Spot Solana exchange-traded funds (ETFs) in the United States could potentially drive up the price of SOL by a factor of nine, suggests crypto market maker GSR Markets.

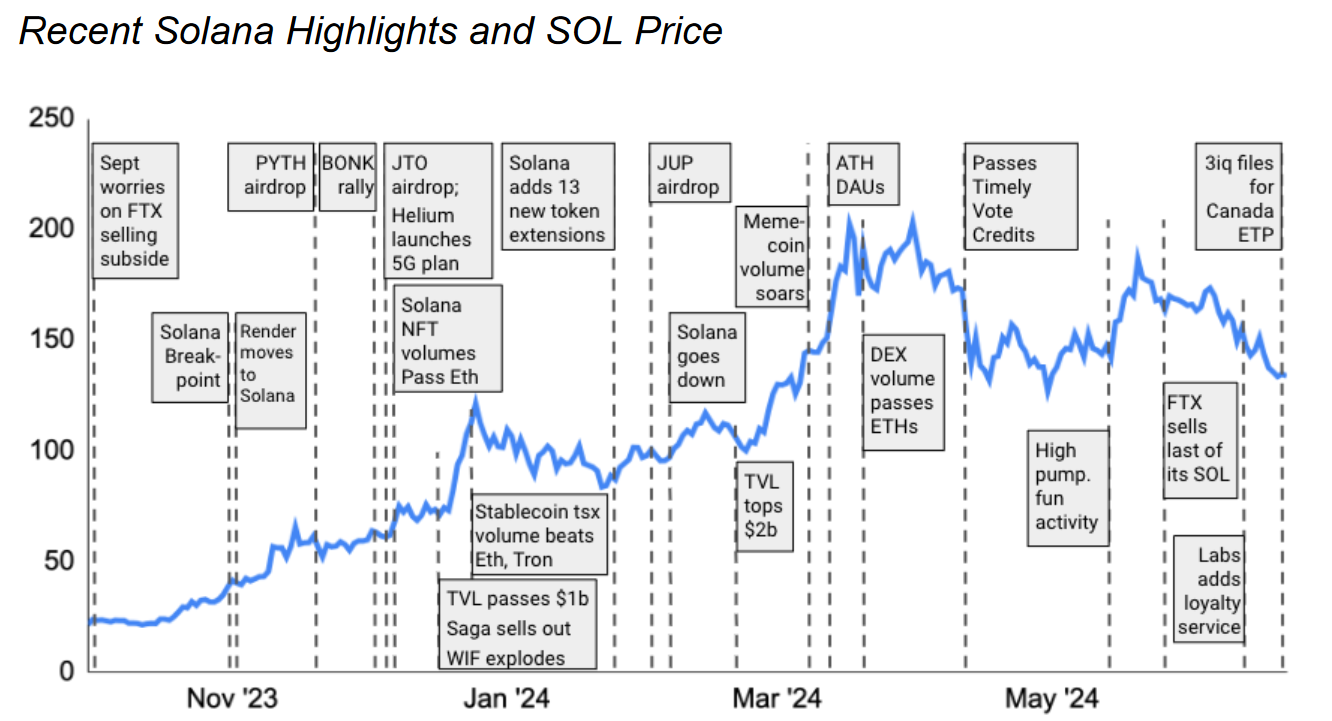

In a June 27 report, the firm described Solana as part of “crypto’s big three” and looked into whether Solana’s (SOL $145) will be the next spot cryptocurrency ETF to receive U.S. regulatory approval.

Coincidentally, GSR’s report was released on the same day VanEck filed to issue a spot Solana ETF, surprising many.

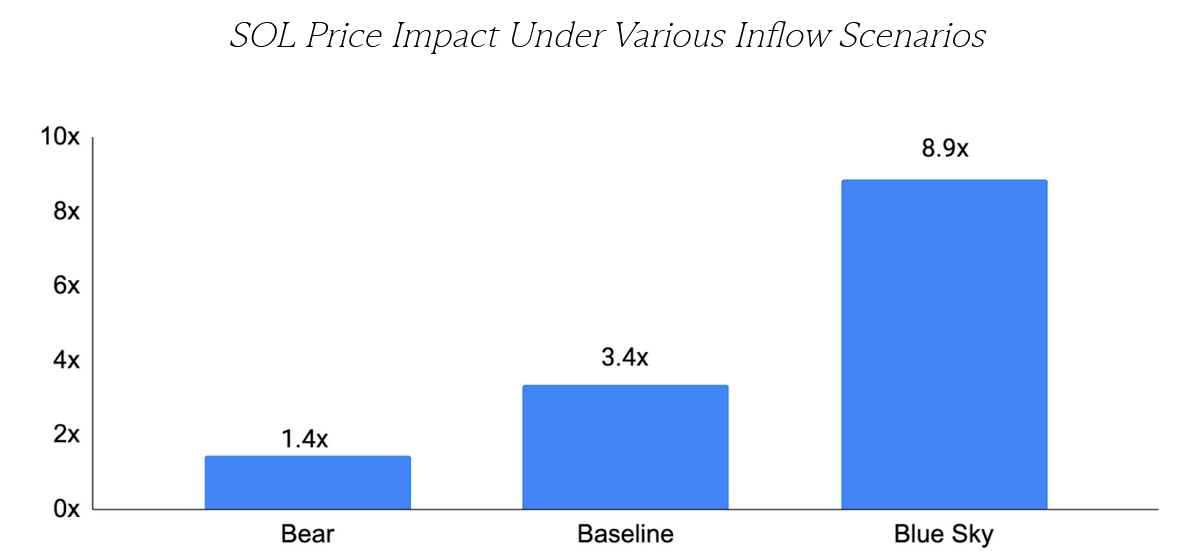

GSR — which holds a long position on SOL — reached the “8.9x” estimate on the assumption that the spot Solana ETFs would take in 14% of the flows that the spot Bitcoin ETFs have seen since launching in January, based on their relative market cap size.

GSR’s “blue sky scenario” would take Solana’s current price of $149 to over $1,320, while Solana’s market cap would increase to $614 billion (at current supply).

Meanwhile, GSR’s “bear” and “baseline” scenarios would see the spot Solana ETFs take in 2% and 5% of what Bitcoin took, triggering 1.4x and 3.4x price rises for SOL, respectively.

The price of SOL under base, bear and bull scenarios. Source: GSR Markets

The firm said these estimates could be even larger if the spot Solana ETFs include income from staking rewards, though staking wasn’t allowed in the approved spot Ether (ETH $3,440) ETFs.

“Solana is poised for a spot ETF if and when additional spot digital asset ETFs are allowed in the US, and the impact on price may just be the largest yet.”

Despite GSR’s optimism, Bloomberg ETF analyst Eric Balchunas and others believe a change of U.S. president and chair of the Securities and Exchange Commission would be necessary for a spot Solana ETF to be seriously considered.

The SEC and its Chair, Gary Gensler, labeled SOL as a security in its lawsuits against Binance and Coinbase, arguably making the pathway toward approval much more challenging than the now-approved spot Bitcoin (BTC $61,453) and Ether ETFs.

VanEck’s application comes a week after cryptocurrency asset manager 3iQ filed for a spot Solana ETF in Canada, which marked a North American first.

Solana’s recent price performance and major developments. Source: GSR

The Solana ecosystem and network have also received praise from $1.5 trillion asset manager Franklin Templeton. However, the firm hasn’t confirmed it will for a spot Solana ETF in the future.

Over $1 billion worth of Solana exchange-traded products are already offered worldwide.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.