Solana price rally isn't over yet, SOL bulls target $150 next

- Solana is on fire and has rallied 33% in just two days.

- More upside is to come, but buyers need to watch out where to get in.

- Spot the pattern repetition and look for that to enter SOL.

Solana price (SOL) is on a sharp trend higher, with buyers very much sitting on their profits, looking for good exit points to cash in. Price action is so vast that it is tough for them to lock in that profit. They are victims of their success. Looking further toward the price action gives us a few clues and pointers that need to be marked up on the chart.

Solana shows familiar bullish pattern

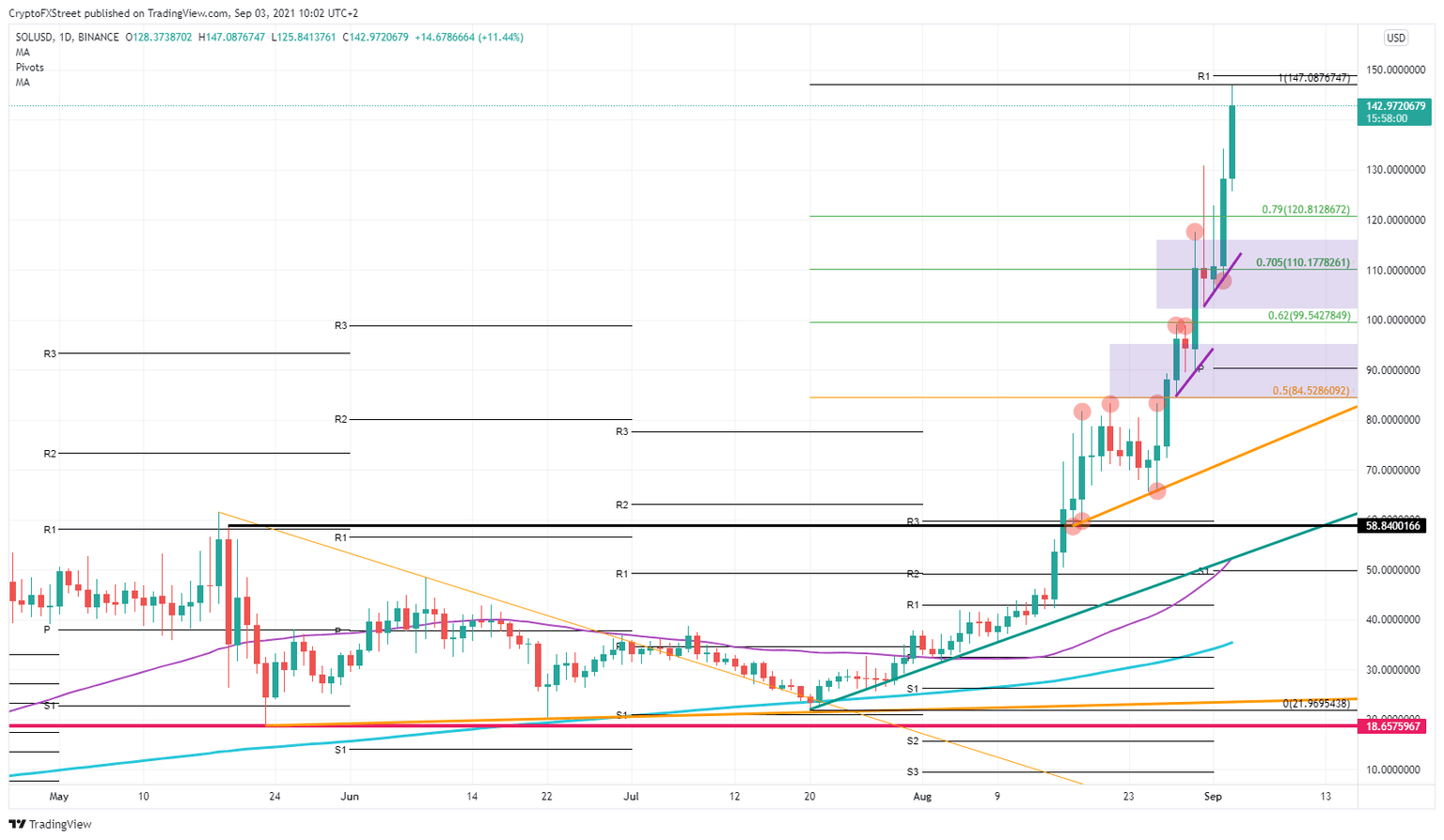

SOL price action today and yesterday has jumped 33% in total – a massive move. Most interesting is that the candle from yesterday bounced off the purple short-term ascending trend line around $110. That level also fell in place with the 70.5% Fibonacci level.

Looking back further down, on August 30 Solana shows the same pattern again. A purple ascending trend line is forming, and once again, the bounce off that trend line allows the move higher. This time the current monthly pivot around $90 was the level marked up as a reference point.

With this wild ride, it is difficult for buyers to lock in some profit. A target is forming today around $147, which is not only today’s high but also just a few ticks below the monthly R1 resistance level. This makes it two good reasons to book some profit here, as during the European session traders already took off some position.

SOL/USD daily chart

Once that R1 resistance at $147 is hit, expect the possibility of a false break out toward $150. By then, sellers will take over the short term and run price action down. Around $120, Solana should start forming the same purple ascending trend line in the coming days. That formation will be a good entry point to go long again or add long positions. The following price target should be a break above $150 after that.

On the downside, if sellers push SOL price below the 79% Fibonacci, expect a retest of the lower purple ascending trend line and the support level at $110.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.