Solana price prepares for massive recovery amidst raging crypto winter

- Solana active developers declined by 90%, from 2,500 in January to mere 75, according to data from Token Terminal.

- The Ethereum-alternative is close to a bullish breakout in the ongoing bear market, based on technical indicators.

- Solana price in a downtrend since early November, SOL preparing for a bullish trend reversal.

Solana, popular as an Ethereum alternative, has witnessed a steep decline in the active developers on its blockchain network. After nearly a month-long downtrend, SOL price is ready to break out of its downtrend and wipe out losses from the spreading FTX exchange contagion.

Solana is ready for a comeback from crypto winter

Solana, a public blockchain platform with smart contract functionality, is ready for making a comeback after a month-long downtrend. SOL, also known as the Ethereum alternative, started its price decline on November 5. The FTX exchange collapse and spreading contagion had a negative impact on Solana price and the altcoin is currently in a descending channel.

The number of active developers in the Solana ecosystem recently witnessed a steep decline. From 2,500 active developers in January the number has declined to 75, a 95% drop within a year. Among all altcoin networks, Ethereum has the highest number of developers, followed by Cardano, Cosmos, Polkadot, and Kusama.

Solana price could witness a bullish breakout in the next two weeks

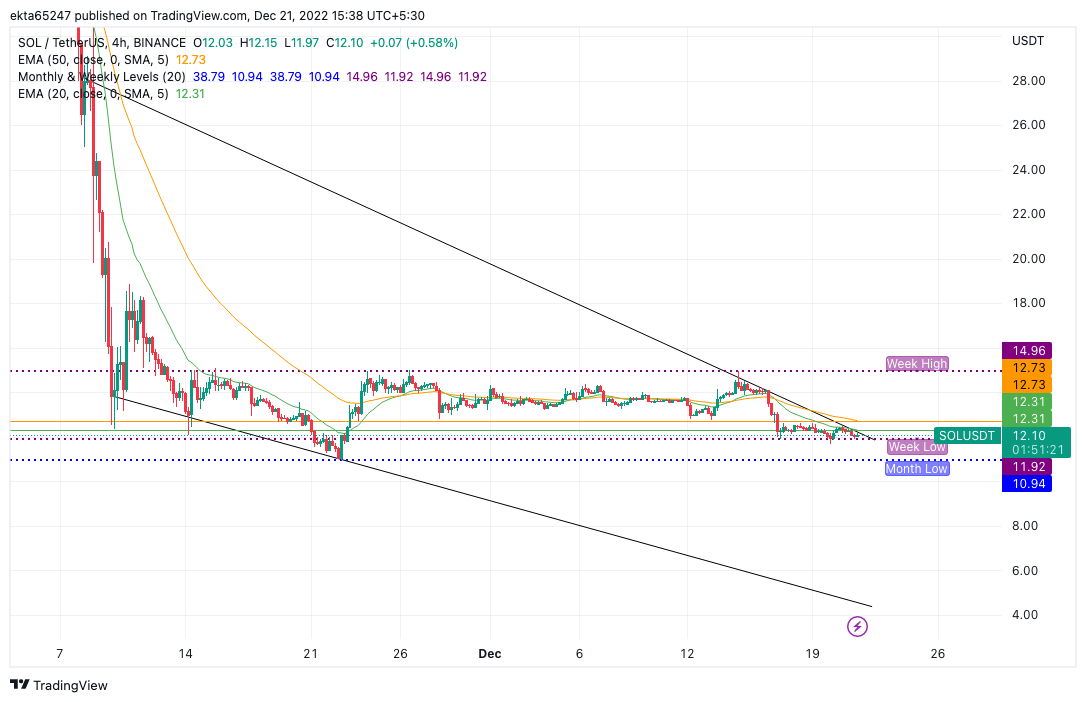

Solana price chart reveals that the altcoin’s price is in a descending channel. SOL price made three attempts to break out of the upper trendline, however, the confirmation needed for a trend reversal is a close above the trendline.

SOL/USDT 4H price chart

Solana faces two immediate resistances at the 20-day Exponential Moving Average at $12.31 and the 50-day EMA at $12.73. A breakout could imply a run-up to the weekly high of $12.73. If SOL price continues its uptrend, it could hit the bullish target of $31.68.

Invalidation of the bullish thesis could result in a price drop to the monthly low of $10.94. Solana is at risk of further price decline if SOL price plummets and closes below the lower trendline of the descending channel.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.