Solana price prediction: SOL price cracks under pressure

- Solana price drops 8% as tail risk inflates during the ASIA PAC session.

- SOL price sees traders reshuffle positions on the back of risk events in the coming days.

- Expect to see SOL price touch base at S1 support with the risk of plunging another 28% over the weekend.

Solana (SOL) price action is getting hammered in the ASIA PAC session as support breaks down as a result of inflated tail risks leading to traders reassessing their positions. The Fed’s Jackson Hole Symposium is in the limelight focusing traders on it's so-far hawkish game plan which is a negative environment for cryptocurrencies to rally in, and some geopolitical tensions are flaring up again as Putin and Xi are set to attend the G20 meeting together, with a possible side-meeting expected between the two to discuss Ukraine and Indonesia which could see investors pull their money out crypto into cash. Global cryptocurrencies are taking a step back due to these risks, and this could see SOL price tanking another 28% over the weekend towards the low of 2022.

SOL price could hit $26 over the weekend

Solana price has taken a nosedive in the ASIA PAC session this morning on the back of the Fed Minutes released on Wednesday, which showed no strong conviction that the Fed will want to start to slow down or cut rates anytime soon. A further catalyst came from the headline risk that Xi and Putin would attend the G20 meeting, sparking geopolitical tensions around Ukraine and Indonesia. With this sudden big balloon of tail risks, price action could only go one way: down.

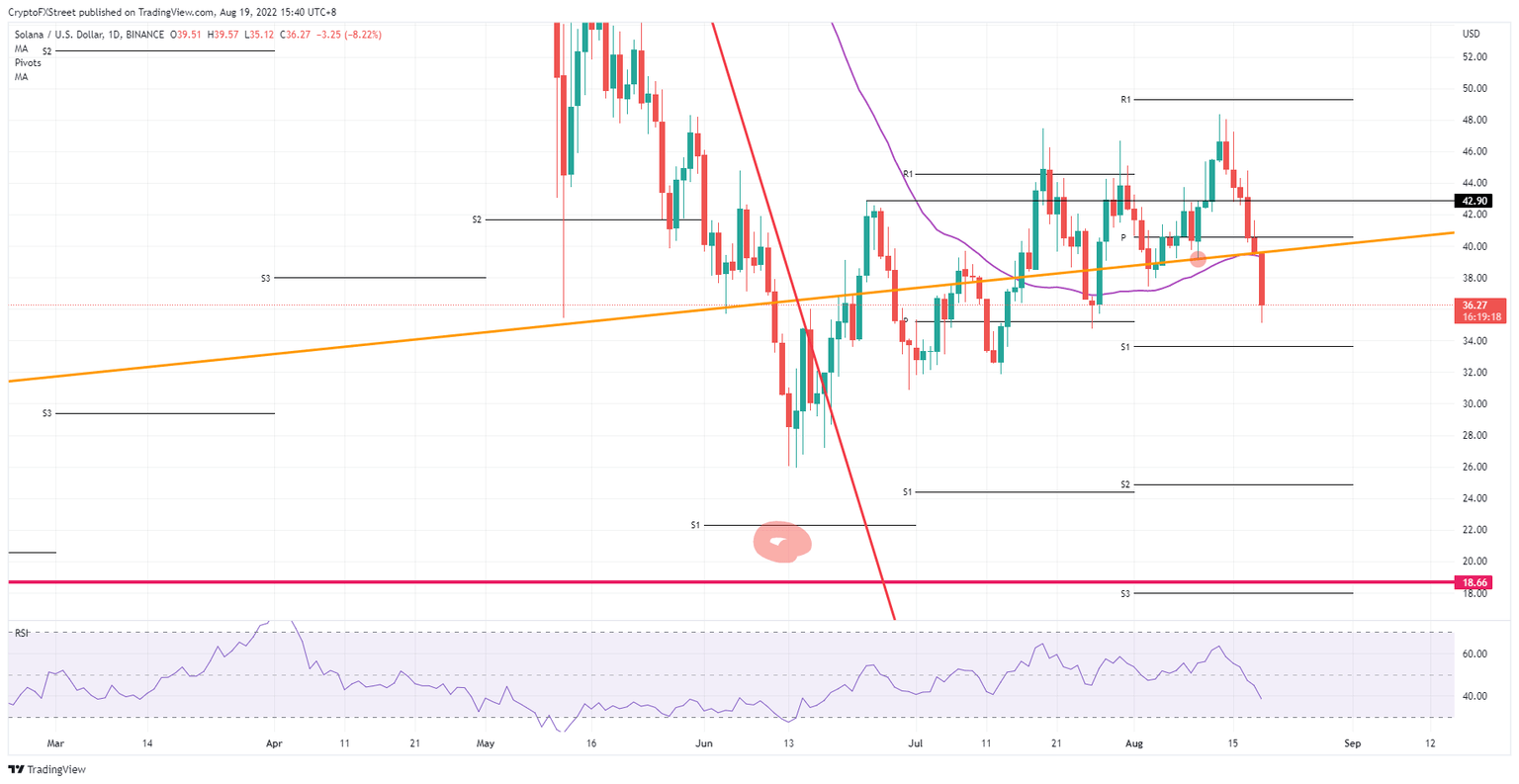

SOL price instantly broke through support from the orange ascending trend line and the 55-day Simple Moving Average at $39.53. Bulls did not even get the chance to pull price action above it and instead received an instant rejection and firm decline. Price action will probably reach $34 by this evening, around the monthly S1, with the risk that the full summer rally will evaporate over the weekend and see SOL price drop back to $26, the low of 2022.

SOL/USD Daily chart

A swift throwback and recovery looks unlikely, seeing that bearish sentiment appears to have extended into the European session and there are no real events that could spin a turnaround for SOL price. Bulls are advised to await a bounce off the monthly S1 support at $34 before expecting a return to $40, and then a test of the top end, and break back above the 55-day SMA and the orange ascending trend line. That could mean a 17% bounce which bulls will gladly take on.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.