Solana price provides last buy opportunity before SOL breaks out to $400

- Solana price retests the $235 support level after a strong breakout from the $216 resistance barrier.

- This downswing will likely prepare the start for an 88% upswing for SOL.

- Reddit co-founder and Solana Ventures allocate $100 million for Web3 social media.

Solana price slowed down its ascent after a massive breakout from a crucial barrier. However, the current downswing will serve as a good buy opportunity for SOL to see explosive growth.

Web3 and $100 million initiative

Solana ecosystem has grown considerably over the past year. From yield farming, dApps to NFTs, tons of projects are making life easier for users, especially in terms of gas fees. While the demand seems to be reflected in the SOL price, the fundamentals are only getting stronger for the token.

On a similar note, Solana Ventures and Reddit co-founder Alexis Ohanian’s Seven Seven Six announced at a Solana conference that they would be allocating $100 million to support the decentralized media projects on Solana.

Although obscure decentralized social media already exists, none of them are at a level to compete with the social media giants. FTX CEO Sam Bankman-Fried signaled this support during the Breakpoint event in Libson as he stated that decentralized social media/Web3 “solves a lot of existing pain points, which are coming to the forefront of society right now.”

Solana price fumbles

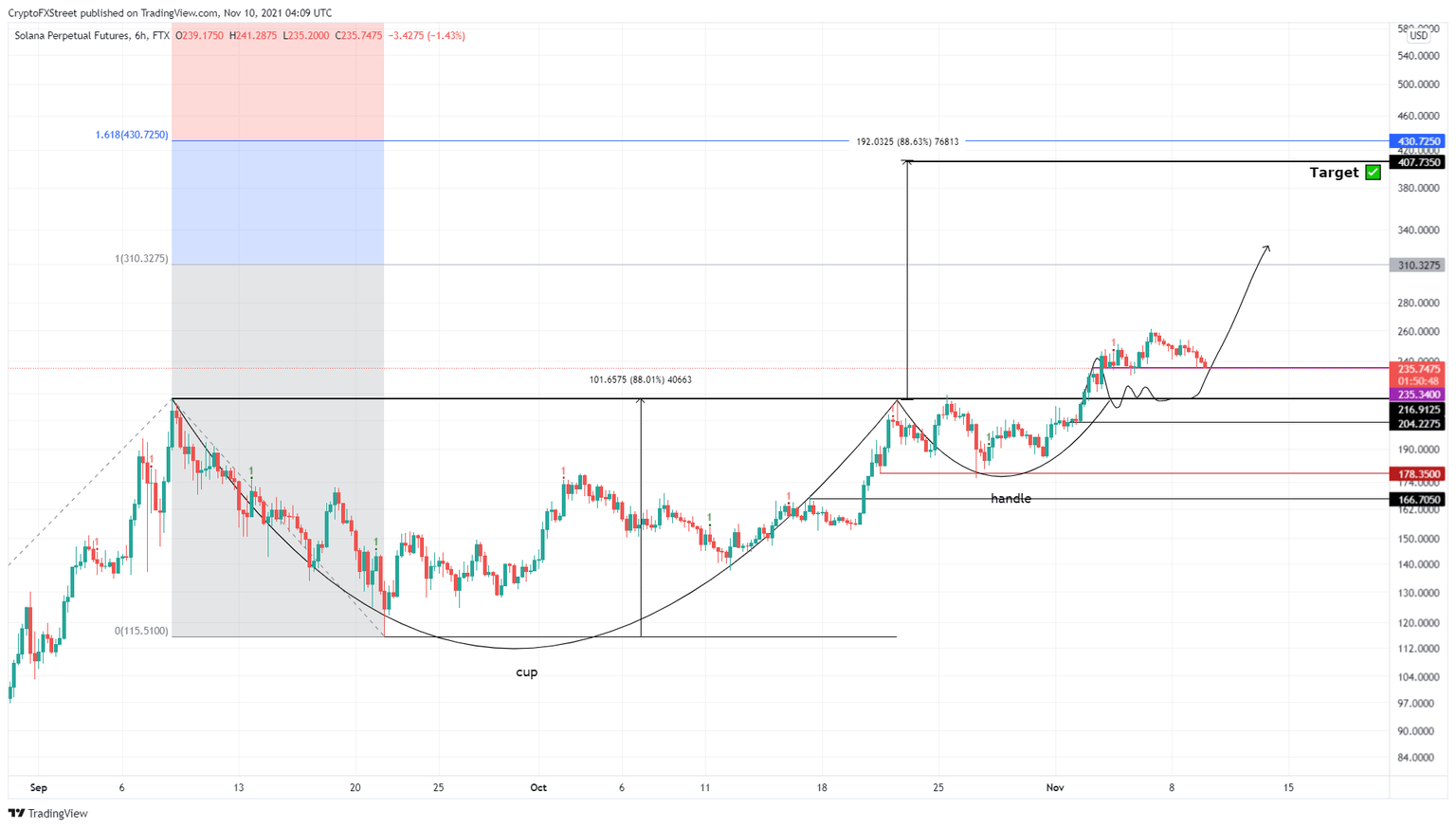

Solana price was seen traversing a cup-and-handle pattern a few days ago. However, SOL triggered an 88% breakout as it produced a daily close above $216 on November 2. This move catalyzed a bull rally for SOL but failed to move beyond $260, suggesting that investors are booking profits.

While Solana price is hovering around $235 support floor, increased selling pressure will likely knock it down to revisit the $216 barrier. If SOL holds above this level and sees a resurgence of buyers, it would confirm a perfect retest and suggest that a move higher is around the corner.

In this case, investors can expect Solana price to rally past the November 6 swing high at $261 and zoom toward the 100% trend-based Fibonacci extension level at $310. This climb would constitute a 44% ascent from $216. However, clearing this barrier will propel SOL toward its intended target at $407, representing an 88% advance from $216. In some situations, SOL could extend this run-up and tag the 161.8% trend-based Fibonacci extension level at $430.

SOL/USDT 6-hour chart

While things are looking up for the Etheruem killer, a breakdown of the $216 support level will suggest an evolving narrative for SOL. If Solana price produces a lower low below the $200 psychological level, it will invalidate the cup-and-handle’s bullish thesis.

This development could likely trigger a potential crash to $178 or $166 footholds.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.