Solana Price Prediction: Make or break moment as SOL runs back to the trendline with falling TVL

- Solana price pullback since late December has seen the altcoin retrace the ascending trendline.

- SOL could drop 7% to test the $89.02 support level, which is critical to determining the next directional bias.

- The odds favor the downside, witj a dwindling TVL accentuating the falling momentum.

Solana (SOL) price has been on an uptrend since mid-October, outperforming most tokens, especially Ethereum after the ETH versus SOL narrative resurfaced. However, the bullish streak for SOL has run out and now it is on a bearish momentum like most altcoins.

Also Read: Solana meme coin Bonk Inu price defies ETF FUD and rallies 22%

Solana price at an inflection point as TVL drops

Solana (SOL) price is at an inflection point, recording yet another downtrend while the ascending trendline support continues to hold. Amid falling momentum, a break and close below the trendline could send SOL to a cliff, as its Total Value Locked drops.

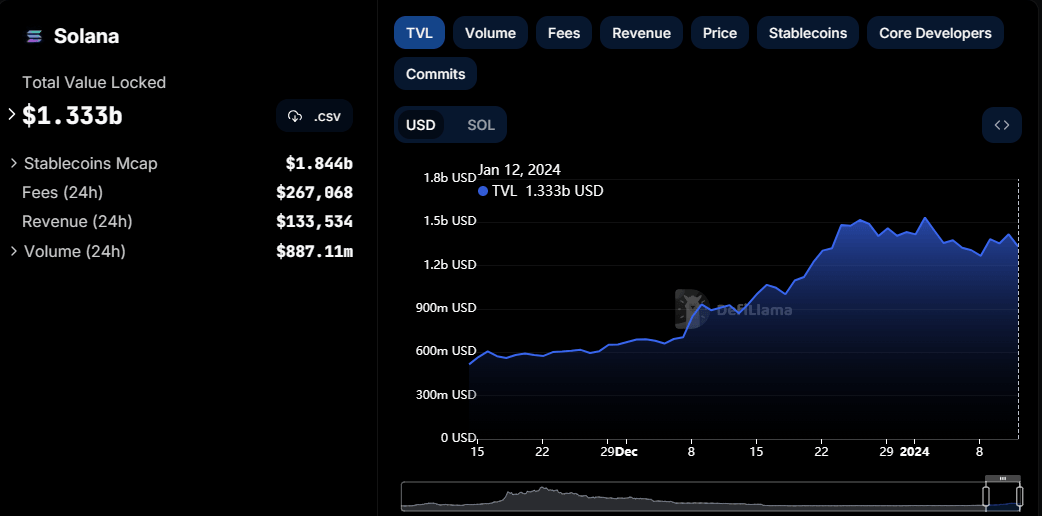

Between January 11 and 13, SOL TVL has dropped from $1.417 billion to $$1.333 billion, representing a 10% drop in two days. This points to money flowing out of the SOL ecosystem, accentuating the bearish outlook.

SOL TVL

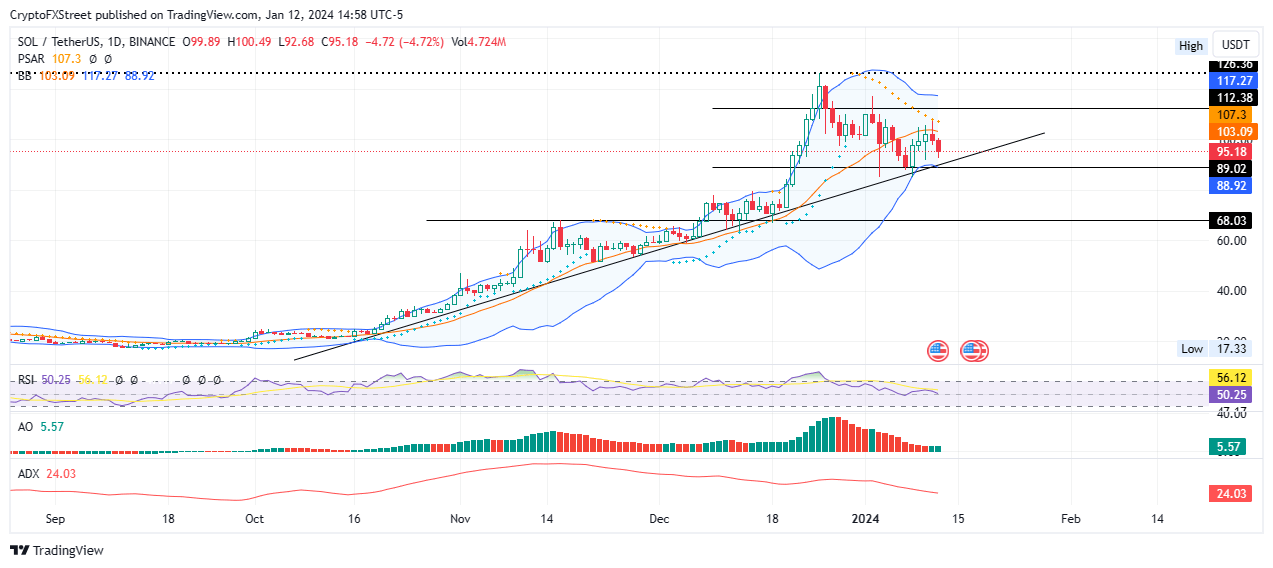

Solana price outlook

With the Solana price trading within the lower half of the Bollinger indicator, bound between the centerline at $103.09 and the lower band at $88.92, momentum dropping, could extend the fall.

This could see Solana price extend a leg lower, first losing the support offered by the horizontal line at $89.02 before testing the lower band of the Bollinger indicator. A break and close below this level would confirm the downtrend.

The ensuing selling pressure could see Solana price retrace the $80.00 psychological level, standing 13% below current levels.

SOL/USDT 1-day chart

Nevertheless, the bulls maintain a strong presence in the SOL market, evidenced by the green histogram bars in the positive territory. Moreover, the Average Directional Index (ADX) indicator continues to flatten, with the slope reducing to show the prevailing trend is losing steam. A retest of the trendline could trigger a bold bounce with the trendline holding, akin to what happened on January 7.

If the support offered by the confluence between the ascending trendline, the lower band of the Bollinger indicator, and the horizontal line around $89.02, the bulls could still recover in a bold attempt to salvage Solana price.

Enhanced buying pressure could see Solana flip the centerline of the Bollinger into support above $103.09. In a highly bullish case, the gains could extend for SOL market value to ascend beyond the $112.38 blockade, or higher, tag the upper band of the Bollinger indicator at $117.27. In a highly bullish case, the gains could see the purported Ethereum killer extend a neck higher to the $126.36 range high, levels last seen on Christmas day.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.