'Staked Ether' becomes focus of crypto stress, from celsius to three arrows

The price gap between the locked-up ether on Lido and spot ether jumped to record highs as large holders sell their tokens, drawing concern of a potential ripple effect on crypto lending markets.

A token known as "staked ether" has suddenly become a key focus for crypto traders trying to monitor extreme stress in digital-asset markets, as important players from the beleaguered lender Celsius to the hedge fund Three Arrows Capital and the industry heavyweight Sam Bankman-Fried's Alameda Research are dumping their holdings.

The key metric is the discount between the price of staked ether (stETH) – a token from the Lido Finance protocol that's supposed to trade at a price close to ether (ETH), the native cryptocurrency of the Ethereum blockchain – and the price of ether itself.

The discount shot to a record 8% on Monday, according to data by Dune Analytics.

The speculation, according to analysts, is that crypto market makers and lenders might be forced to dump their holdings of the stETH tokens to fund withdrawals and meet margin calls.

Staked ether was launched by decentralized-finance (DeFi) platform Lido Finance as a way to provide liquidity to traders who are "staking" their ether on Ethereum's Beacon Chain. It's all part of the process by which Ethereum is transitioning to a "proof-of-stake" blockchain. Without going into all the details, participants in the system have to commit to locking up their tokens for a period of time to help process transactions; in return they receive crypto rewards. But in the meantime, they can take stETH tokens and continue to trade.

Lido dominates the Ethereum staking ecosystem, with about one-third of all staked ether deposits. In May, Goldman Sachs wrote that such a concentration of deposits “can theoretically increase systemic risk” because of Lido’s interconnections to crypto markets.

Big holders dump

Celsius, a crypto lender that has come under scrutiny since it froze withdrawals last weekend, citing "extreme market conditions," holds 409,260 stETH tokens, worth about $470 million at current prices, according to data provided by Ape Board, a portfolio tracker from the blockchain analysis firm Nansen.

Johnny Louey and Andy Hoo, analysts at Huobi Research Institute, the research arm of the Huobi crypto exchange, wrote in a note Tuesday that Celsius took a loss of almost $71 million earlier from staking stETH on Stakehound because Stakehound misplaced the keys.

Worried Celsius users started a rapid wave of redemptions at a rate of around 50,000 ETH per week, the report added, and the platform was scrambling for liquidity.

“What Celsius can do is sell its stETH in order to buy ETH on the market to satisfy client requests,” Noelle Acheson, head of market insights at crypto market maker Genesis, told CoinDesk. (Genesis and CoinDesk are both owned by Digital Currency Group.)

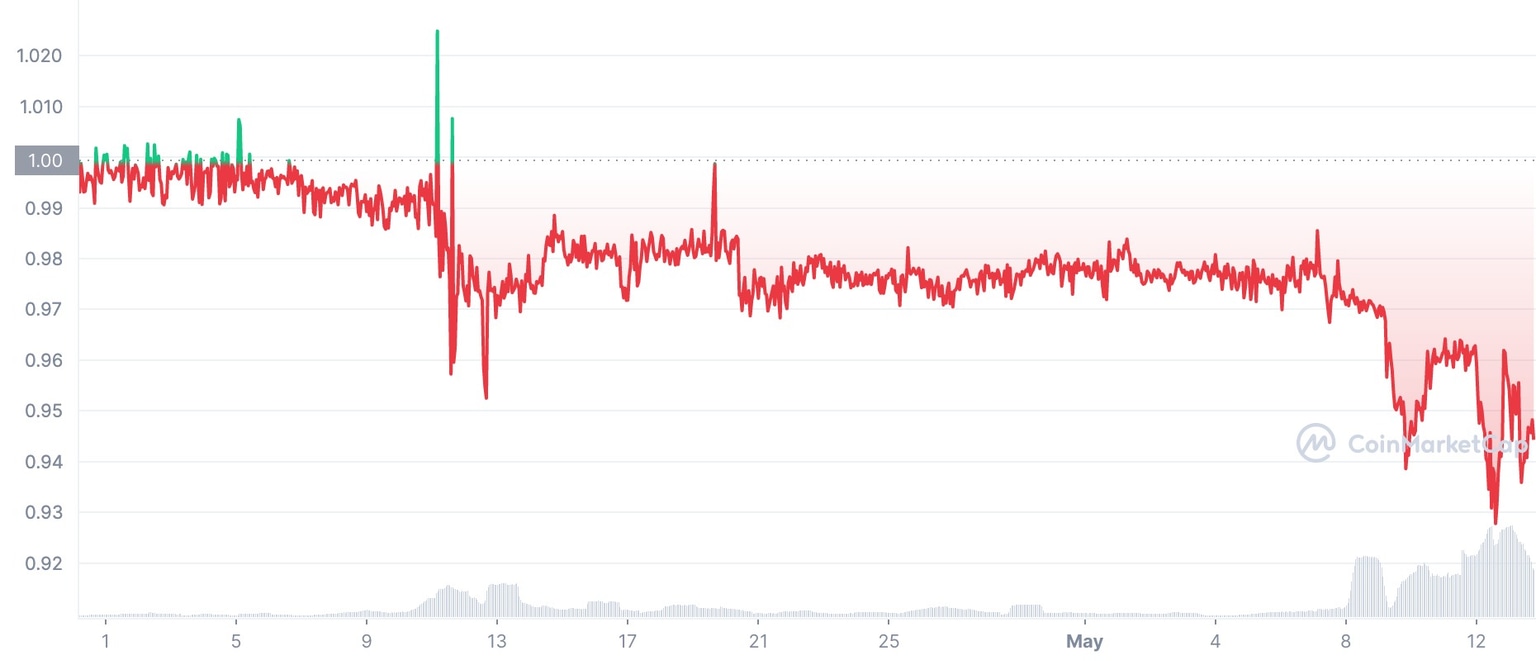

The stETH discount initially opened up last month, when crypto markets were roiled by the collapse of the Terra blockchain network and its stablecoin UST. Since then, stETH has mostly traded at a discount of 2-3%, with a spike to 5% on May 12 when UST fell into a death spiral.

Staked ether (stETH) started to depeg from the 1:1 exchange ratio to ETH in early May, and the gap has been widening ever since. (CoinMarketCap)

The market capitalization of stETH has dropped to $4 billion from about $10 billion at the start of May, driven by holders who are fleeing staking platforms as ether’s price crashes.

Three Arrows Capital, a Singapore-based trading and investing firm that was one of the biggest investors in the Terra blockchain, withdrew nearly $400 million of stETH and ETH from the Curve protocol in May, Andrew Thurman, a Nansen analyst, told CoinDesk.

Three Arrows Capital, often shorthanded as 3AC, “has caught the attention of the on-chain community in recent weeks with how they’ve been managing their stETH position," Thurman said.

Data from Nansen shows that a wallet attributed to 3AC withdrew 80,000 stETH from decentralized lending protocol Aave Tuesday and converted 38,900 stETH (some $45 million) in two transactions at an 5.6-5.9% discount rate for ether.

That came after rumors on crypto Twitter that the investment firm may be facing financial difficulties.

Representatives of 3AC didn’t immediately respond to requests for comment.

Last week, another big-name trading firm, Alameda – which is closely connected to Sam Bankman-Fried, founder and CEO of crypto exchange FTX – dumped 50,615 stETH, worth about $88 million at the time, according to a tweet from Hsaka, a popular crypto trader.

Illiquidity frenzy

Another reason for the discount is the relative illiquidity of staked ether, Acheson said.

Investors are fleeing risky assets such as cryptocurrencies as financial markets around the world decline in response to central banks raising interest rates to fight inflation. That is squeezing crypto platforms to meet customer redemptions. At the same time, investors now prefer to hold assets that are more liquid.

The daily trading volume of stETH is in the hundreds of thousands of dollars, compared with ETH’s daily volume in the billions, making the less-liquid asset’s price more sensitive to selling pressure. When a big player needs to sell its holdings, it may find fewer buyers, pushing down the price of stETH.

“In the short term, stETH will face tremendous selling pressure," Huobi Research Institute’s report concluded. "Turbulence is expected in the near future.”

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.