Solana price tests holders’ patience before 25% rally

- Solana price is nearing the end of a falling wedge, hinting at a 24% ascent to $112.

- The ongoing consolidation will likely result in an explosive move to $105 before retesting $112.

- A daily candlestick close below $75.33 will invalidate the bullish thesis for SOL.

Solana price action continues to tighten as it approaches the end of a converging setup. A breakout from this pattern is likely to result in a volatile move for SOL.

Solana price prepares for volatility

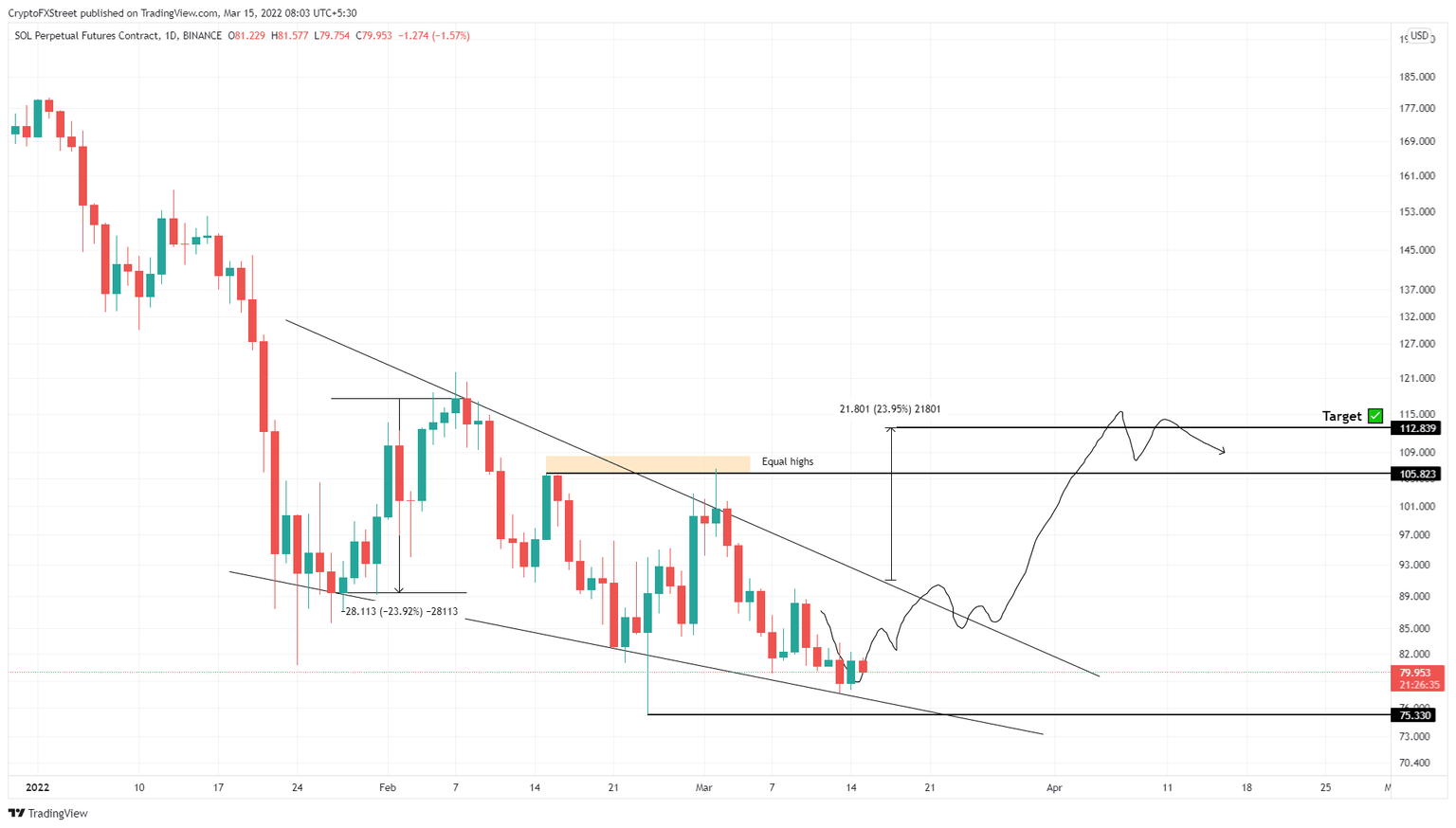

Solana price set up two lower highs and three lower lows since the January 22 crash. The swing points in the range can be connected using trend lines to form a falling wedge. This technical formation leans bullish and forecasts a 24% ascent, determined by adding the distance between the first swing high and low to the breakout point.

Assuming Solana price produces a daily candlestick close above $91.04, it will signal a breakout. In such a case, investors can expect SOL to rally 24% and hit the intended target at $112.84.

However, this move could pause around $105.82, where SOL formed equal highs in early-to-mid February. A move beyond this level will allow market makers to farm the buy-stop liquidity resting above it. Beyond this barrier, Solana price upside seems to be capped at $112.84.

SOL/USDT 1-day chart

Regardless of the bullish pattern, if leading big crypto Bitcoin price action turns sour and crashes, Solana price and altcoins will follow suit. If the resulting downswing produces a daily candlestick close below $75.33, it will create a lower low and invalidate the bullish thesis for SOL.

In this scenario, Solana price might continue heading lower and retest a stable support level at $66.88 that absorbs the selling pressure. Here, buyers will have a chance at reattempting to establish a new uptrend.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.