Solana slumps to 45-day low – Will SOL price bounce at $130?

Despite a brief rally to $151 on June 16, Solana’s native token SOL

SOL

$136

has experienced a 24% correction since June 7. It has underperformed against the total cryptocurrency market capitalization that’s down 14% over the same period.

This suggests that SOL’s issues are more pronounced than the overall market’s reduced interest in cryptocurrencies.

Several indicators, including Solana Network’s on-chain activity and demand for leveraged positions, indicate that SOL's bearish momentum is likely to continue. If demand remains stagnant, this could lead to a retest of the $130 level or lower.

SOL price may struggle due the lack of an ETF

Part of the reduced interest in cryptocurrencies can be attributed to the strong performance of the S&P 500 index, which reached an all-time high on June 17.

Stock market gains have been driven by tech stocks, and recent employment and consumer data suggest positive second-quarter earnings reports. Investors are pricing in a two-thirds chance that the U.S. central bank will begin cutting interest rates by September.

Despite the cryptocurrency market's higher potential, investors are concerned that the U.S. economy may not sustain its growth for much longer, given the high interest rates. This risk is particularly burdensome for altcoins like SOL, as Bitcoin (BTC $65,085) and Ether (ETH $3,389)have preferential access to institutional money through exchange-traded funds (ETFs).

Even if the crypto market experiences a rally in the coming months, the competition for smart contract-focused blockchains will be fierce. Multiple apps running on the Solana Network offer asset bridges to other blockchains that also compete by yield, airdrops, liquidity, and token launches.

Solana's native staking reward rate is only 1.3% above the SOL token inflation rate. In contrast, Ethereum offers a 2.8% effective reward rate due to its burn mechanism, which results in a mere 0.4% annualized inflation, according to StakingRewards. This directly impacts Solana’s total value locked (TVL), which has stagnated below $30 million since May.

BitMEX co-founder and former CEO Arthur Hayes predicts that Solana will not be a top base layer decentralized application (DApps) network within one to three years. According to Hayes, Aptos is the most likely candidate for leadership, although he did not provide much detail for this pick, according to Wu Blockchain.

Aptos uses a "modular approach" to transaction processing, where transactions are grouped into batches and executed using a sharded architecture.

Solana on-chain and derivatives metrics worry investors

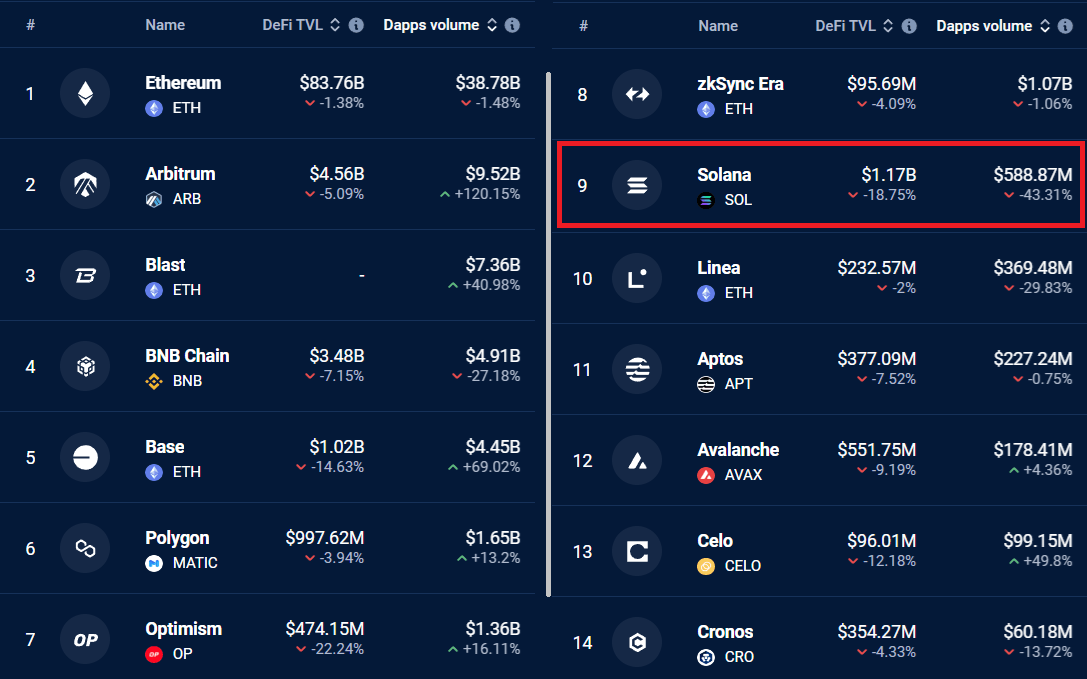

In addition to direct competition from layer-1 alternatives, Solana faces increased pressure as Ethereum's layer-2 ecosystem TVL remains above $40 billion. Blockchains, including Arbitrum, Base, and Optimism, have already surpassed Solana Network in terms of DApps activity.

Top blockchains ranked by 7-day DApps volume, USD. Source: DappRadar

Notice how Solana's $589 million weekly volume is significantly smaller than BNB Chain's $4.9 billion and Arbitrum's $9.5 billion activity in the same period. Similarly, the decentralized finance TVL on Solana, according to DappRadar, stands at $1.2 billion, which is higher than competitors Aptos and Avalanche but far lower than BNB Chain's $4.9 billion.

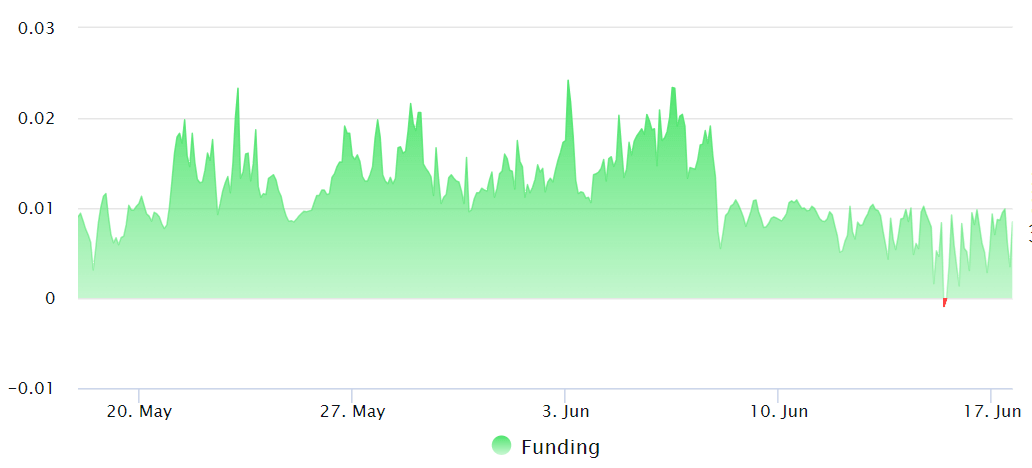

For a better understanding of market sentiment, traders are advised to observe the derivatives markets. Perpetual contracts, also known as inverse swaps, incorporate an embedded rate recalculated every eight hours. In short, a positive rate indicates a preference for higher leverage being utilized by longs (buyers).

SOL perpetual futures 8-hour funding. Source: Laevitas.ch

The funding rate for SOL perpetual futures has remained below 0.01% every 8-hour for the past 7 days, equivalent to a rate of 0.2% per week, typical of neutral markets. The last period of moderate excitement occurred on June 6, when the cost for leverage longs jumped to 0.5% per week.

Given Solana Network's activity by DApp deposits, volumes, and the lack of appetite from SOL derivatives traders, the odds of SOL price breaking below the $130 support level in the near term remain high.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.