Solana price readies for a fall after FTX gets approval to dump $3.4 billion worth of crypto

- The court has approved crypto exchange FTX to liquidate $3.4 billion worth of crypto, comprising SOL, BTC, ETH, and other coins.

- Weekly sell limit of 50 million for the first week; most Solana locked until 2025, preventing panic selling.

- Fundstrat’s data shows that approximately 13% of FTX’s SOL holdings are liquid, which explains why it has not slumped.

- While experts dismantled the assumption that FTX was the one that propped up Solana, the altcoin eyes a 10% rundown.

Solana (SOL) price could be due for a fall, coming on the back of selling pressure after Judge John Dorsey allowed defunct cryptocurrency exchange FTX to liquid billions of assets, including Bitcoin (BTC), Ethereum (ETH), and most interestingly, Solana (SOL), among other assets.

Also Read: Justin Sun of Tron contemplates an offer for FTX's holding tokens as crypto markets bend to FUD

Solana price could suffer as FTX readies for mass liquidations

Solana (SOL) price could suffer up to 10% in losses soon, with a lot of selling pressure anticipated around the token. The assumption comes after the court gave permission to the bankrupt crypto firm FTX to offload up to $3.4 billion worth of crypto.

Solana price remains confined within a descending parallel channel, facing immediate resistance from the governing pattern’s midline at around $18.42. Unless bulls get their act together, SOL could extend south, breaking below the immediate support at $17.34 before dipping into the demand zone (DZ) around the psychological $16.00 range. Such a move would denote a 12% decline from current levels.

In the dire case, the downtrend could extend to the $14.49 support floor, with the negative position of the Awesome Oscillator (AO) indicator motivating this outlook with red histogram bars showing selling pressure.

SOL/USDT 1-day chart

Conversely, the Relative Strength Index (RSI) shows rising momentum as it moves north, suggesting one cohort of investors is using the FUD to accumulate. Increased buying pressure could see Solana price make a decisive close above the midline at $18.42, before leaping higher to vindicate itself from the foothold of the bearish technical formation at $20.23, or in highly ambitious cases, the $21.92 resistance level last tested in late August.

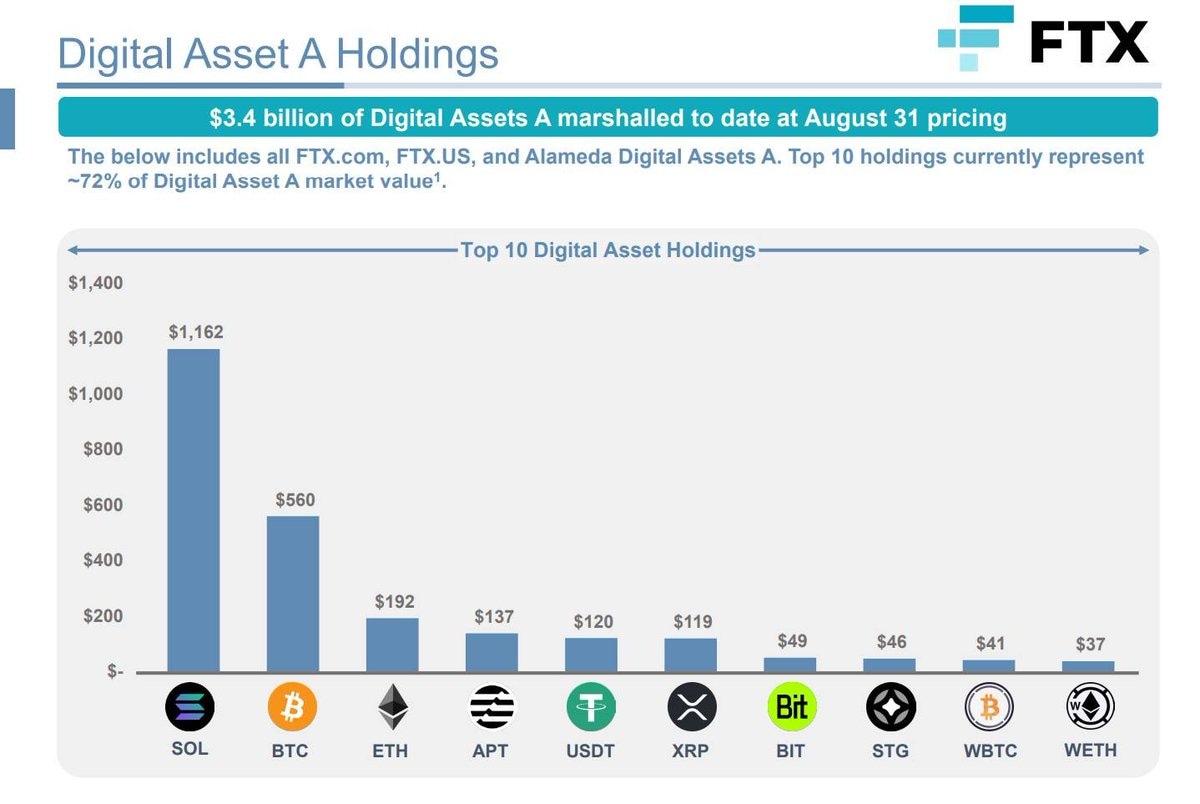

FTX digital asset holdings

According to data as of August 31, FTX was holding SOL valued at $1,162M, making the firm one of Solana’s largest holders.

FTX top 10 digital asset holdings

With the approval to offload, therefore, the odds look bearish for SOL. However, it is imperative to note that most of FTX's SOL is linear unlocked until 2028. Nevertheless, with a large holder of FTX’s magnitude constantly selling will exert huge pressure on Solana, unless there is an over-the-counter (OTC) deal such as what Tron Founder Justin Sun was hinting at.

Court approval, complete rundown

Judge John Dorsey of the US Bankruptcy Court for the District of Delaware on Wednesday allowed FTX to sell $3.4 billion in SOL, BTC, ETH, and other assets.

The firm had detailed its offloading structure in August, noting that Galaxy Digital’s Mike Novogratz would spearhead the process as investment manager to lead the sale. The plan was to set a weekly limit of $50 million for the first week, and $100 million worth of tokens for each subsequent week, while maintaining an openness to extrapolate to $200 million on “an individual token basis.”

Based on the latest development, however, the Judge has kept the weekly limit staggered, allowing extrapolation provided the firm gets “written authorization from the court.” A snapshot of the footnote in the order is as follows:

Notably, panic selling has been prevented with a weekly sell limit of 50 million for the first week, aided by the fact that most of the Solana remains locked until 2025.

According to data by market strategist and sector researcher, Fundstrat, only approximately 13% of FTX’s SOL holdings are liquid (orange). This explains why it has not slumped.

FTX liquid assets

Further, experts have attempted to dismantle the assumption that FTX was the one that propped up Solana, with one analyst acknowledging that FTX did not put the bottom in on Solana price in 2022 when FTX exchange imploded. The user also argues that FTX was not the driving force behind SOL’s 3X growth in 2023 because the firm had been busy navigating bankruptcy woes.

I would disagree with your “well known” premise — did FTX put the bottom in on SOL in 2022 when the exchange was imploding? Did FTX push the asset 3x this year as the company was muddling through bankruptcy?

— Chris Burniske (@cburniske) September 13, 2023

Still, another user challenges, that Solana price nosedived from $13 billion to $5 billion within days of the FTX collapse, pointing to a solid connection between the two incidences.

Solana fell from $13 billion to $5 billion within days of the FTX collapse, which seems odd if there was no connection. If I recall it was @VitalikButerin who saved SOL when it was falling like a rock by pumping it out to his fanboys.

— digitalcleavage (@digitalcleavage) September 13, 2023

Nevertheless, considering the market depth all around, $3.4 billion is still a massive amount of sell pressure for the market to absorb.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.