- Stablecoin USDC transfer volume 5x that of Tether, after FTX fallout and shutdown of DCG’s crypto wealth division.

- Crypto.com announced the delisting of Tether from its cryptocurrency exchange platform for customers in Canada.

- USDC has been the preferred choice for crypto users, over USDT, averaging over $12.5 billion more in transfer volume per day than Tether.

USD Coin (USDC), the second-largest stablecoin in the crypto market, witnessed a spike in its trade volume since October last year. Crypto.com announced the delisting of Tether (USDT) for Canadian customers whilst the stablecoin battled competitors for dominance as USDC takes over with rising trade volume.

Also read: Samuel Bankman-Fried asked Tether for billions, the stablecoin turned FTX down

USDC v. Tether, stablecoins battle for dominance as Crypto.com announces USDT delisting

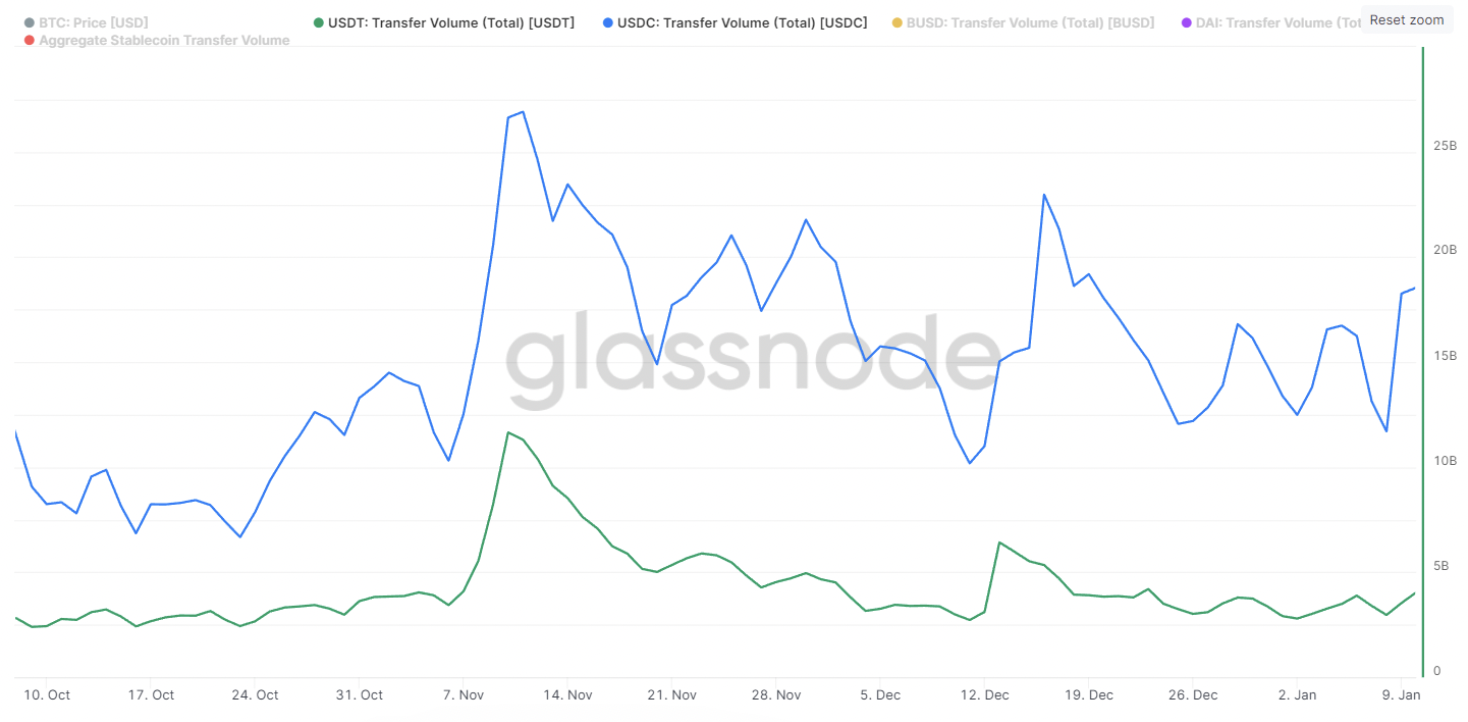

USD Coin (USDC) and Tether (USDT) are the two largest stablecoins in the crypto ecosystem. Tether’s market capitalization is nearly 11 times that of USDC, at $29.4 billion. Despite the vast difference between the market cap of the two stablecoins USDC trade volume is nearly five times that of USDT since October 2022, based on data from Glassnode.

Two leading factors that contributed to USDT’s declining trade volume are Samuel Bankman-Fried’s FTX exchange’s collapse and the shutdown of the crypto wealth division at the Digital Currency Group. Tether’s market share in daily stablecoin transactions dwindled as users preferred USDC over the past three months.

Based on data from the crypto intelligence tracker, USDC has been the preferred choice, clocking over $12.5 billion more in daily transfer volume than USDT.

USDT and USDC transfer volume since October 2022

Experts believe that USDC is preferred over Tether, because it is backed by cash or short-term United States Treasuries and its monthly audits are handled by global accounting firm Grant Thornton. Tether continues battling criticism for lack of a transparent auditing and reserves.

Tether adoption takes a hit with Crypto.com’s announcement

Tether was further hit by the news Crypto.com, a cryptocurrency exchange platform, had announced that it will no longer facilitate transactions involving the stablecoin in Canada. The exchange’s plan is to delist the stablecoin as it fails to meet regulatory requirements of the region.

In accordance with instructions from the Ontario Securities Commission (OSC), USDT has been delisted for Canadian users on Crypto.com’s exchange platform. As part of the exchange’s pre-registration undertaking for a restricted dealer license, Tether and transactions involving the stablecoin are now unavailable for Canadian traders.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

PEPE Price Forecast: PEPE could rally to double digits if it breaks above its key resistance level

Pepe (PEPE) memecoin approaches its descending trendline, trading around $0.000007 on Tuesday; a breakout indicates a bullish move ahead.

Tron Price Prediction: Tether’s $1B move triggers TRX ahead of US Congress stablecoin bill review on Wednesday

Tron price defied the broader crypto market downtrend, surging 3% to $0.25 on Monday. This bullish momentum comes as stablecoin issuer Tether minted another $1 billion worth of USDT on the Tron network, according to on-chain data from Arkham.

Ethereum Price Forecast: Short-term holders spark $400 million in realized losses, staking flows surge

Ethereum (ETH) bounced off the $1,800 support on Monday following increased selling pressure from short-term holders (STHs) and tensions surrounding President Donald Trump's reciprocal tariff kick-off on April 2.

BlackRock CEO warns Bitcoin could replace US Dollar as global reserve currency, crypto ETFs witness inflows

BlackRock CEO Larry Fink stated in an annual letter to investors on Monday that the US national debt could cause the Dollar's global reserve status to be replaced with Bitcoin if investors begin to see the digital currency as a safer asset.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.