- Stablecoin market capitalization is increasing, ratio to Bitcoin market cap is similar to previous all-time high.

- USD Coin deposits on exchanges climbed to a one-year high on Monday.

- CryptoQuant CEO says stablecoins have been used as buy-side liquidity in this cycle.

Stablecoin market capitalization is on rise as USD Coin (USDC) deposits on exchanges hit a one-year peak on Monday, June 24. Stablecoins play a pivotal role in the ecosystem since they are the fiat on-ramp for traders in the crypto ecosystem.

Ki Young Ju, CEO and co-founder at CryptoQuant, notes that stablecoins have acted as buy-side liquidity, per data from the tracker.

USDC deposits hit one-year peak

Bitcoin sustains above $61,000, and altcoins have started their recovery from the recent correction in prices. Crypto traders are likely buying the recent dip in cryptocurrencies, per IntoTheBlock data.

Lucas Outumuro, Head of Research at IntoTheBlock, noted that USDC net inflows into centralized exchanges hit a one-year high on June 24 at $228 million. Outumuro poses the question, “People depositing stables to buy the dip?”

USDC net inflows into centralized exchanges hit a one-year high yesterday of $228M

— Lucas (@LucasOutumuro) June 25, 2024

People depositing stables to buy the dip? $BTC $ETH pic.twitter.com/oAwDv4O1dX

It is likely that the stablecoin deposits to exchanges represent buyers lining up to buy crypto during the dip. The thesis is backed by Ki Young Ju’s recent tweet on X.

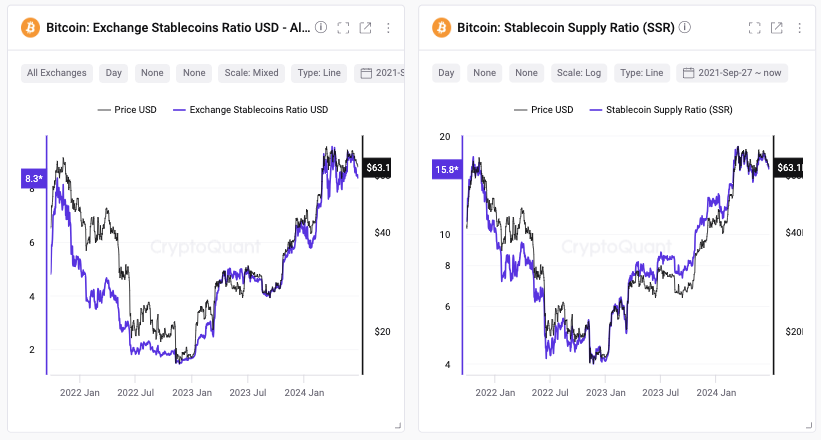

The CryptoQuant co-founder observed that stablecoin market capitalization is increasing, while its ratio to Bitcoin market capitalization is similar to the previous all-time high levels. The same applies to the exchange reserves ratio.

The two key metrics used to draw the conclusion are:

- Exchange stablecoin ratio, derived by dividing Bitcoin reserve by all stablecoin reserves across centralized exchanges.

- Stablecoin supply ratio, calculated by dividing the market capitalization of Bitcoin by the market capitalization of all stablecoins.

The CEO concludes that stablecoins have been used as buy-side liquidity. He mentions that new inflows are likely to drive the next leg up.

Bitcoin: Exchange Stablecoins Ratio, Bitcoin: Stablecoin Supply Ratio

Is it the right time to buy the Bitcoin dip?

The Bitcoin Market Value to Realized Value (MVRV) indicator is used to evaluate the tops and bottoms of the Bitcoin market and provides valuable information about traders' buying and selling behavior.

The MVRV ratio on a 30-day timeframe has proven to be an effective metric to identify an upcoming bounce in Bitcoin price. The following Santiment chart shows MVRV dips below 8.40% on numerous occasions in the past year and half, and Bitcoin price has rallied between 25% and 100% each time.

At the time of writing, Bitcoin price is $61,416, and MVRV is 9.69%. Therefore, based on the above observation, this is a good time for traders to buy the Bitcoin dip, per on-chain data.

Bitcoin MVRV ratio (30-days) vs. price

Bitcoin rallied nearly 2% on Tuesday, and the seven-day return is a negative 7.66%.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin falls below $94,000 as over $568 million outflows from ETFs

Bitcoin continues to edge down, trading below the $94,000 level on Thursday after falling more than 5% this week. Bitcoin US spot ETFs recorded an outflow of over $568 million on Wednesday, showing signs of decreasing demand.

Altcoins Tron and Toncoin Price Prediction: TRX and TON show signs of weakness

Tron and Toncoin prices extend the decline on Thursday after falling more than 6% this week. TRX and TON face rejection from key levels, suggesting double-digit cash ahead. Traders should be cautious as both altcoins show signs of weakness in momentum indicators.

BNB Price Forecast: Poised for a decline on negative Funding Rate

BNB price hovers around $696.40 on Thursday after declining 4.58% in the previous two days. BNB’s momentum indicators hint for a further decline as its Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) show bearish signals.

Ripple's XRP eyes recovery following executives' dinner with Donald Trump

Ripple's XRP is up 2% on Wednesday following positive sentiments surrounding its CEO Brad Garlinghouse's recent dinner with incoming US President Donald Trump. If the recent recovery sentiment prevails, XRP could stage a breakout above the upper boundary line of a bullish pennant pattern.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

%20[22.22.09,%2025%20Jun,%202024]-638549337899172831.png)