- Centralized cryptocurrency exchanges have seen an increased inflow of stablecoins, the highest level of 2023.

- While Bitcoin prices have declined in the short-term, analysts have identified an increase in the purchasing power of the market.

- Bitcoin inflows to exchanges remain relatively low, suggesting BTC holders are accumulating the asset.

Centralized cryptocurrency exchanges have witnessed a spike in stablecoin inflow, hitting the highest level in 2023. The netflow crossed $1 billion, based on data from CryptoQuant. Despite the spike in stablecoin inflow, BTC inflow to exchanges has remained relatively low, suggesting an accumulation by holders.

Also read: Bitcoin vs. Ethereum, race for NFT dominance with Bored Ape-parent Yuga Labs TwelveFold auction

Stablecoin inflows to exchanges hit highest level in 2023

Based on data from crypto intelligence tracker CryptoQuant, stablecoins are pouring into centralized exchanges at a fast pace. Stablecoin inflow to exchanges has hit its highest level since 2023. In the chart below, the netflow of stablecoins has far exceeded 1 billion.

Stablecoin all exchange netflow

A spike in inflow of stablecoins is typically associated with buyers preparing for a move in cryptocurrency prices. Pumped up inflows are considered indicative of rising buying power and demand for cryptocurrencies, driving their prices higher.

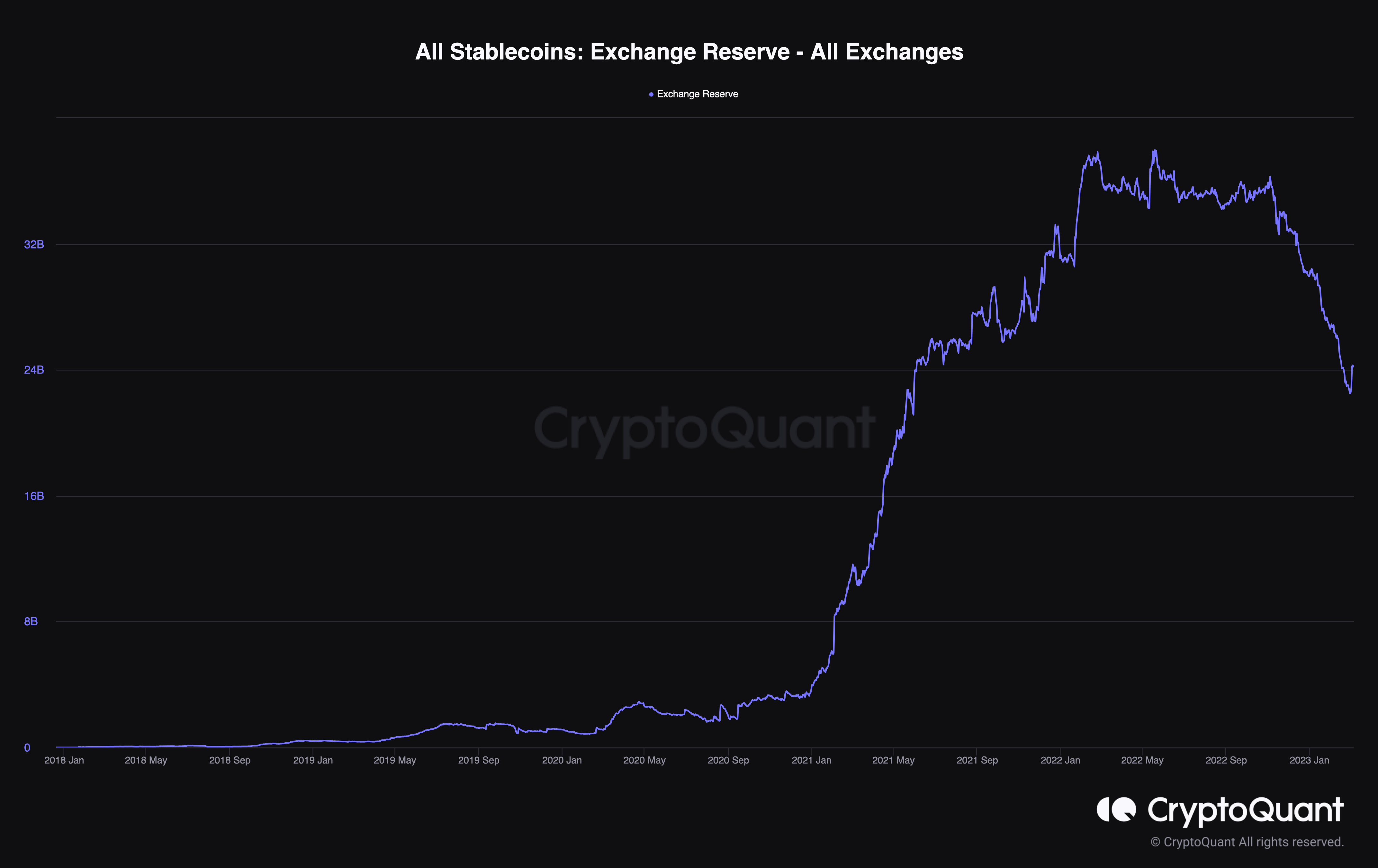

In the chart below, it is evident that stablecoins reserves across centralized exchanges has climbed from 22.8 billion to 24.2 billion since March 1.

All Stablecoins: Exchange reserves

Interestingly, Bitcoin inflows to exchanges have remained low, implying accumulation by BTC holders. As purchasing power increases, analysts at CryptoQuant expect Bitcoin to climb higher.

Tether whales continue accumulating, what this means for BTC?

As seen in the chart below, there is a spike in accumulation by USDT whales. Addresses holding large volumes of USDT have climbed consistently since the first week of January. Typically, an increased accumulation of the stablecoin by whales is followed by an increase in Bitcoin price.

%20[16.24.21,%2006%20Mar,%202023]-638136974263285680.png)

Tether whale accumulation

The rising number of whales accumulating the US-Dollar pegged stablecoin Tether could be an indicator of an upcoming rally in Bitcoin. Tether whale accumulation, rising stablecoin inflows to exchanges, and relatively low BTC reserves could all act as “buy signals” for the asset as it struggles to recover from its recent decline below $23,400.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EOS 22% pump steals the show unveiling Vaulta’s web3 banking ecosystem

EOS, the token behind the recently rebranded Vaulta network, has increased by a staggering 22% in the last 24 hours.

Curve DAO Price Forecast: CRV bulls could aim for double-digit gains above key resistance

Curve DAO (CRV) price is in the green, up 8%, trading above $0.53 on Thursday after rallying nearly 15% so far this week.

Bitcoin price reacts as Gold sets fresh record highs after Trump’s reciprocal tariffs announcement

Bitcoin price plunges towards $82,000 as Gold soars past $3,150 after US President Donald Trump imposed new tariffs on Israel and UK, triggering global markets turbulence.

Bitcoin and top altcoins slide as Trump kicks off reciprocal tariffs

Bitcoin (BTC) and the entire crypto market saw a quick correction on Wednesday following President Donald Trump's reciprocal tariff announcements based on half of each country's respective rates.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.