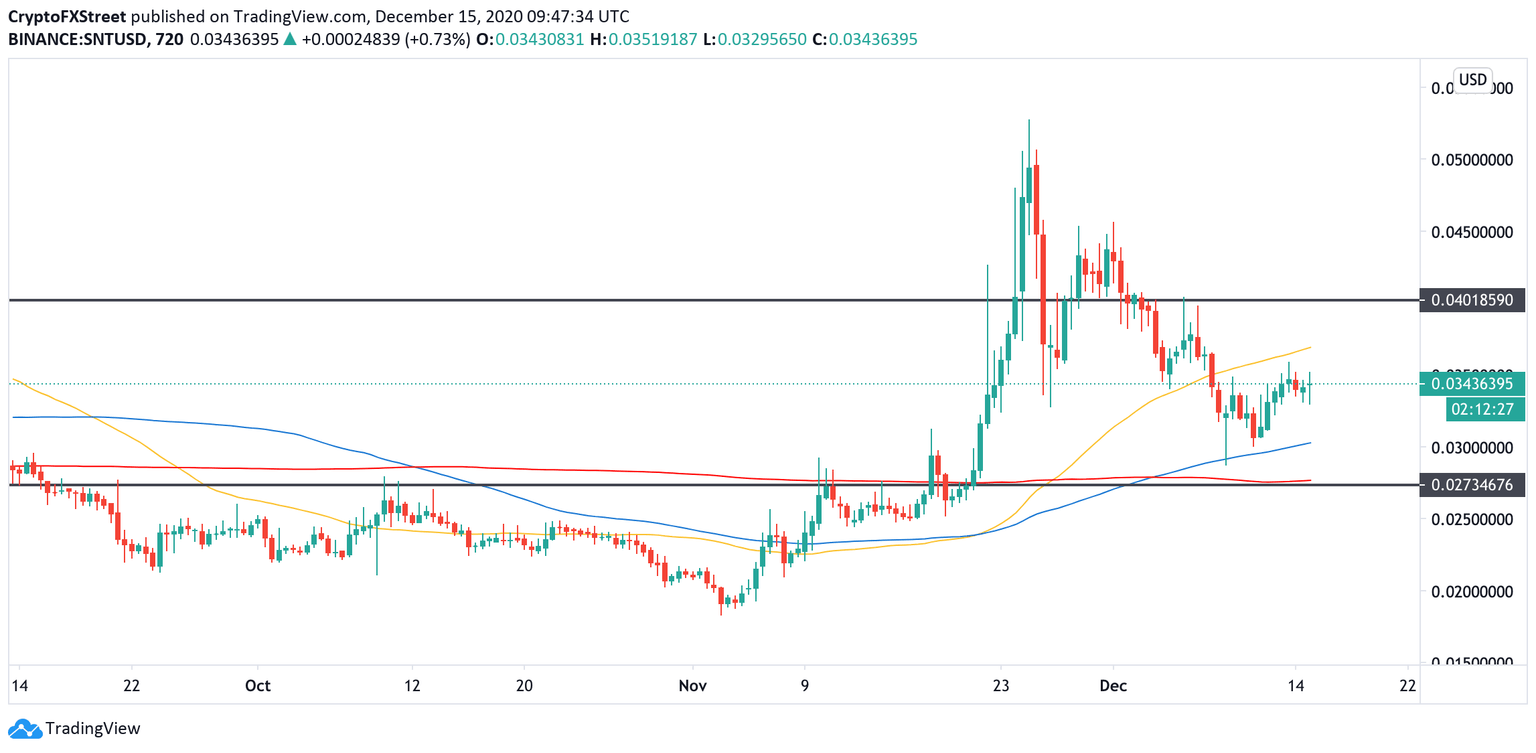

Status Price Analysis: SNT to re-test $0.04 if critical support holds

- SNT has been range-bound after a short-lived recovery from $0.028.

- The token may retest $0.04 if the support of $0.03 holds.

SNT is a native token of Status, an open-source messaging platform interacting with dApps run on Ethereum blockchain. SNT is a utility and governance token. Users can earn it by generating content.

At the time of writing, SNT is in 95th place in the global cryptocurrency market rating with the current market capitalization of $119 million and an average daily trading volume of $6 million. The token is most actively traded at Binance, Huobi Global and ZG.

SNT recovery underway

SNT bottomed at $0.028 on December 9 and attempted a recovery; however, the upside momentum remains slow so far. On the 12-hour chart, SNT is supported by the 100 EMA, currently at $0.03. Once it is broken, the sell-off may be extended towards $0.027. This barrier was tested as resistance on numerous occasions in October and November and it is now reinforced by 12-hour 200 EMA.

On the upside, the recovery is limited by 12-hour 50 EMA at $0.036. Once it is out of the way, the upside is likely to gain traction with the next focus on $0.04 and the recent recovery high at $0.045.

SNT, 12-hour chart

Meanwhile, the In/Out of the Money Around Price data confirms the resistance on approach to $0.035 as over 700 addresses bought 80 million tokens between $0.035 and $0.036. An even bigger supply wall comes at $0.039, with 1,350 addresses holding 86 million SNT. A failure to clear this barrier may trigger the downside correction.

SNT's In/Out of the Money Around Price data

On the downside, SNT sits on top of strong support as over 1,690 addresses purchased over 150 million coins between $0.031 and $0.032. This barrier can stop the sell-off create e precondition for a new recovery attempt.

Author

Tanya Abrosimova

Independent Analyst

%2520Analytics%2520and%2520Charts-637436232921715537.png&w=1536&q=95)