Stellar price explodes by 40% in the past 24 hours but faces short-term pressure

- Stellar price is up by around 40% in the past 24 hours after a massive breakout above $0.16.

- The digital asset could be facing some short-term pressure as its price is overextended.

After an initial significant 33% rally that started on January 3, Stellar hasn’t paused and has seen another 40% breakout hitting $0.21. After a lot of bullish momentum, the digital asset might be on the verge of a correction, suggests various indicators.

Stellar price needs to pause before resuming uptrend

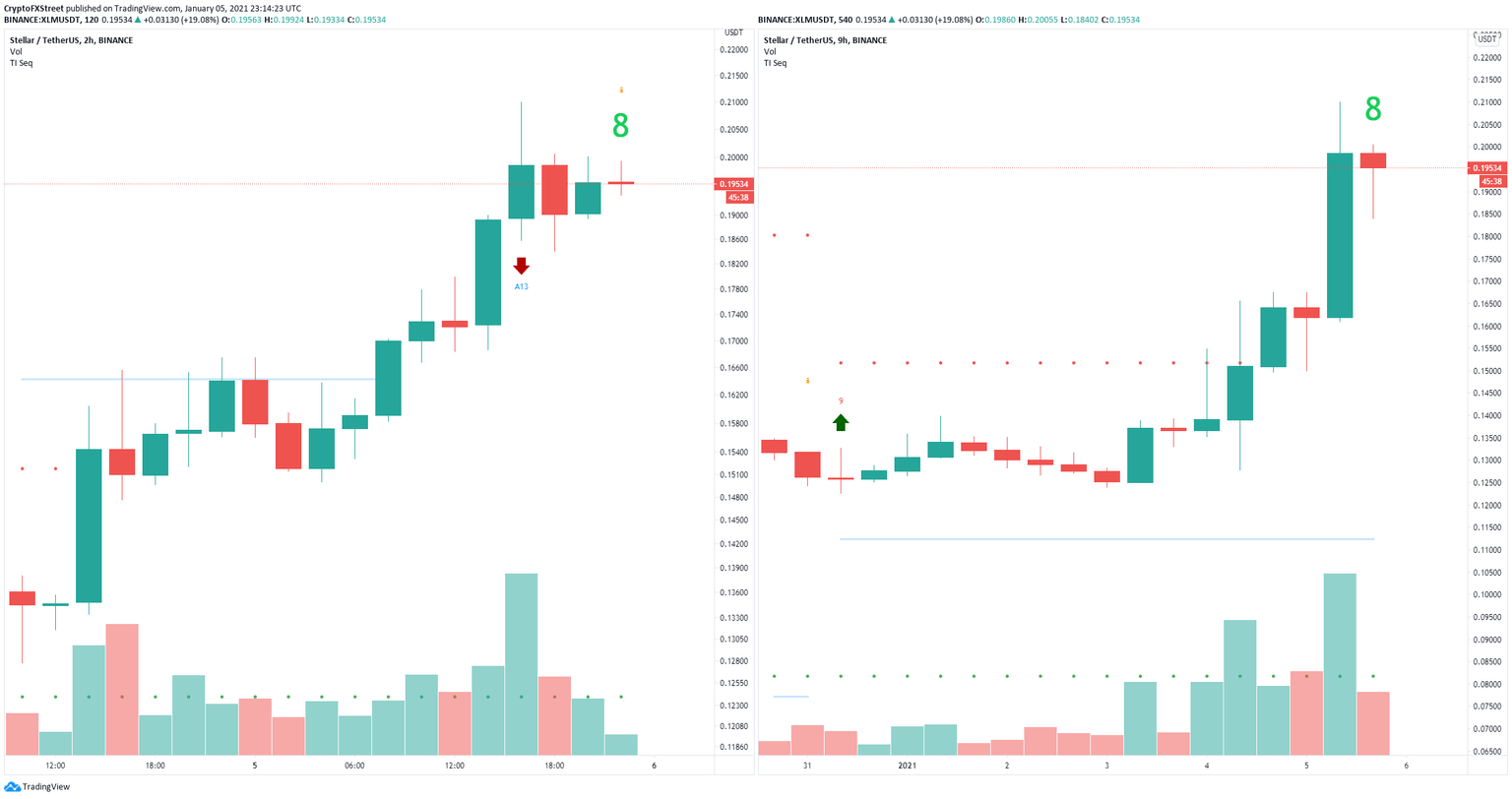

On the 2-hour and 9-hour charts, the TD Sequential indicator has presented a green ‘8’ candle which is usually followed by a sell signal which will be posted within the next hour. Confirmation of both signals would shift the odds in favor of the bears in the short-term.

XLM 2-hour and 9-hour charts

Additionally, we can also see a massive spike in XLM’s social volume in the past few days that we haven’t seen since February 2019. The chart below shows several other spikes in social volume which were accurate indicators of tops in the past.

XLM Social Volume chart

It’s also important to note that on the daily chart, XLM price hit a critical resistance level at $0.20 and got rejected from it. However, if the bulls can hold the 12-EMA and the 26-EMAs on the daily chart when they catch up to the price, they will have a good chance of a breakout above the level.

XLM/USD daily chart

The $0.20 resistance level has been a robust point tested several times in the past since November 25 but XLM has been unable to close above it. A breakout can quickly push Stellar price beyond $0.23.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B00.23.59%2C%252006%2520Jan%2C%25202021%5D-637454866624586499.png&w=1536&q=95)