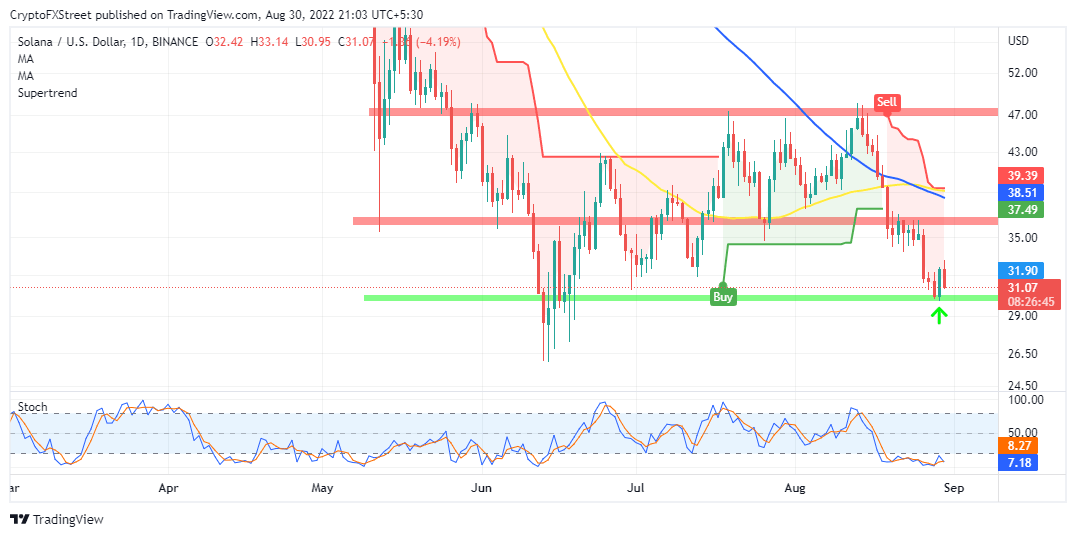

Solana price’s restrained recovery spells potential doom below $30.00

- Solana price bounce weakens at $33.15, casting doubts on the token’s ability to close the gaps to $38.50 and $48.50.

- Solana’s total value locked is a pale picture of its $10 billion November peak – implying more downside in the offing.

- Harrowing losses may engulf SOL price if support at $30.00 crumbles.

Solana price is scampering for support barely a day after reclaiming its position above $32.00. The competitive smart contracts token tagged an intraday high of $33.15 before dropping to exchange hands at $31.36. As discussed yesterday, SOL needs to recapture resistance at $36.50 to corroborate the climb to $38.50 and then to $48.50.

Solana’s DeFi TVL plunges to 2021 pre-rally levels

Defi Llama, a platform tracking the decentralized finance (DeFi) sector, reveals an enormous drop in Solana’s TVL from $10.17 billion in November 2021 to $1.42 billion. Although SOL’s 87.8% drop from historical highs of $259.96 cannot be entirely attributed to the massive drop in the TVL, its impact on Solana price is quite vivid.

According to CoinDesk, “investors look at the TVL when assessing whether a DeFi project’s native token is valued appropriately. The market cap of the token may be high or low relative to the TVL of the project. The more extreme the relationship, the more overvalued or undervalued the token may appear.”

Total value locked (TVL) refers to the overall value of crypto assets stored in DeFi protocols, mainly in USD. Smart contracts play a key role in this crypto segment, enabling staking, lending and liquidity pool features. In other words, Solana’s position in the DeFi market could provide investors with insight into price performance – not only for the native token, SOL but for other assets within its DeFi ecosystem.

Why Solana price pullback is far from over

Solana price could not sustain a reflex recovery on Monday despite wading through extremely oversold conditions. Besides, without a daily close above $32.00, a sustainable upside move would be a tall order for bulls.

Support at $30.00 is expected to prevent Solana price from exploring more downhill levels. Traders should keep in mind a sell signal from the Super Trend indicator, which might wreak havoc beneath $30.00.

SOL/USD daily chart

If push comes to shove and overhead pressure surges, recovery to $38.50 and $48.50 would be unmanageable. On the downside, investors may be forced to acclimatize to SOL retesting support at $25.00 and $20.00 sequentially.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren