Solana price rally attracts former BitMEX CEO Arthur Hayes to SOL, here’s why

- Former BitMEX CEO Arthur Hayes admitted to buying Solana for the token’s recent price performance.

- Solana price yielded 88% gains over the past month, rallying alongside Bitcoin in October.

- SOL price rally resisted the bearish catalysts like FTX and Alameda’s Solana sale over the past few weeks.

Solana price climbed 88% over the past month. Bitcoin’s October rally fueled a bullish outlook among market participants, driving gains in altcoins like SOL.

While crypto influencers and retail traders have critiqued Solana for its association with bankrupt FTX exchange’s Samuel Bankman-Fried, former BitMEX CEO Arthur Hayes jumped in on the SOL wagon for the asset’s performance.

SOL price performance attracts crypto traders to Solana

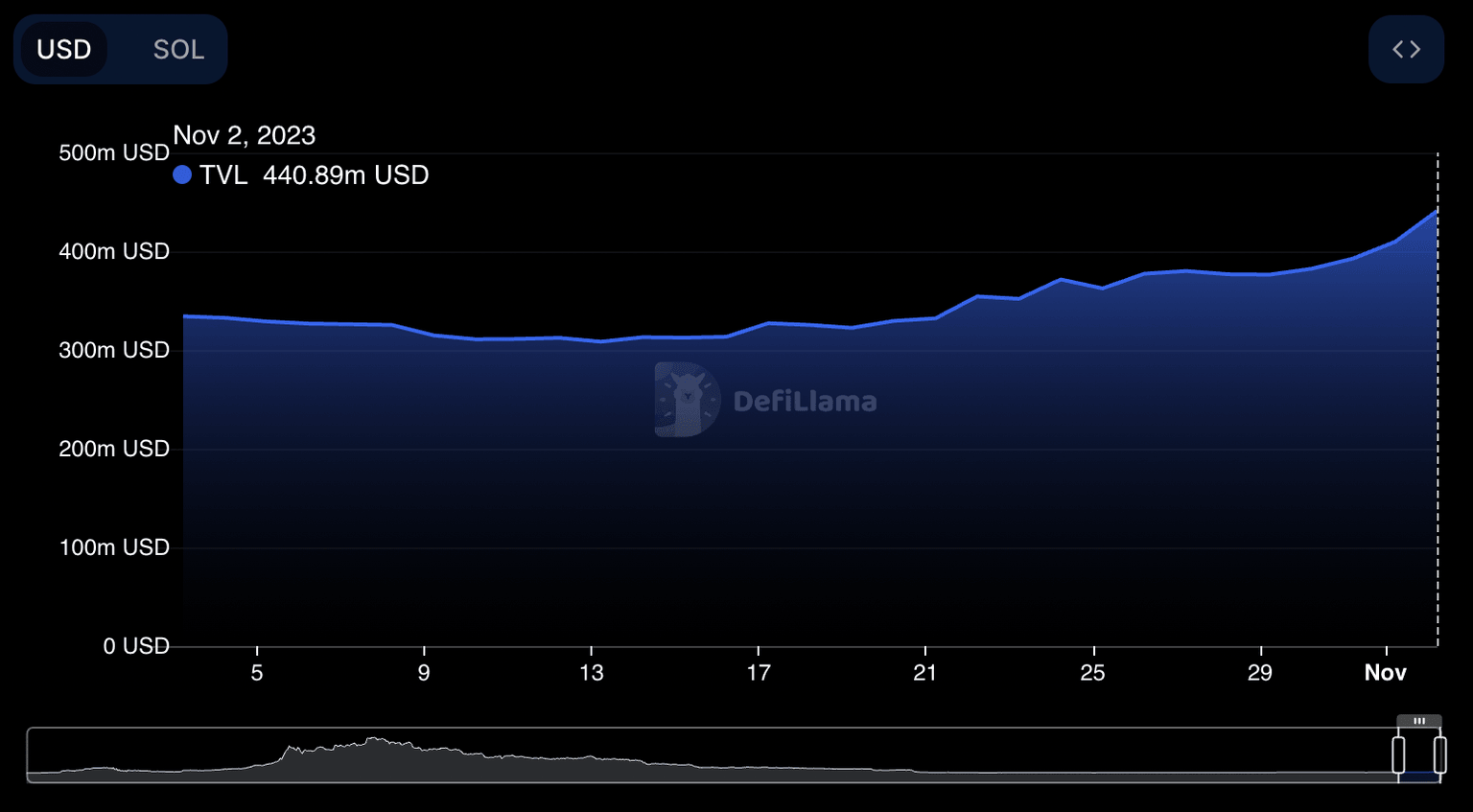

Solana price climbed 88% in the past month and 35% in the past seven days, on Binance. The Ethereum competitor has garnered the attention of retail traders, with its massive price action. Solana’s Total Value Locked (TVL) climbed nearly 32% between October 2 and November 2.

Total Value Locked in Solana as seen on DeFiLlama

The activity on Solana has increased, there is a 25% increase in daily active addresses and transactions, based on data from Santiment. The volume of daily trades climbed to highs previously seen in November 2022, when the bankrupt FTX exchange collapsed.

Former BitMEX CEO Arthur Hayes attributed Solana’s price action to his SOL purchase. The crypto community looks up to Hayes for identifying the most profitable positions in altcoins. Hayes’ move is therefore likely to influence his followers on X.

Fam I have something embarrassing I must admit.

— Arthur Hayes (@CryptoHayes) November 2, 2023

I just bot $SOL, I know its a Sam-coin piece of dogshit L1 that at this point is just a meme. But it is going up, and I'm a degen.

Let's Fucking Go!

In its ongoing uptrend, SOL price resisted mass sell-off from FTX and Alameda and the ongoing litigation against Samuel Bankman-Fried. SOL price climbed to $43.64, at the time of writing.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.