Solana price uptrend holding steady as bulls rally 60% on the month

- Solana price has risen by 60% since January 1.

- Bulls’ next target may lie 30% ahead at $20.

- A daily candlestick close beneath $16.25 could invalidate the bullish trend.

Solana price has pulled off a surprising rally this week, outperforming nearly all other cryptocurrencies in the space. As the price consolidates, investors are cued in, wondering how high the centralized smart contract token will rise.

Solana price outperforms the rest

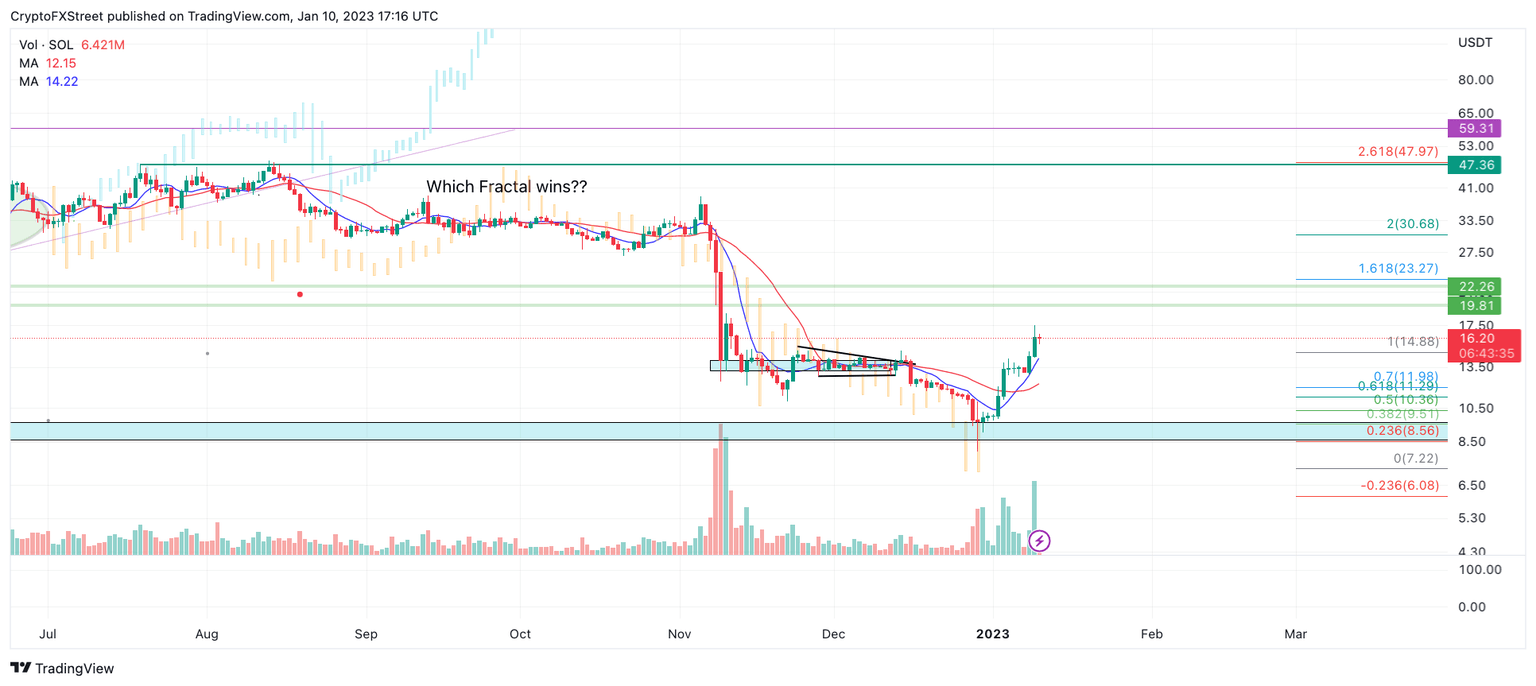

Solana price is currently trading at $16.14, an impressive 60% increase in market value since the start of the new year. On January 10, during a 20% upswing into the new yearly high at $17.50, the volume indicator, which extracts data from Binance exchange API, increased by 175%. By the end of the daily auction, SOL produced $20 million worth of transactions, $14 million more than the day prior.

Solana price now consolidates at the upper bounds of the newly established rally with a volume back around the average $6 million worth of transactions on the day. The indicator is a bullish gesture since transactions have not yet increased to the downside. Considering these factors, the next bullish target is likely to be the psychological $20 level, resulting in a 30% rise from the current Solana price.

SOL/USDT 1-day chart

The bears will need to show more signs of a reversal before calling the uptrend over. A daily candlestick close beneath January 10 opening price at $16.25 could weigh too heavily on the bullish momentum and spark a cascade of selling. Ultimately, the next level of support to be tested would be the recently breached $12 resistance, which would result in a 27% decline from Solana's current market value.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.