Solana USDC transfer volume exceeds $70 billion, hits 6-month peak

- Solana USDC transfers hit $71 billion in November, marking a six month peak for the Ethereum alternative token.

- DEX trading volume in the SOL ecosystem hit a record high, signaling investors are likely re-entering the Solana network.

- SOL price rallied 78% in the past thirty days, yielding massive gains for holders.

Solana blockchain noted a spike in USDC transfer volume in its network. Alongside SOL price rally, there is an increase in DEX trading volume. Solana price rally is likely to continue with these developments in the ecosystem.

Also read: Cosmos community passes proposal to slash ATOM inflation, seeks long-term profitability

Solana metrics hit new highs in November

Stablecoin USDC transfer volume on Solana climbed to $71 million in November. This marks a 6-month peak for the Ethereum alternative token, as seen in the chart below. Solana hit this milestone while the trading volume for the altcoin on DEXes hit a peak.

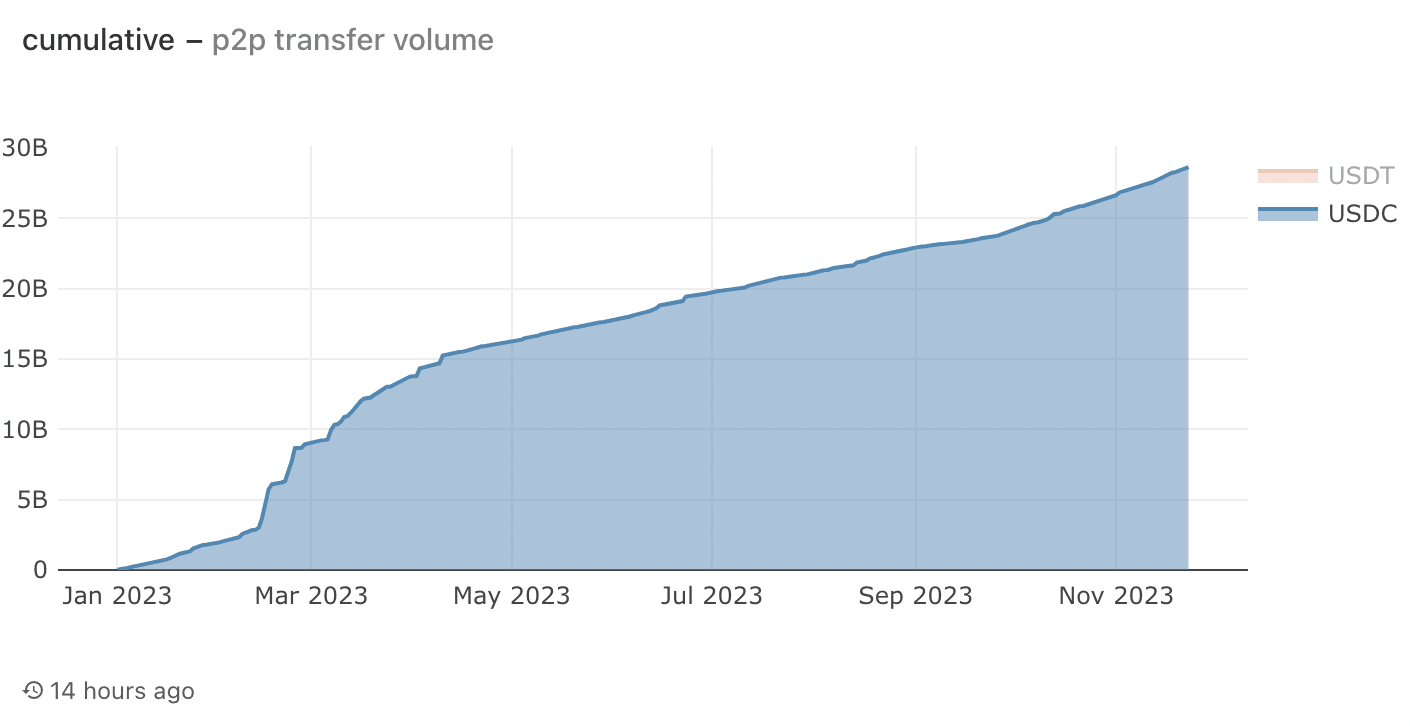

USDC transfer on Solana

The cumulative peer-to-peer transfer volume of USDC hit a 2023 high in November.

Cumulative peer-to-peer transfer volume USDC

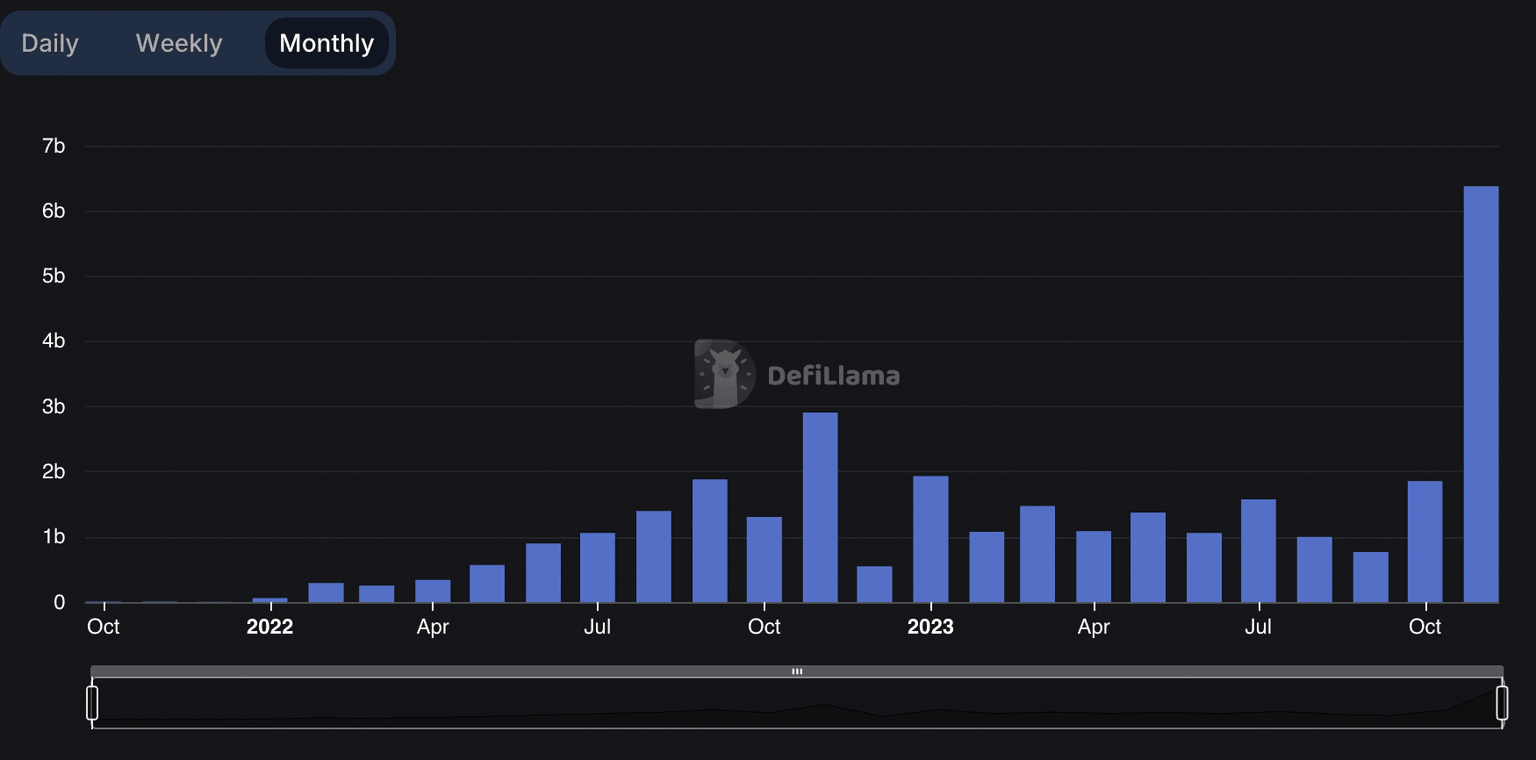

Based on data from DeFiLlama, DEX trading volume climbed in October and hit a new high in November. Market participants engaged in higher trading activity on Solana based DEXes, while SOL price yielded gains for holders. The rising activity in the SOL ecosystem has contributed to the altcoin’s recent gains.

Solana DEX trade volume

These developments are likely signs of investors entering the Solana ecosystem again, to help sustain the altcoin’s recent gains. In the past month, SOL price yielded 77.70% gains for holders.

Jeremy Allaire, the co-founder and CEO of Circle, the firm behind the stablecoin USDC, commented on Solana’s rise in USDC transfers in November. Allaire noted that it is encouraging to see an ecosystem develop for USDC on Solana.

Really encouraging to see such a strong ecosystem growing for USDC on Solana. ~850B annual run-rate in Tx volume. https://t.co/rTQhn6fvQF

— Jeremy Allaire (@jerallaire) November 25, 2023

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.