Stellar Price Forecast: XLM edges closer to a bullish explosive impulse

- Stellar price is contained inside an ascending parallel channel on the 4-hour chart.

- The digital asset faces one critical resistance level before a move towards $0.41.

- There is one indicator that suggests XLM might need to see a correction first before another leg up.

Stellar has been trading inside a strong uptrend for the past week and it’s on the verge of another significant breakout in the short-term. The digital asset has reached a market capitalization of $8 billion and aims to overtake Bitcoin Cash for the 10th place.

Stellar price can promptly jump to $0.41 if this level cracks

On the 4-hour chart, Stellar has established an ascending parallel channel with a resistance point located at $0.362. Breaking above this level will drive Stellar price towards a high of $0.41, a 13% move determined by using the height of the pattern as a reference point.

XLM/USD 4-hour chart

Additionally, the MACD flipped bullishly again strongly for the first time since January 28 which managed to push XLM by more than 50%. This adds more credence to the bullish outlook described above.

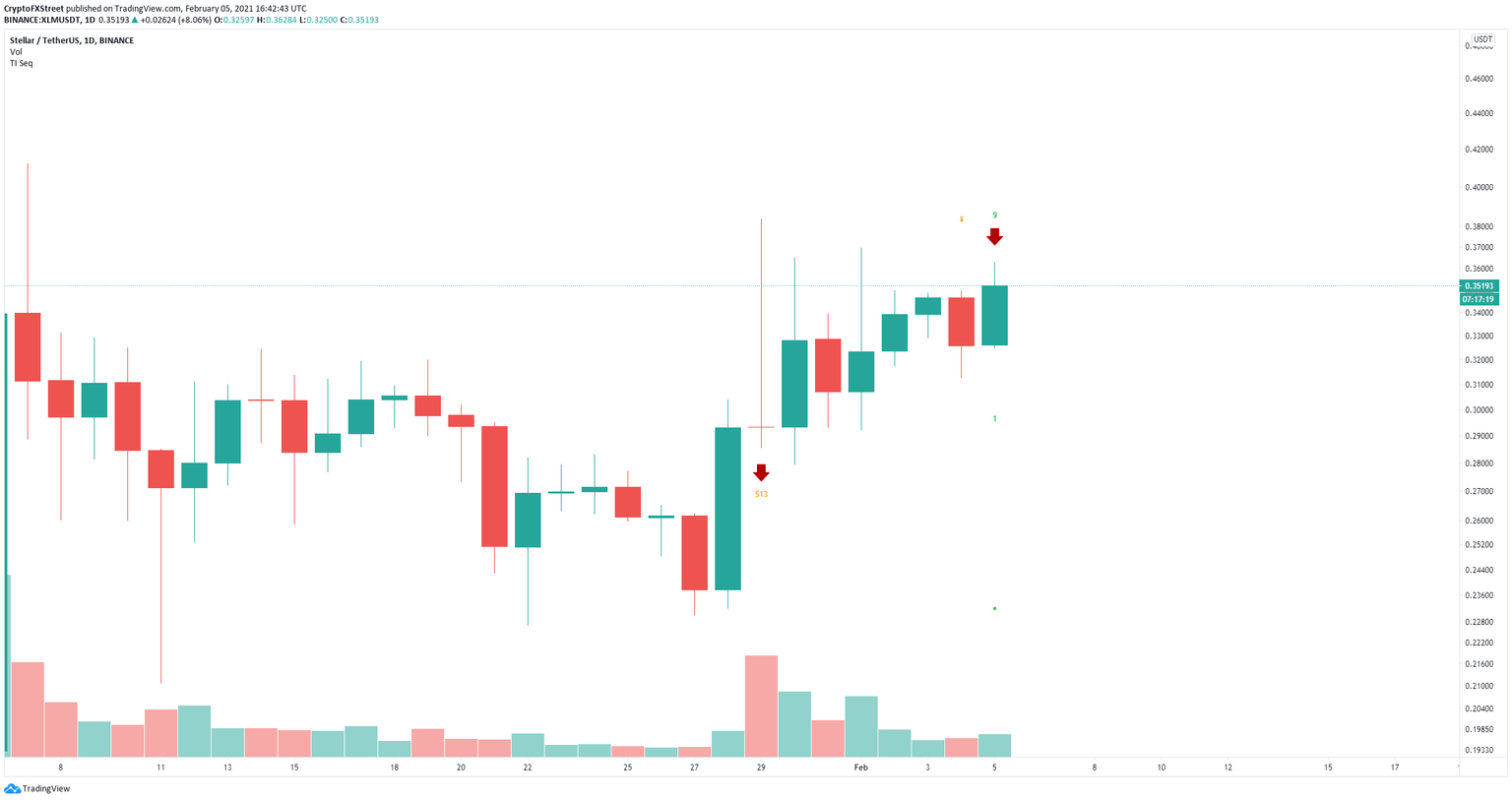

XLM/USD daily chart

However, on the daily chart, the TD Sequential indicator has just presented a sell signal for the first time since November 24, 2020. Validation of this call can drive Stellar price towards the psychological level at $0.30 for a retest.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.