Solana witnesses liquid staking boom with staking rate at 71% amid SBF trial

- Solana boasts 400 million SOL tokens staked, representing a staking rate of about 71.3%.

- SOL price has seen growth amid the ongoing trial of FTX's Sam Bankman-Fried

- The Layer 1 chain has been focusing on validator diversity, with Jito Labs now holding a 31% stake

Solana (SOL) is experiencing a shift in sentiment with a staking ratio that has grown to 71.3%, which denotes a high level of community participation. The notable increase in liquidity staking comes as Sam Bankman-Fried of the collapsed FTX exchange goes to trial. In its latest report, Solana Foundation boasts of network growth through multiple validator clients, with Jito Labs' 31% stake.

Also read: Solana price performance YTD eclipses BTC, ETH; emerges as the largest decentralized PoS network

Nearly 400 million Solana staked as SBF's trial begins

SOL is now witnessing a surge in staking activity, accompanied by resilient price performance in the run-down to the week.

Notably, Solana’s network growth comes against the backdrop of the trial of Sam Bankman-Fried, the former CEO of the now-bankrupt FTX crypto exchange, which began on Tuesday.The legal battle that brings several counts of fraud against SBF had previously reduced liquidity for the network. In the last quarter of 2022, SOL experienced price weakness as its liquidity was hit by the FTX collapse.

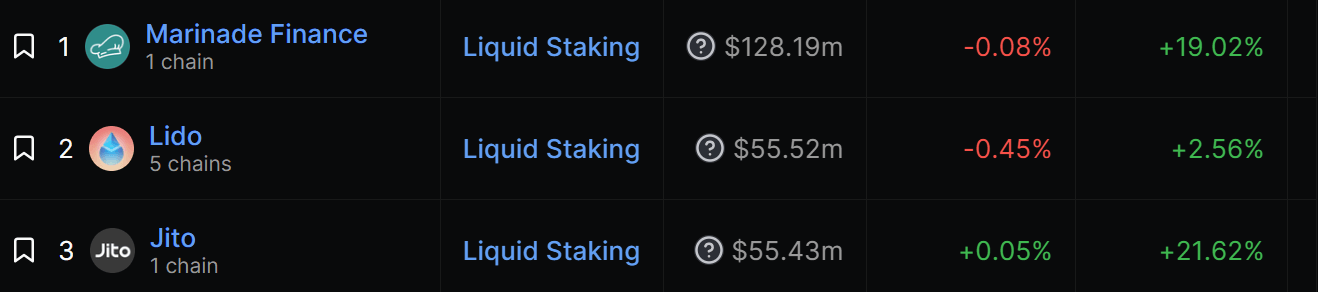

In the last seven days, as per DeFiLlama, liquidity staking on Solana expanded. Marinade Finance experienced an 18.9% increase, and Jito Labs hiked by 22.2%. Multichain staking protocol Lido grew by 2.6%.

Liquidity staking on Solana

The proof-of-stake layer 1 chain allows staking through lending, running a validator, or delegating SOL to validators.

Jito Labs Dominates a 31% Stake

In a recent Validator Health Report, Solana revealed that more than 31% of the total stake is now flowing through the Jito Labs client. Jito Labs' presence in the Solana ecosystem has expanded from 0% last year. Solana has also revealed that two new validator clients are in development.

According to the Dune Analytics dashboard, SOL staked on Jito reached 2.3 million. It mentions that there are 15,310 stakers participating in JitoSOL.

Meanwhile, the price of Solana has been in the green with the token trading at $23.40 at press time. Over the past week, SOL price has gone up by over 21%.

SOL price/Staked SOL 1-day chart

In the last week, the price of SOL has increased by 21.3%, reaching $23.31, and the total market capitalization has also grown by 21.5% to $9.64 billion. Daily trading volume has surged by nearly 74% to $453.85 million, reflecting increased activity.

Overall, SOL has a staking market cap of $9.25 billion,based on StakingRewards data. The R/R ratio, which measures reward-to-risk, is 0.81%, with a marginal decrease of 0.01%.

Solana's staking market growth, including the increase in staking by Jito Labs, bodes well for the layer 1 chain. As the FTX trial unfolds, Solana's price is expected to maintain its performance. Solana's focus on validator client diversity reduces the likelihood of network outages, adding positively to its price stability and liquidity.

Author

Shraddha Sharma

FXStreet

With an educational background in Investment Banking and Finance, Shraddha has about four years of experience as a financial journalist, covering business, markets, and cryptocurrencies.