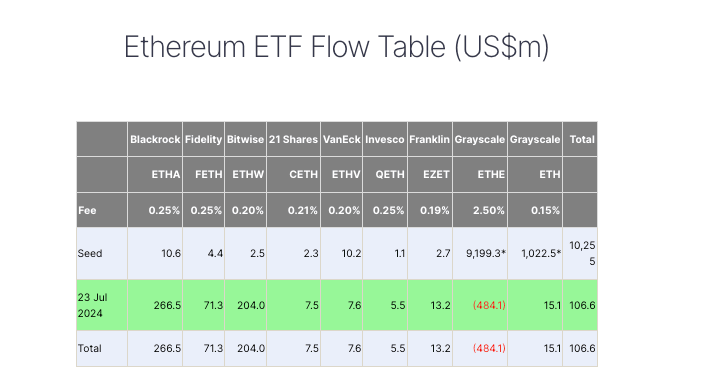

Spot Ethereum ETFs post $107M net inflows on first day

United States Ether exchange-traded funds (ETFs) posted a net inflow of $106.6 million on their first day of trading — despite massive outflows from Grayscale’s freshly-converted Ethereum Trust.

BlackRock and Bitwise’s ETFs led the pack, with BlackRock’s iShares ETF (ETHA) posting $266.5 million and Bitwise’s Ethereum ETF (ETHW) with $204 million in net inflows.

Fidelity’s Ethereum Fund (FETH) came in third with $71.3 million.

The Ethereum ETFs notched $106.6 million worth of inflows on day one. Source: FarSide

The inflows to the “newborn” spot Ether funds were enough to overcome bleeding from Grayscale Ethereum Trust (ETHE), which outflowed $484.9 million on the day — equating to 5% of the once $9 billion fund.

ETHE was launched by Grayscale in 2017 and allowed institutional investors to buy ETH. However, it imposed a six-month lock-up period on all investments.

The conversion to a spot ETF means that investors are now able to more easily sell their shares, which could explain the high day-one outflows.

In January, spot Bitcoin ETFs were marred by a similar dynamic with Grayscale’s Bitcoin Trust (GBTC), which saw over $17.5 billion in outflows following the launch of the 11 spot BTC funds.

Meanwhile, Grayscale’s Ethereum Mini Trust — a spinoff product launched by the asset manager with lower fees — generated $15.2 million in new inflows.

Franklin Templeton’s fund (EZET) netted $13.2 million, while 21Shares’ Core Ethereum ETF (CETH) saw $7.4 million in inflows.

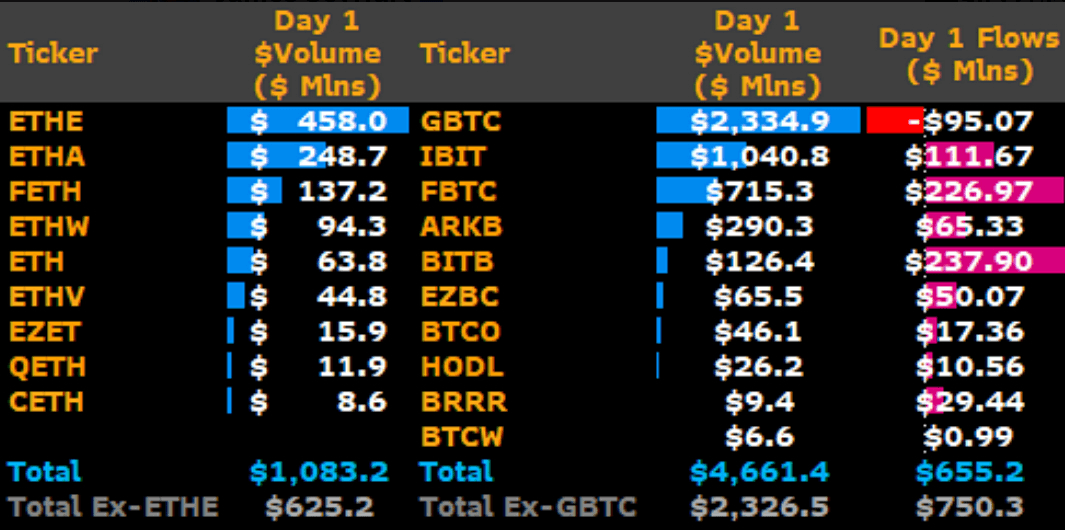

Overall, the spot ETH funds generated $1.08 billion in cumulative trading volume on their first day of trading — 23% of the volume spot Bitcoin ETFs saw on their debut.

Source: James Seyffart

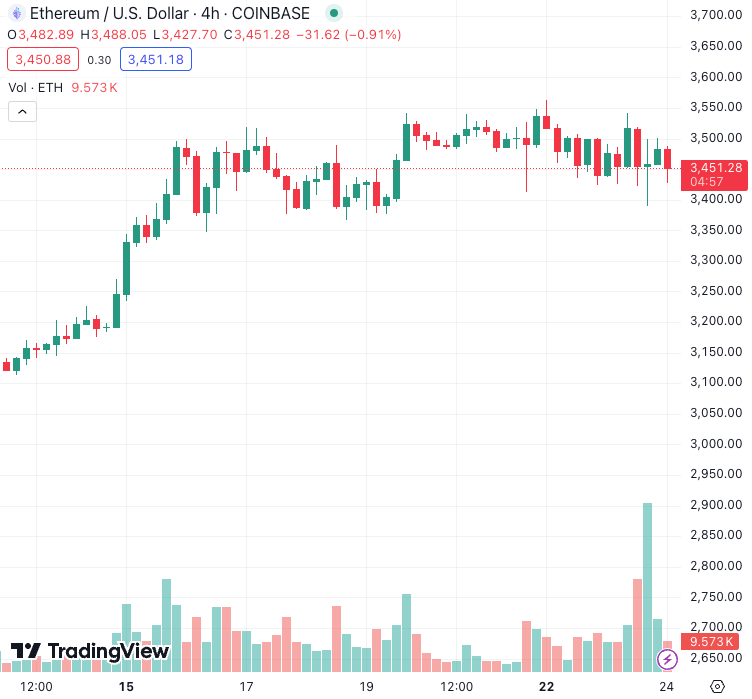

The price of ETH tumbled slightly on the day.

ETH is changing hands for $3,451 at the time of publication, down 1.4% in the last 24 hours and 1.5% on the week, per TradingView data.

The price of Ether slid during the spot ETF debut. Source: TradingView

The Ether ETFs received the final tick of approval from the SEC on July 22 and went live for trading in the United States on July 23.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.