XLM Price Prediction: Stellar explodes 25% but correction seems imminent

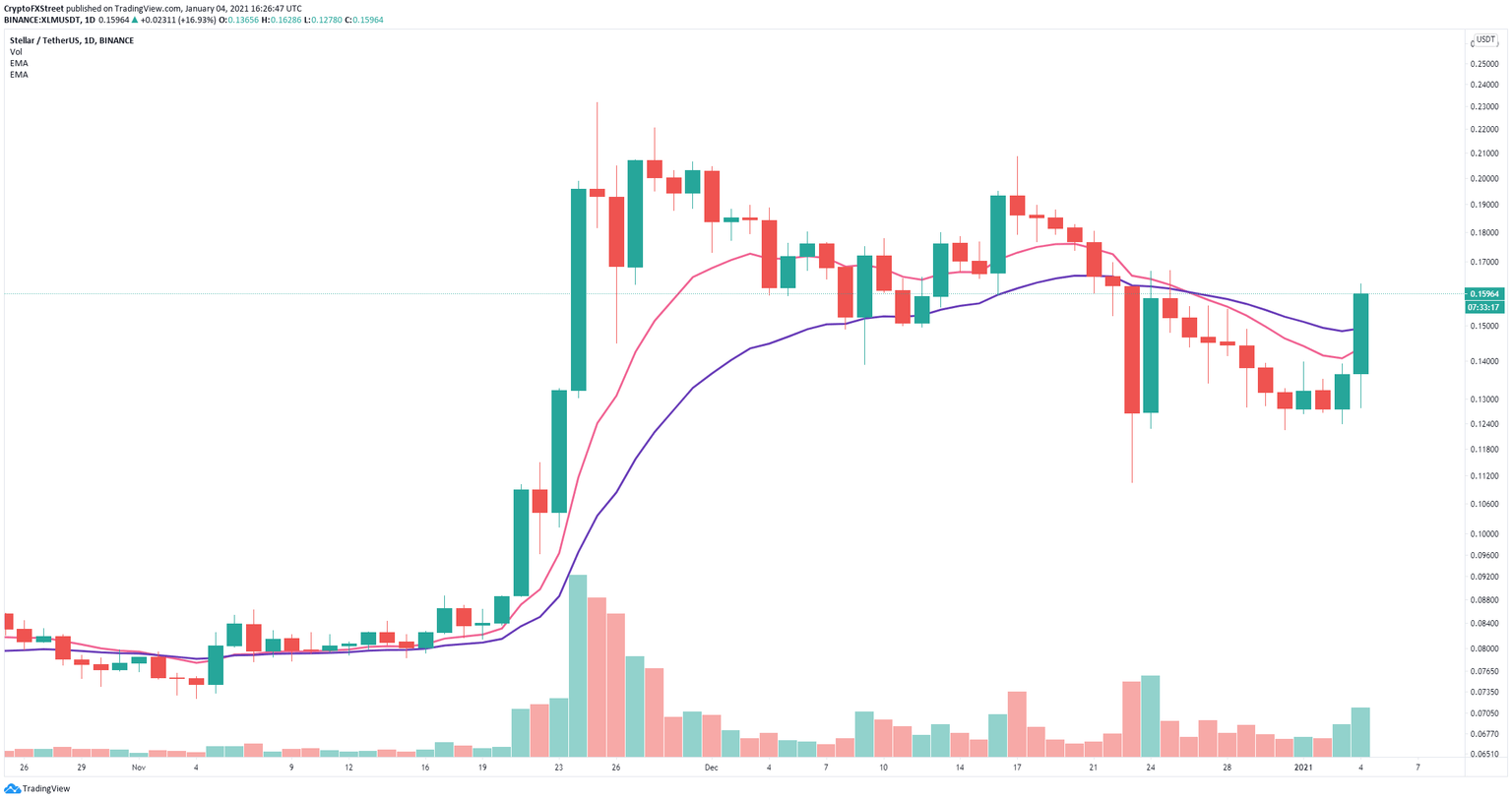

- Stellar price had a major pump in the past 24 hours rising from a low of $0.127 to a high of $0.162.

- The digital asset faces very little resistance until $0.2 which is the bullish price target.

Stellar was trailing behind Bitcoin and was trading in a daily downtrend. However, in the past 24 hours, bulls have managed to push Stellar price above several resistance points with a 25% pump.

Stellar price gears up for a rally to $0.2 but faces short-term pressure

On the daily chart, Stellar has climbed above several resistance levels and two critical points. The 12-EMA and the 26-EMA were acting as strong hurdles and are now support levels. However, bulls still need to push Stellar price above $0.166 to fully confirm an uptrend on the daily chart.

XLM/USD daily chart

If Stellar can crack $0.166, it will face practically no resistance until the next high at $0.2. However, there seems to be a lot of short-term pressure for XLM as a key indicator presented several sell signals.

XLM Sell Signals

On the 15-minutes, 30-minutes, and 4-hour charts, the TD Sequential has presented a strong sell signal and it’s on the verge of doing the same on the 10-minutes chart. It seems that Stellar price is poised for a short-term pullback before resuming the uptrend.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.