Solana scrambles to patch failed transactions on its chain, crushed under rising user activity

- Solana co-founder defended the rate at which transactions are failing on the SOL blockchain.

- Co-founder Raj Gokal says that world class engineering teams are working to push fixes to the SOL chain.

- Solana has seen a surge in new addresses and volume, alongside nearly 70% average failure rate of transactions.

Solana blockchain (SOL) has witnessed a surge in users and their on-chain activity with the rise in meme coins and transactions on DEXes. In the past few weeks the SOL chain has seen a failure of nearly 70% non-voting transactions.

Solana’s co-founders defended the project and said that teams are working on tackling the technical issues and a fix will be issued in due time.

Solana co-founders defend the chain, assure engineers are developing a fix

Anatoly Yakovenko and Raj Gokal, the Ethereum alternative chain’s co-founders tweeted in Solana’s defense as the chain is being critiqued for high failure rate of its transactions. Data from Dune Analytics shows that over 70% of non-voting transactions on the network have failed in the past few weeks.

world class engineering teams are working around the clock to push fixes to improve the experience of submitting transactions on @solana.

— raj (@rajgokal) April 4, 2024

I am messaging them multiple times a day asking how it’s going, and they tell me this is a very helpful way to contribute to the solution.

dealing with congestion bugs sucks so much more than total liveness failure. the latter is one and done, bug is identified and patched and chain continues. the former has to go through the full release and test pipeline. shipping fast is impossible

— toly (@aeyakovenko) April 5, 2024

The co-founders of the project explained that engineers are working on dealing with congestion bugs. It requires a full release and the fix goes through a test pipeline, it may be impossible to ship it faster.

Gopal said he stays up to date with world class engineering teams working on pushing fixes to improve the experience of submitting transactions on the chain and they believe this is a helpful way to contribute to the solution.

Faced with the crisis, Solana’s new users and volume continues to rise. Data from Santiment shows a spike in volume, between March 31 and April 6.

Volume (SOL)

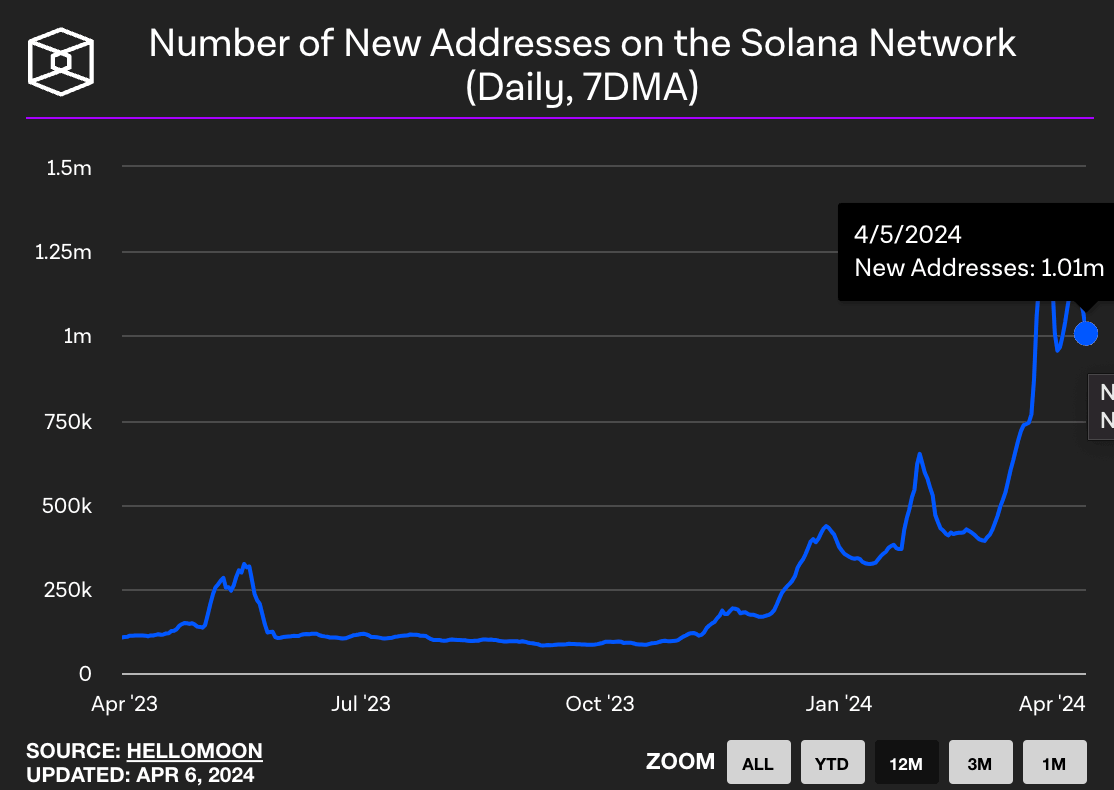

In the same timeframe, there is a rise in the number of new addresses, as seen on The Block.

Number of new users on Solana

At the time of writing, SOL price is up nearly 2%, trading at $177.40 on Binance.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B13.32.56%2C%252006%2520Apr%2C%25202024%5D-638479900439497594.png&w=1536&q=95)