Solana Price Prediction: SOL maintains optimistic macro perspective

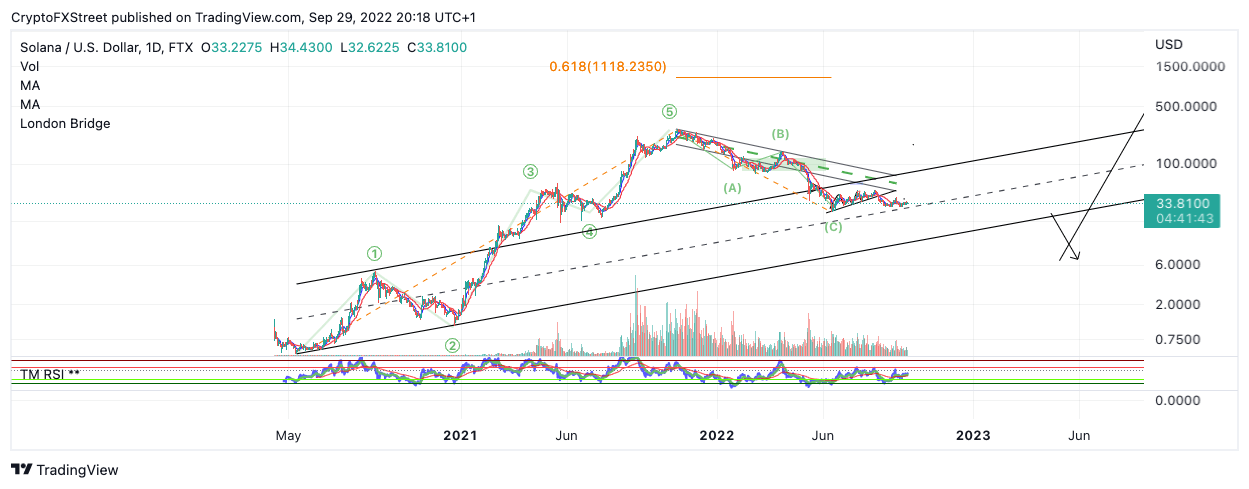

- Solana price has retracted into a previous fourth wave after printing three sets of impulse waves up.

- SOL price hovers over a parallel channel median line with a tapered volume pattern on the Volume Profile Index.

- SOL price has 90% cushion space to fall without invalidating the macro count.

Despite the ever-looming bearish environment in which the crypto space has found itself, the Solana price shows optimistic macro technicals in the grand scheme of things.

Solana price is macro bullish

Since its inception in May 2020, Solana has rallied immensely from $0.50 to all-time highs at $250. One can easily fit three impulsive waves within the uptrend, which suggests Solana has printed an impulse wave of a larger degree.

Solana price currently auctions at $33.72. Since all-time highs, the SOL price is down 87%, which is the classic level for a market bounce. Additionally, the retracement has fallen into the previous wave four under less volume than the previous bull run. Lastly, the SOL price hovers over the ascending trend channel surrounding the first wave and correction, another text-book-like market-bottom gesture.

SOL USD 1-Day Chart

A Fibonacci projection tool surrounding the origin and all-time highs, then projected into the current price levels, shows a 61.8% retracement level at $1,118. Based on Elliott Wave and Fibonacci theory, if the Solana price does overcome the bear market, a conventional target to aim for during the next crypto season will be in the $1,000 price level.

Combining these factors, Solana price is a crypto one should confer dollar cost averaging into. The market still has over 90% cushion space to fall without invalidating the macro count. This thesis would be void if the bears were to tag the $0.50 level. Still, several compounding factors suggest SOL will be one of the few cryptos to make it through the bear market.

In the following video, our analysts deep dive into the price action of Solana, analyzing key levels of interest in the market - FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.