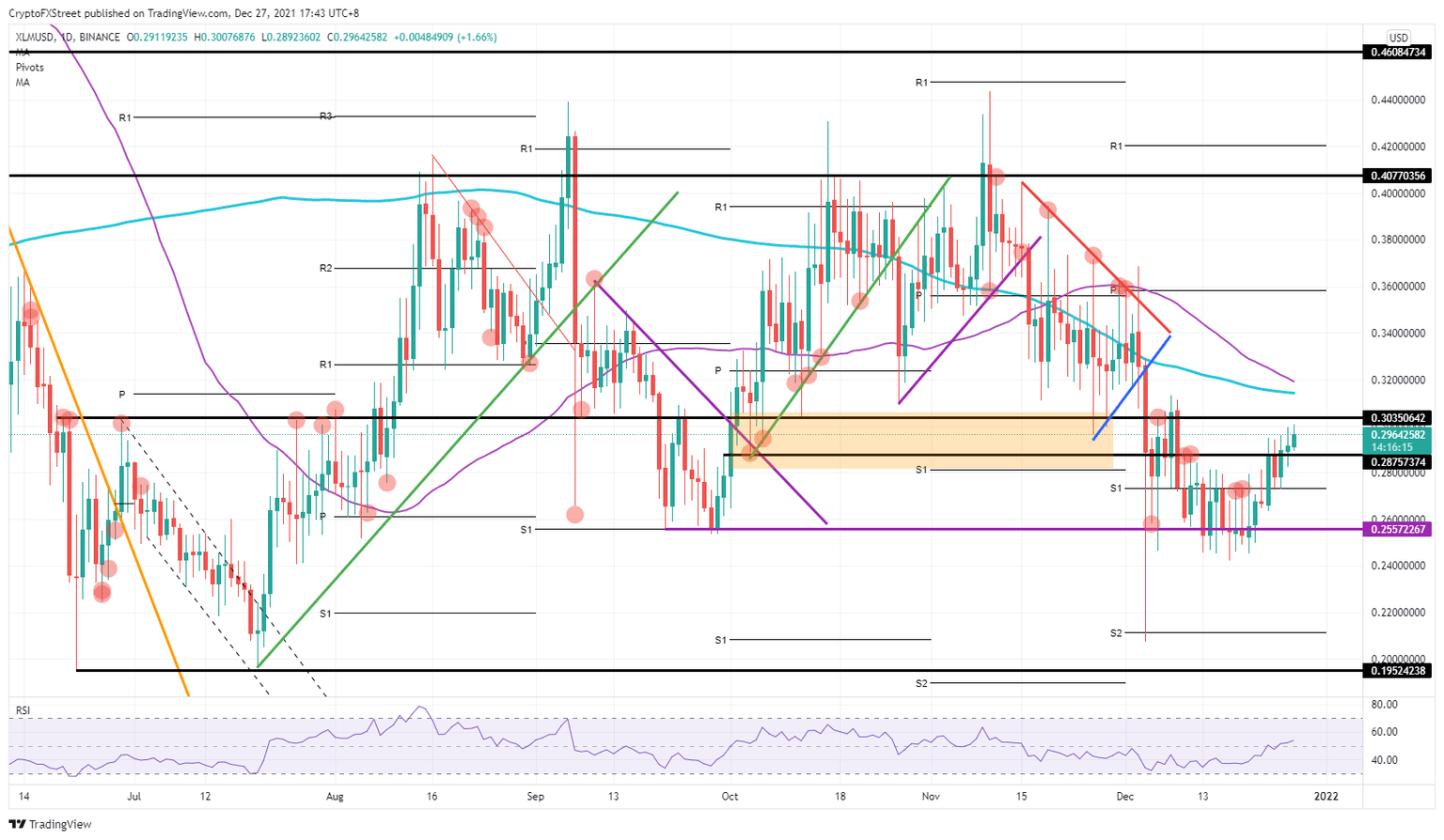

- XLM price opens above $0.28, turning the historical level from resistance into support.

- Price action makes new highs, confirming the rally.

- Expect a test and break above $0.30, with $0.32 as the profit target level.

Stellar (XLM) price has opened today above $0.28, which shows that bulls are trying to push the trend higher. The Relative Strength Index (RSI) is confirming the high demand with a move above 50 but still holds plenty of upside potential. The price target looks to be set at $0.32, where both the 55-day and 200-day Simple Moving Average (SMA) form a double cap.

Stellar sees bulls squeezing out the last remaining profit in the current rally

XLM price action has seen investors enjoying the Christmas rally, after returning a 20% profit since December 21. But bulls are not happy enough with what they have on the table and are looking to squeeze out another 7% to 10% of gains if they can break above $0.30. As XLM price already firmly opened above $0.28, this level has now become support and should the first attempt to break $0.30 fail it could offer an entry to new bulls if retested.

Further upside looks a little muted as both the 55-day and the 200-day SMA provide resistance at $32. Together, these two elements can weigh on any further upside potential and could provide a ceiling. A deciding factor could be how much room the RSI still has to go before hitting the overbought area, and whether it is enough for price to break above that level, but all-in-all 10% of gains are still possible.

XLM/USD daily chart

The risk to the downside is that bulls might get rejected at $0.30 and that the support at $0.28 does not hold. If that is the case, there is a risk of a complete collapse of the price action,bringing XLM price back down to $0.25 at the purple flat line. Even a further dip towards $0.24 or $0.21 is not unthinkable if global markets take a turn for the worse and go fully risk-off.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.