Solana price prepares epic bear trap that could see SOL return to $115

- Solana price flashes warning signs that a collapse of over 45% is incoming.

- Unless bulls come in and reject the bearish structure, SOL is poised for a major sell-off.

- Limited upside potential – but a bear trap might change that if triggered.

Solana price has the ugliest and most depressing looking technical chart out of the major market cap cryptocurrencies for bulls. For bears, the SOL chart represents joy, anticipation, and happiness.

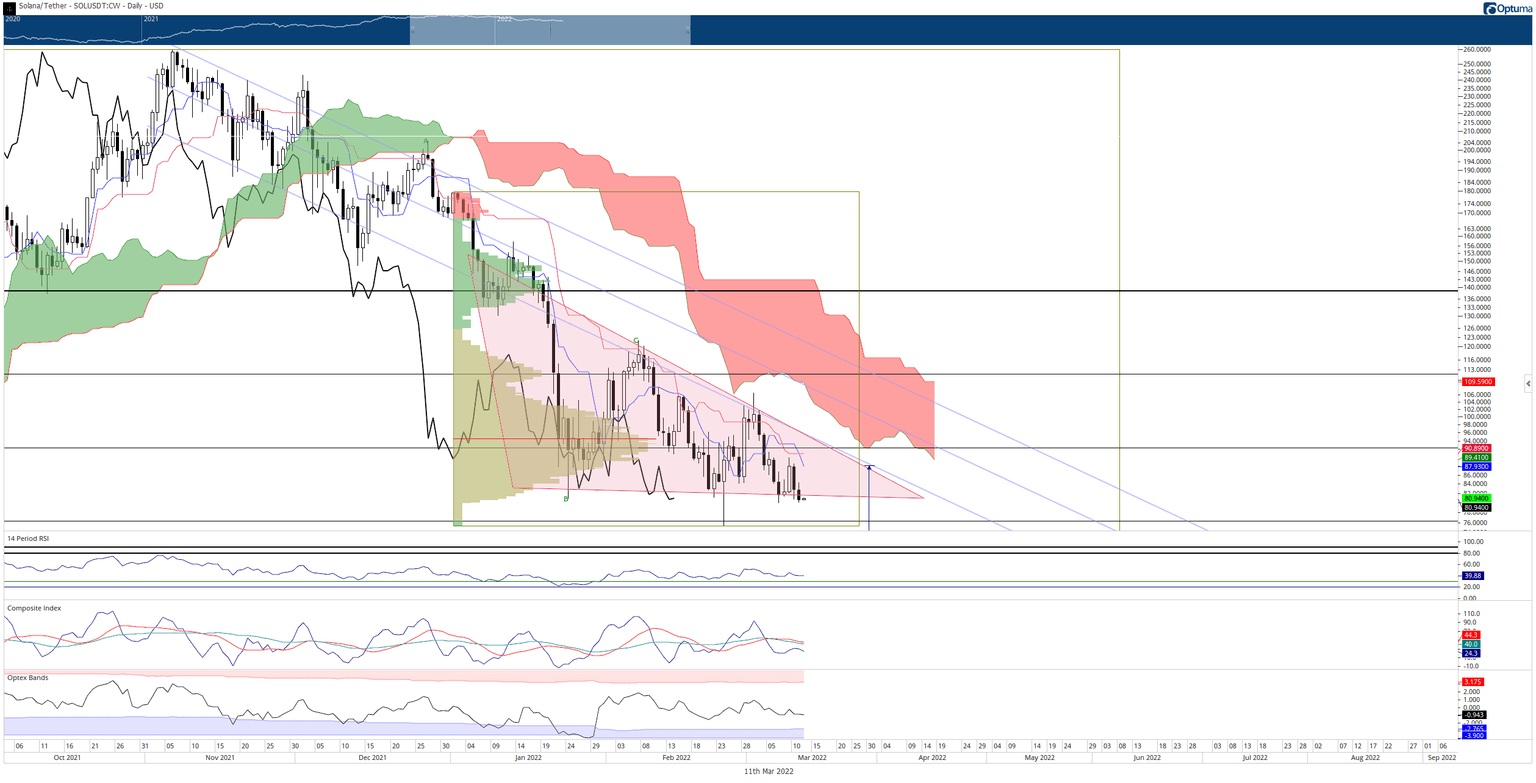

Solana price slides below the descending triangle, likely triggering a big capitulation move

Solana price is currently positioned for the biggest crash since January 20, 2022. The current daily candlestick warns that SOL is at the precipice of a major drop. Solana hanging just below the descending triangle at $80, with little buying support coming in at the end of the Friday trading session.

The risks to the downside for Solana price are substantial. The extended 2021 Volume Profile shows a massive gap between $50 and $75. Solana appears to almost certainly want to test $75, which is just above the 2022 low. $75 has a small volume node, and the psychological importance as the only factors as support. If it fails, then Solana price will likely experience a flash-crash down to the $50 value area.

SOL/USDT Daily Ichimoku Kinko Hyo Chart

However, as bearish as the current conditions are for Solana price, it is curious that bears have taken over sooner. The conditions are prime for short sellers – almost a gift with how powerful the combination of signals are. When these kinds of scenarios occur – very strong warnings of impending sell pressure - but they fail to play out, a bear trap is likely in play.

Bulls have an opportunity to pull the rug out from under any new and current short sellers. Bulls only need to push Solana price to a close at or above $90 to begin a short squeeze that would likely rally Solana back to the $115 value area.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.